Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

EU proposes phased ban of Russian oil

- On 4 May, European Commission President Ursula von der Leyen announced a proposal for the EU to impose a gradual embargo on Russian oil as part of its sixth sanctions package. The Commission's proposal, which needs unanimous backing by the 27 EU countries to take effect, includes phasing out supplies of Russian crude oil and refined products by the end of 2022. It also proposes to ban in a month's time all shipping, brokerage, insurance, and financing services offered by EU companies for the transport of Russian oil.

US plans crude buyback for strategic petroleum reserve

- On 5 May, the US announced plans to buy 60 million barrels of crude oil as the first step in a years-long process aimed at replenishing America's emergency oil reserve. Reserves were already sitting at 20-year lows before President Joe Biden announced the release of a record-setting 180 million barrels of oil to ease pressure on energy markets on 31 March. The buyback process will begin with a call for bids in Fall 2022 to repurchase a third of the 180 million emergency barrels released as part of a coordinated action with IEA member countries to support consumers and the global economy until new production ramps up. The delivery window of the crude will be based on anticipated market conditions and when crude prices are expected to be “significantly lower.”

Energy prices remain volatile

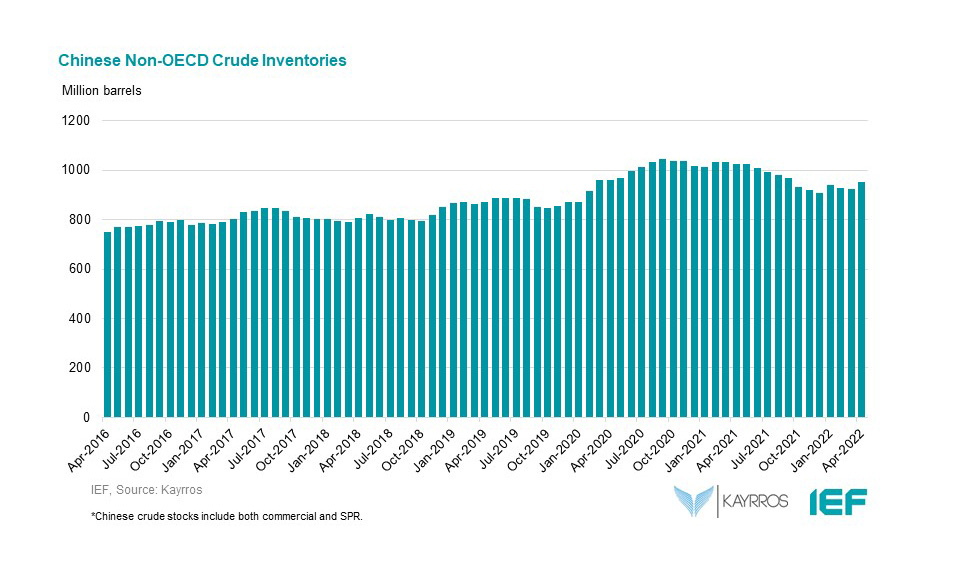

- COVID-19 lockdowns in China have impacted crude prices, but they remain above the $100-threshold while soaring fuel prices are increasing refining margins to all-time highs amid reduced refining capacity and trade constraints. US natural gas prices have also spiked with Henry Hub spot and futures prices soaring above $8/MMBtu; price levels last seen before the shale gas revolution broke through in the 2010s.

OPEC stays the course

- On 5 May, OPEC and non-OPEC countries reconfirmed the production adjustment plan and the monthly production adjustment mechanism approved at the 19th OPEC and non-OPEC Ministerial Meeting on 18 July and adjust monthly overall production by 0.432 mb/d for the month of June 2022. The 29th OPEC and non-OPEC Ministerial Meeting is scheduled for 2 June 2022.

US Senate Judiciary Committee passes NOPEC antitrust bill

- On 5 May, a US Senate committee passed the No Oil-Producing and Exporting Cartels Act that could expose the Organization of the Petroleum Exporting Countries and partner countries to US claims of collusion to boost oil prices. Versions of the legislation have failed in Congress for more than two decades, but lawmakers are pushed to act on rising fuel prices. The legislation must be considered by the full chamber in both houses of Congress and signed by the President before it becomes US law.

