Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

US Leaders' Summit on Climate Announces Establishment of Net-Zero Producers Forum

- Canada, Norway, Qatar, Saudi Arabia, and the United States announced on 23-24 April that they will come together to form a cooperative forum that will develop pragmatic net-zero emission strategies. These will focus on methane and carbon dioxide abatement, including by advancing integrated circular carbon economy technologies development and deployment of clean-energy and carbon capture and storage, diversification from reliance on hydrocarbon revenues, and other measures in line with each country's national circumstances. The five countries collectively represent 40 percent of global oil and gas production.

Cyberattack shuts down largest US pipeline for refined products

- U.S. fuel pipeline operator Colonial Pipeline shut its entire network on 7th May due to a cyberattack caused by ransomware – a type of malware that is designed to lock down systems by encrypting data and demanding payment to regain access. The attack underscores the vulnerability of energy infrastructure to cyberattacks, and the need for resiliency against such operations. Colonial pipeline transports 2.5 mb/d of gasoline, and other fuels through 5,500 miles (8,850 km) of pipelines linking refiners on the Gulf Coast to the eastern and southern United States.

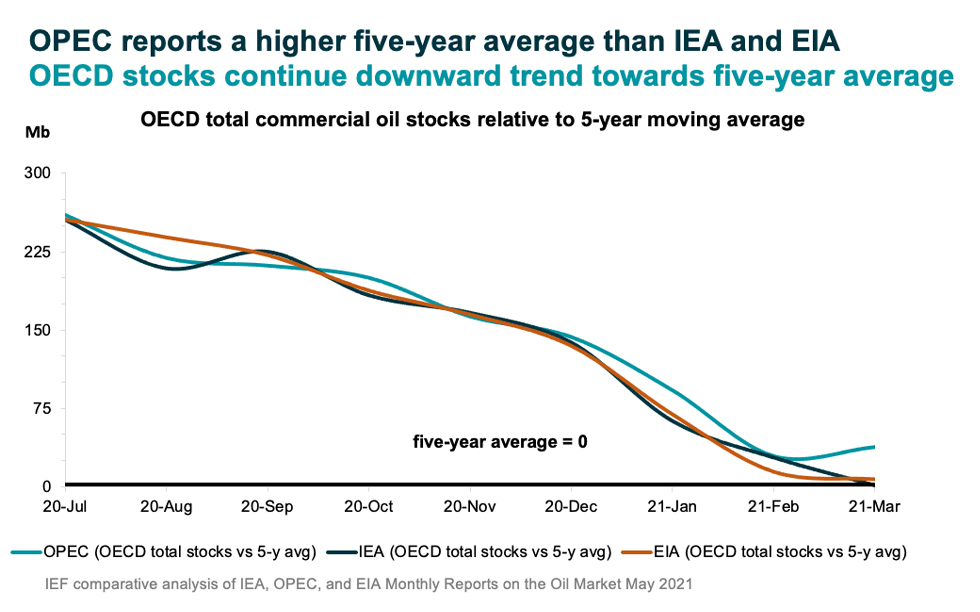

OECD oil inventories returning to normal levels, but volatility persists

- The IEA and EIA report oil inventories above the five-year average by about 2 mb and 7 mb, respectively while OPEC diverges and reports oil stocks around 38 mb above the latest five-year average. The rise of vaccinations and global mobility will see demand rise according to the IEA, but continued COVID outbreaks in India and renewed restrictions in Japan are reason for caution as uncertainty persists.

16th OPEC and non-OPEC Ministerial Meeting agrees to continue market rebalancing

- OPEC and non-OPEC Ministers agreed to abide by the planned output increase decided at its most recent meeting. The 15th meeting agreed to boost production by 350 kb/d in May, add the same volume again in June, and increase production by another 440 kb/d barrels in July. Saudi Arabia will begin rolling back its voluntary 1 mb/d adjustment, adding 250 kb/d in May, 350 kb/d in June, and 400 kb/d in July.