2. KEY POINTS

2.1 DEMAND

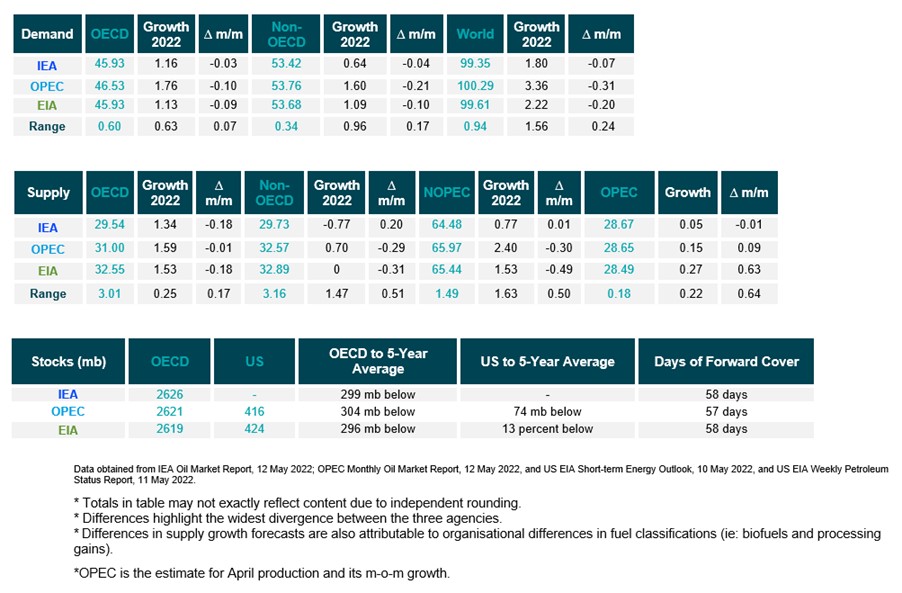

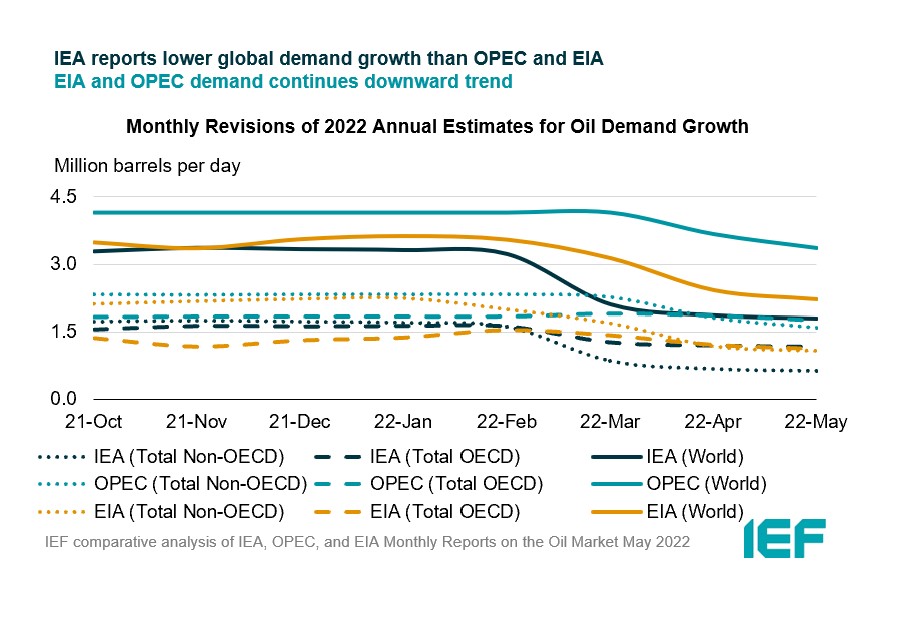

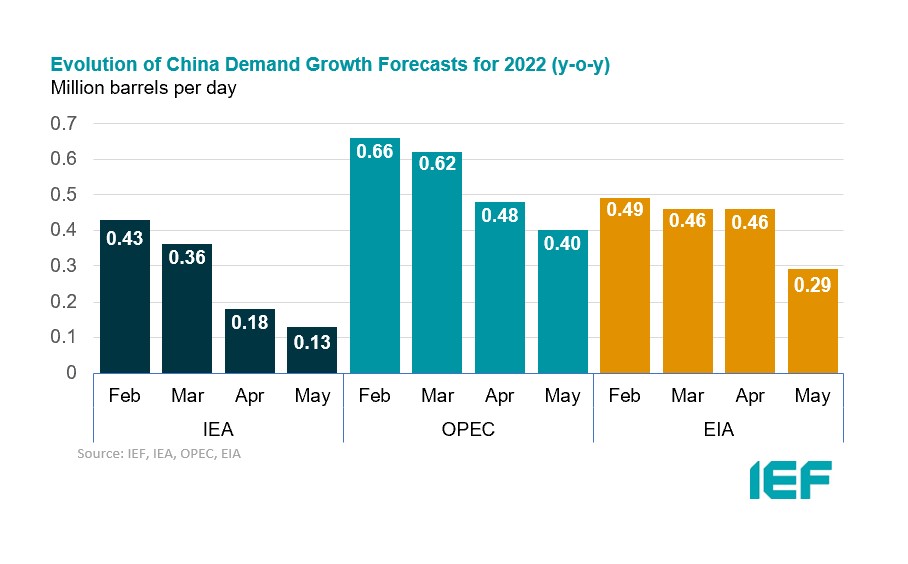

The IEA expects lower demand growth than OPEC and the EIA in 2022.

- IEA’s demand growth assessment for this year falls by 70 kb/d to 1.80 mb/d year-on-year (y-o-y) due to economic uncertainties caused by a resurgence of COVID-19 cases and lockdowns in China and the war in Ukraine.

- OPEC’s y-o-y forecast falls by 310 kb/d for total growth of 3.36 mb/d.

- EIA’s assessment falls by 200 kb/d for a growth of 2.22 mb/d this year. The IEA, OPEC, and EIA estimates for absolute world demand are now 99.35 mb/d, 100.29 mb/d, and 99.61 mb/d for 2022, respectively.

The IEA, OPEC, and the EIA differ on non-OECD demand growth in 2022.

- The IEA's assessment of y-o-y non-OECD demand growth falls by 40 kb/d to 0.64 mb/d, while OPEC’s estimate falls by 210 kb/d to 1.60 mb/d. EIA non-OECD demand growth falls by 100 kb/d to 1.09 mb/d.

- The IEA's estimate for OECD demand growth falls by 30 kb/d to 1.16 mb/d for 2022 while OPEC’s projection falls by 100 kb/d for a growth of 1.76 mb/d. EIA revises OECD demand growth down by 90 kb/d to 1.13 mb/d this year.

- The largest divergence in OECD and non-OECD demand growth estimates is between OPEC and EIA differing by 630 kb/d and between IEA and OPEC at 960 kb/d, respectively.

2.2 SUPPLY

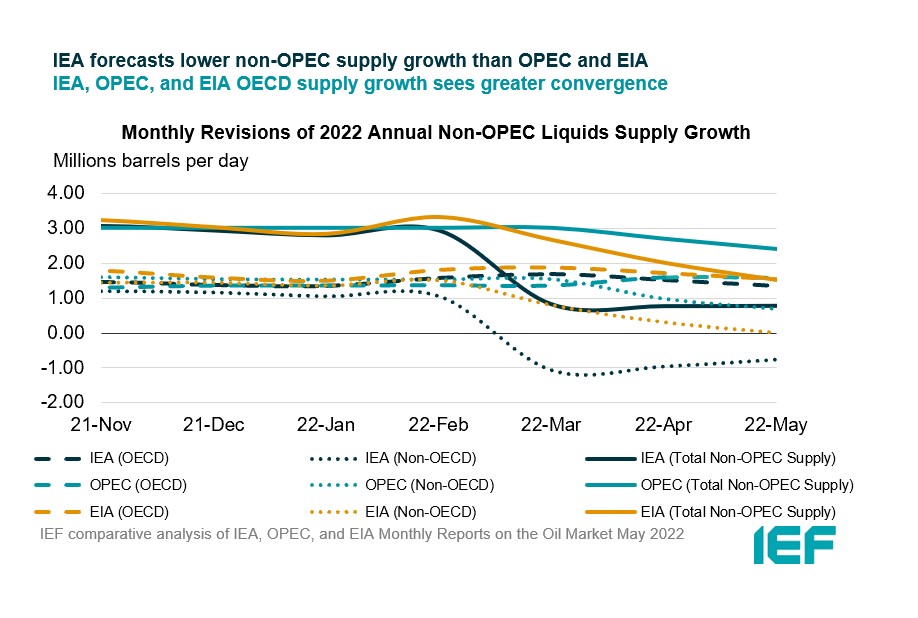

The IEA’s estimate of non-OPEC supply growth remains stable while OPEC and EIA report decreases.