2. Key Points

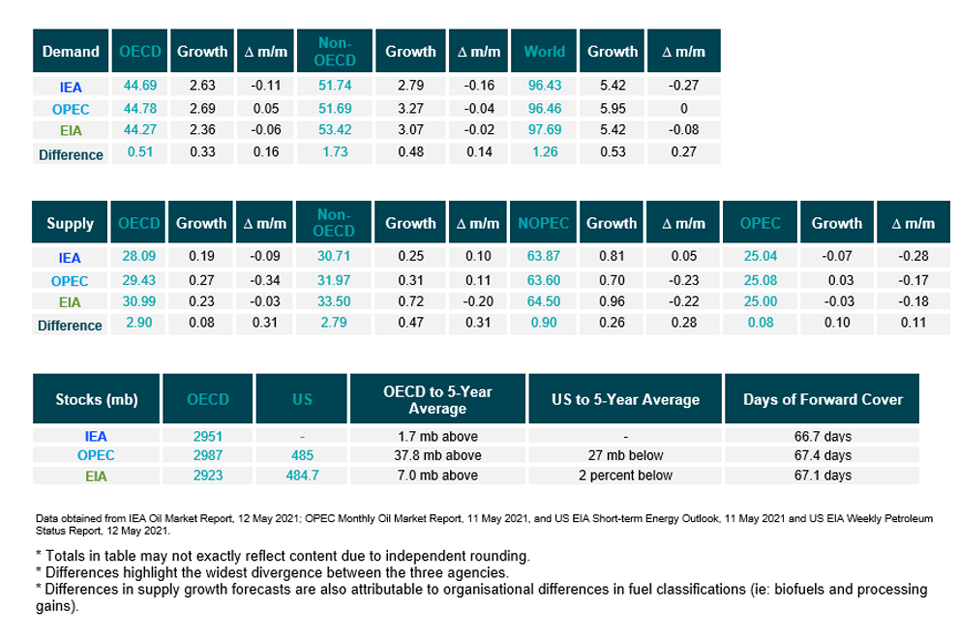

2.1 Demand

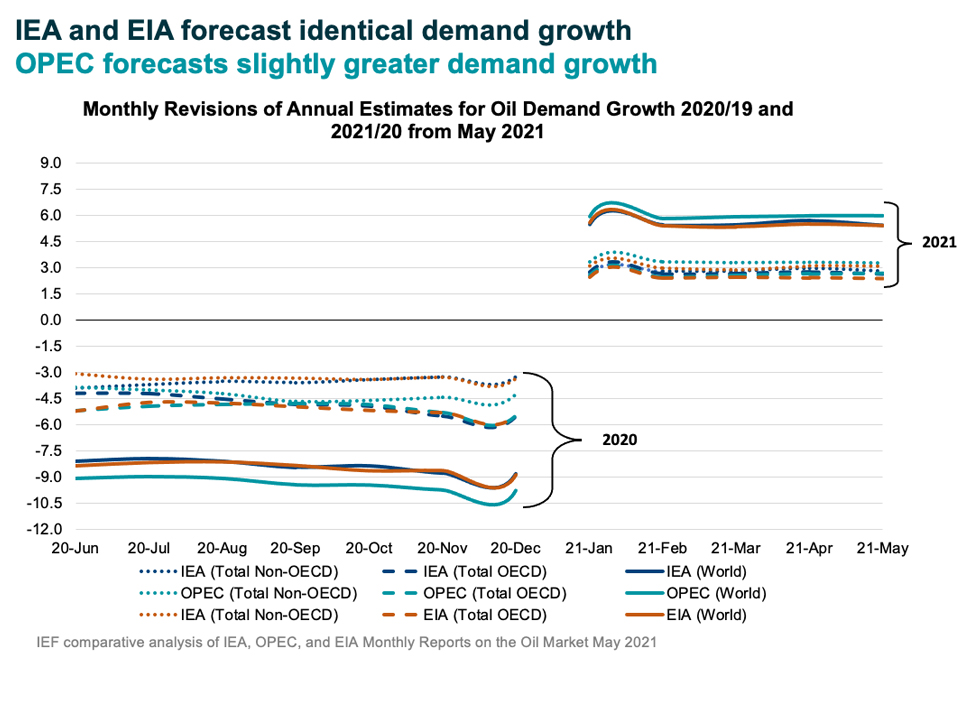

The IEA and EIA demand growth assessments decrease while OPEC growth remains static.