- The IEA’s May assessment for non-OPEC supply rises by 10 kb/d to reach a growth of 0.77 mb/d while OPEC’s estimate falls by 300 kb/d for a growth of 2.40 mb/d. The EIA’s assessment falls by 490 kb/d for an overall growth of 1.53 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 64.48 mb/d, 65.97 mb/d, and 65.44 mb/d, respectively for 2022.

- The IEA estimates OECD oil supply growth this year at 1.34 mb/d, OPEC pegs it at 1.59 mb/d, and EIA reports growth at 1.53 mb/d, decreases of 180 kb/d, 10 kb/d, and 180 kb/d, respectively. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 29.54 mb/d, 31.00 mb/d, and 32.55 mb/d, respectively for 2022. The largest divergence of OECD supply growth estimates is between the IEA and OPEC differing by 250 kb/d.

The IEA forecasts a decline, EIA reports zero growth, and OPEC continues to see growth for non-OECD supply in 2022.

- The IEA’s assessment for non-OECD supply rises by 200 kb/d for a total decline of 0.77 mb/d compared to last month’s assessment of a 0.97 mb/d decline.

- OPEC and the EIA also substantially revised down their forecasts by 290 kb/d and 310 kb/d with OPEC estimating non-OECD supply growth at 0.70 mb/d and EIA reporting no growth.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 29.73 mb/d, 32.57 mb/d, and 32.89 mb/d, respectively for 2022 with the largest divergence in growth estimates between the IEA and OPEC at 1.47 mb/d.

The IEA, EIA, and OPEC revise OPEC production estimates upwards.

- The IEA increased its OPEC production estimate for April upward by 50 kb/d month-on-month (m-o-m) to reach total production of 28.67 mb/d. OPEC also revised its assessment of its OPEC production upwards by 150 kb/d to 28.65 mb/d. The EIA revised its assessment upwards by 270 kb/d with total OPEC crude production reaching 28.49 mb/d.