- The IEA reduced its assessment of year-on-year (y-o-y) demand growth by 270 kb/d to 5.42 mb/d due to weaker than expected demand in 1Q21 and a lower demand outlook for India.

- OPEC's y-o-y demand growth estimate remains the same as last month at 5.95 mb/d.

- EIA's assessment fell by 80 kb/d for a demand growth of 5.42 mb/d in 2021. The IEA, OPEC, and EIA estimates for absolute world demand are now 96.43 mb/d, 96.46 mb/d, and 97.69 mb/d for 2021, respectively.

The IEA, OPEC, and EIA OECD and non-OECD demand growth assessments remain largely stable.

- The IEA's assessment of y-o-y non-OECD demand growth falls by 160 kb/d 2.79 mb/d, while OPEC's drops by 40 kb/d to 3.27 mb/d. The EIA's assessment falls by 20 kb/d for a total non-OECD demand growth of 3.07 mb/d.

- The IEA's estimate for OECD demand fell by 110 kb/d to 2.63 mb/d for 2021. OPEC's estimate rose by 50 kb/d to 2.69 mb/d while EIA's assessment sees growth at 2.36 mb/d y-o-y, a decrease of 60 kb/d.

- OPEC and EIA assessments differ by 0.33 mb/d and OPEC and IEA assessments differ by 0.48 mb/d on OECD and non-OECD demand growth, respectively.

2.2 Supply

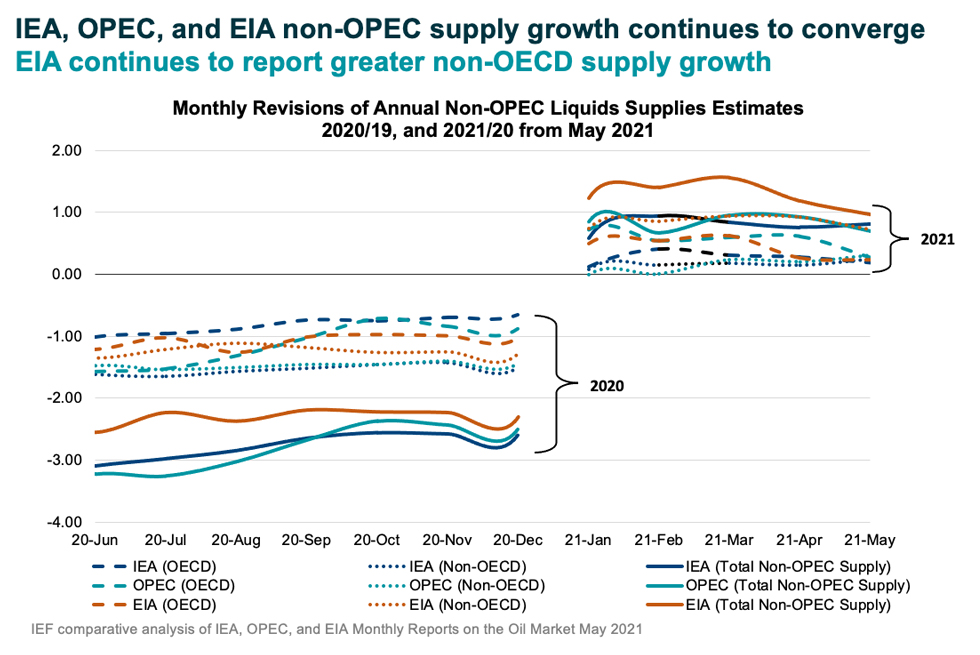

The IEA, OPEC, and EIA non-OPEC supply growth assessments continue to converge.

- The IEA's May assessment for non-OPEC supply increases by 50 kb/d for a total growth of 0.81 mb/d while OPEC reports total growth of 0.70 mb/d, a decrease of 230 kb/d. The EIA reports a higher overall supply growth of 0.96 mb/d y-o-y, a decrease of 220 kb/d from last month's assessment. In absolute values, the IEA, OPEC, and EIA estimate non-OPEC supply at 63.87 mb/d, 63.60 mb/d, and 64.50 mb/d, respectively for 2021.

- The IEA reports OECD supply growth at 0.19 mb/d while OPEC records OECD growth at 0.27 mb/d, a decrease of 90 kb/d and 340 kb/d, respectively. The EIA also records a decrease of 30 kb/d for a growth of 0.23 mb/d. In absolute values, the IEA and OPEC, and EIA estimate OECD supply at 28.09 mb/d, 29.43 mb/d, and 30.99 mb/d, respectively for 2021. Divergence on OECD supply growth is the largest between OPEC and IEA differing by 80 kb/d.

The EIA reports higher non-OECD supply growth than the IEA and OPEC.

- The IEA's supply assessment reaches total supply growth of 0.25 mb/d, an increase of 10 kb/d from last month. OPEC's forecast reports a growth of 0.31 mb/d, an increase of 110 kb/d from last month. The EIA is substantially more optimistic showing non-OECD supply growth of 0.72 mb/d, a decrease of 200 kb/d from last month.

- In absolute values, the IEA, OPEC, and EIA non-OECD supply estimates are 30.71 mb/d and 31.97 mb/d, and 33.50 mb/d, respectively for 2021. Divergence on total non-OECD supply growth is widest between the IEA and EIA that differ by 470 kb/d.

The IEA and EIA report decreases while OPEC reports an increase in OPEC production in April.

- The IEA revised its OPEC production estimate downward by 70 kb/d month-on-month (m-o-m) in April to reach total production of 25.04 mb/d. OPEC, meanwhile reported an increase of 30 kb/d m-o-m for total production of 25.08 mb/d in April. The EIA decreased its assessment by 30 kb/d for total OPEC crude production of 25.00 mb/d.

2.3 Stocks

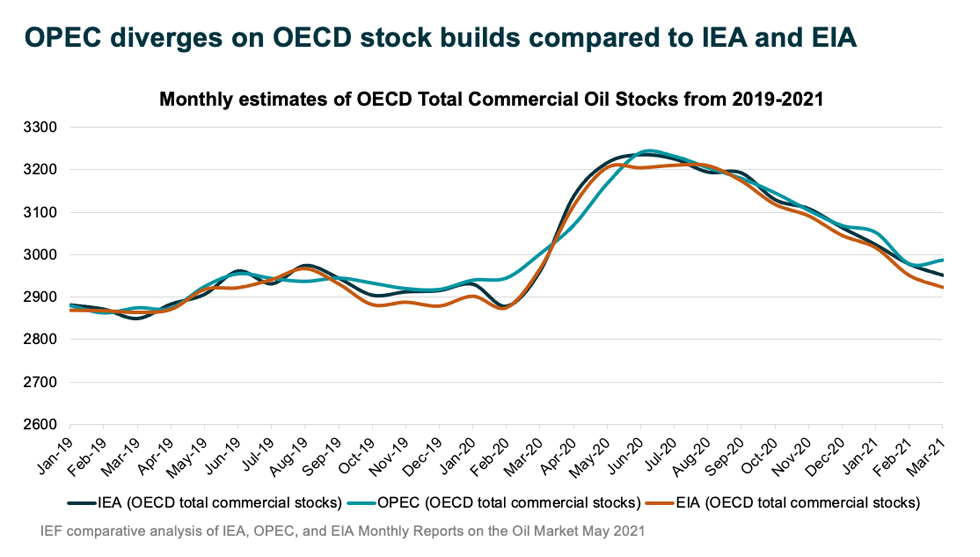

The IEA, OPEC, and EIA continue to report strong alignment on stock figures.

- The IEA reports OECD stock levels at 2951 mb, which is close to OPEC's assessment of 2987 mb and EIA's assessment of 2923 mb, which is 1.7 mb, 37.8 mb, and 7 mb above the five-year average, respectively.

- According to the IEA, crude oil inventories built by 6.1 mb while product stocks fell by about 31 mb. Other oils, including NGLs and feedstocks built by 0.2 mb. According to OPEC, crude oil stocks built by around 7 mb while products built by 3.3 mb.

- EIA estimates OECD inventories dropped by 30 mb in March to 2923 mb – 7 mb above the five-year average.

- The widest divergence in inventories is between OPEC and the EIA which stands at 64 mb. Total US crude inventories (excluding SPR) amount to about 485 mb according to the EIA which are 2 percent below the five-year average for this time of year. OPEC reports US commercial crude oil stocks at about 485 mb and around 37.8 mb above the five-year average.

2.4 Snapshot (mb/d)

3. Global Analysis

3.1 Demand Data

Figure 1

3.2 Supply Data

Figure 2

3.3 Stock Data

Figure 3

Figure 4

JODI Data:

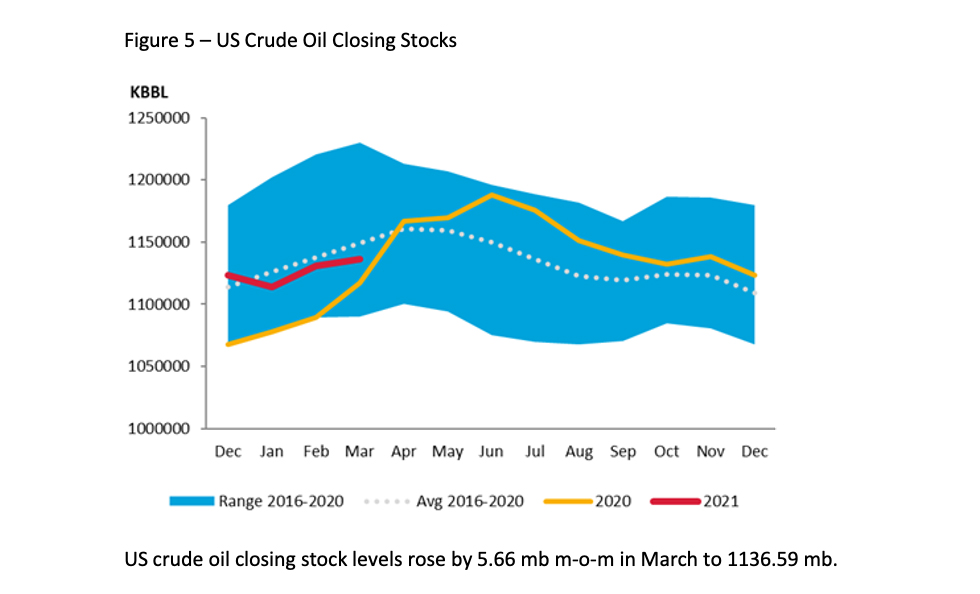

Figure 5 - US Crude Oil Closing Stocks

US crude oil closing stock levels rose by 5.66 mb m-o-m in March to 1136.59 mb.

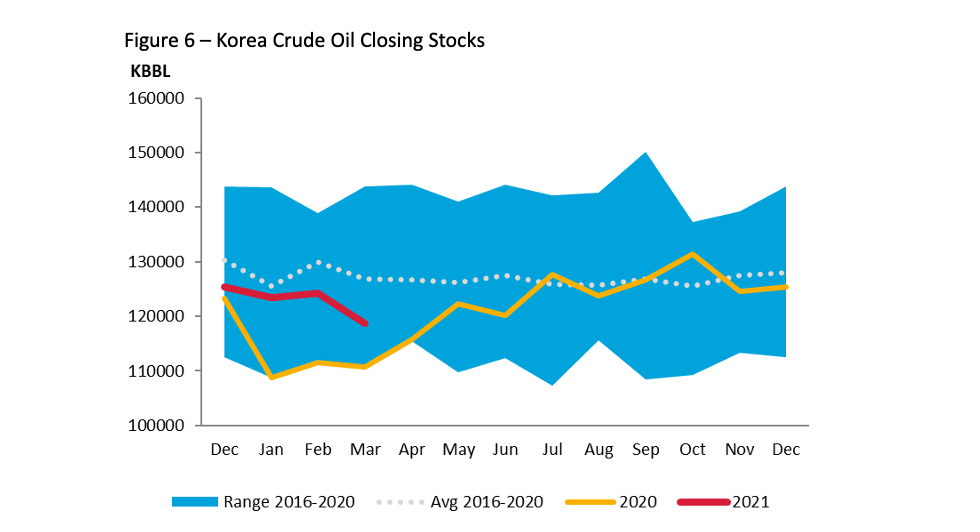

Figure 6 - Korea Crude Oil Closing Stocks

Korean crude oil closing stock levels fell by 5.44 mb m-o-m in March to 118.75 mb.

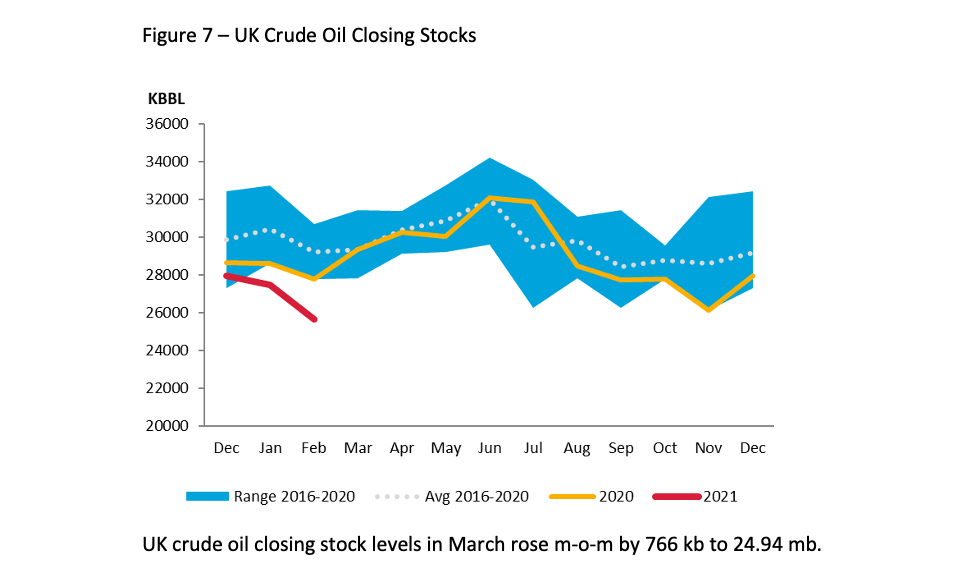

Figure 7 - UK Crude Oil Closing Stocks

UK crude oil closing stock levels in March rose m-o-m by 766 kb to 24.94 mb.

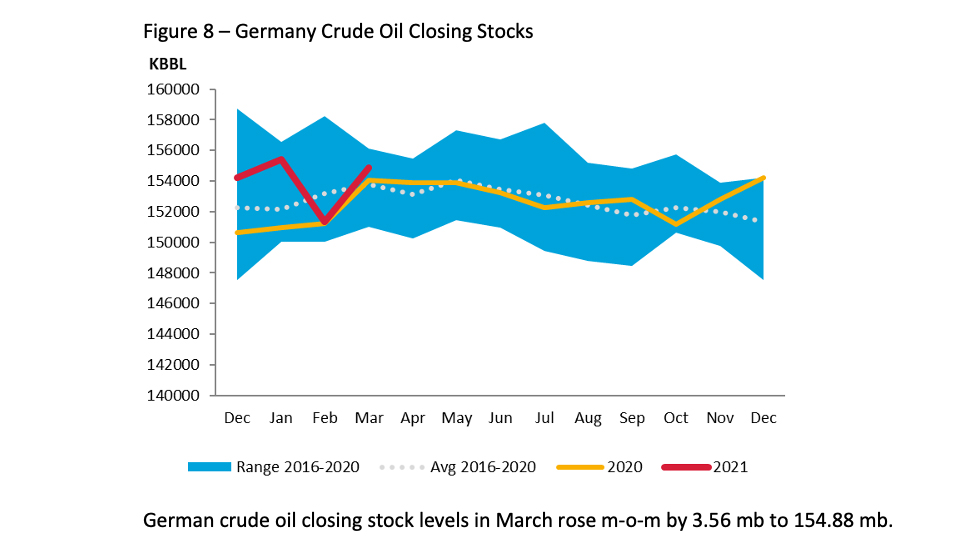

Figure 8 - Germany Crude Oil Closing Stocks

German crude oil closing stock levels in March rose m-o-m by 3.56 mb to 154.88 mb.

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report and the OPEC Monthly Oil Market Report.

- A comparative analysis of oil inventory data reported by JODI, the IEA, OPEC, and the US EIA.

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.