2.3 STOCKS

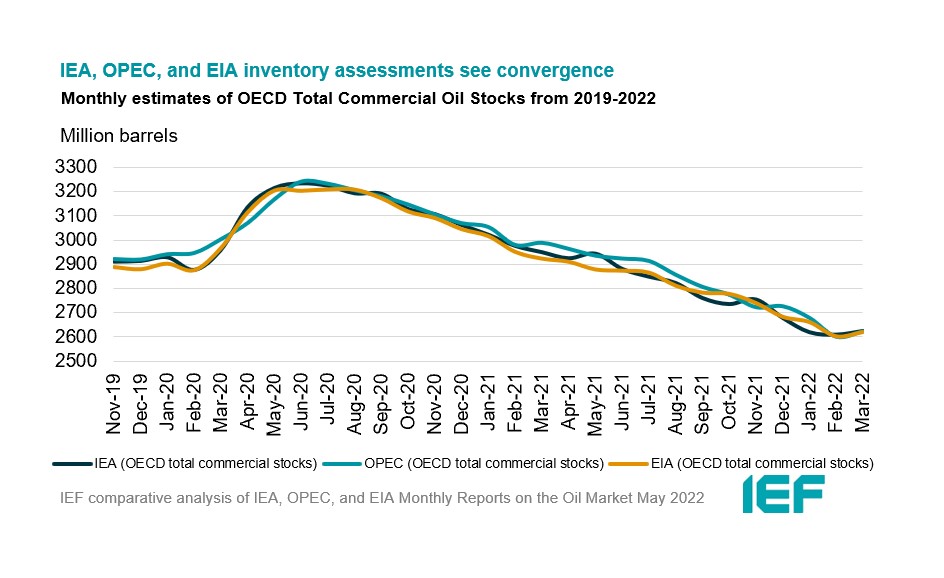

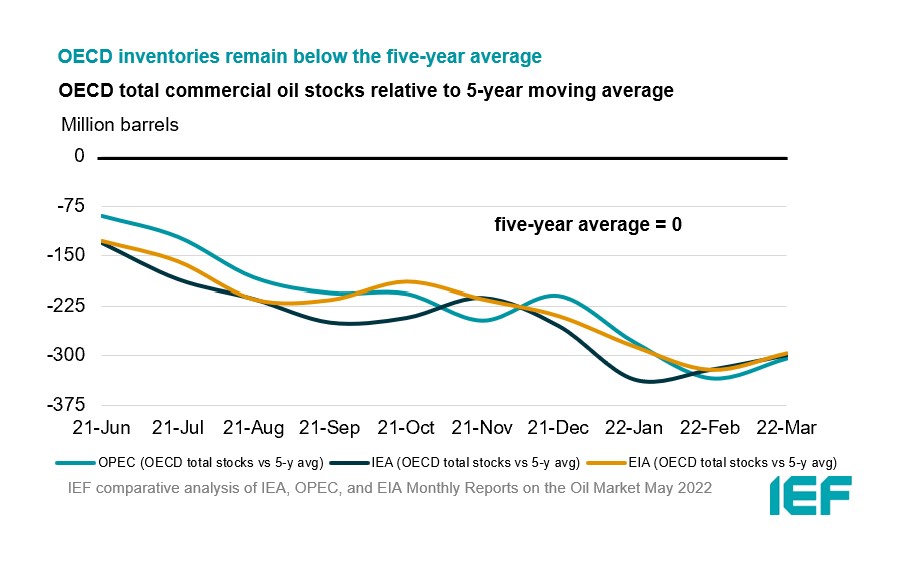

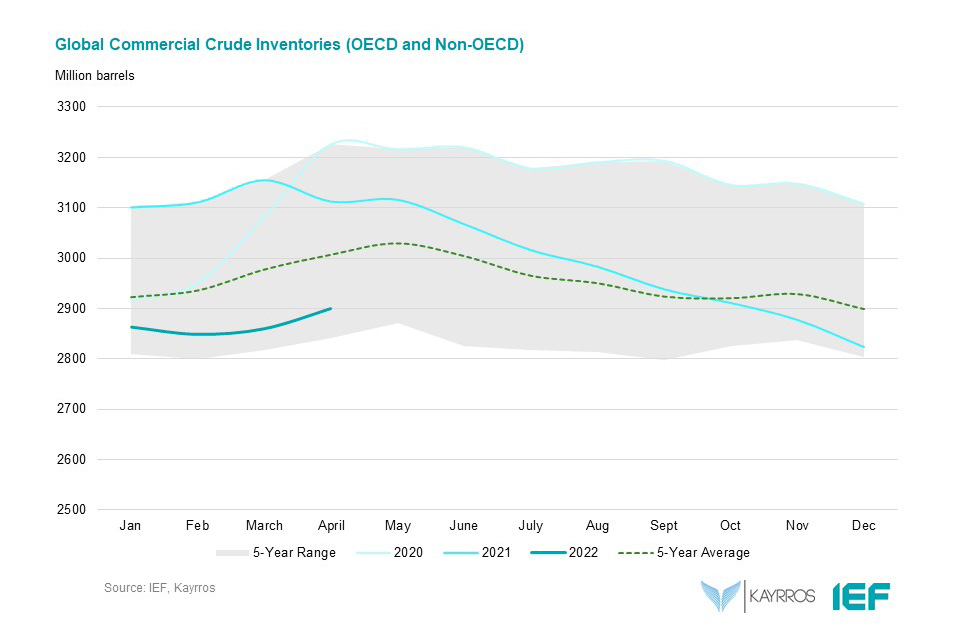

The IEA, OPEC, and EIA continue to display strong alignment on stock figures which are below the five-year average and now below 60 days forward cover.

- The IEA reports OECD stock levels at 2626 mb, which is close to OPEC’s assessment of 2621 mb and EIA’s assessment of 2619 mb. These are around 299 mb, 304 mb, and 296 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 22.8 mb while product stocks drew by 25.5 mb. Other oils, including NGLs and feedstocks built by 5.7 mb. According to OPEC, crude oil stocks built by 12.9 mb while products drew by 2.8 mb.

- The EIA estimates OECD inventories rose by 18 mb in March to 2619 mb – 296 mb below the five-year average.

- The widest divergence in inventories is between the IEA and EIA at 7 mb. Total US crude inventories (excluding SPR) amount to about 424 mb, according to the EIA, which is 13 percent below the five-year average for this time of year.

2.4 Snapshot (mb/d)

3. Global Analysis

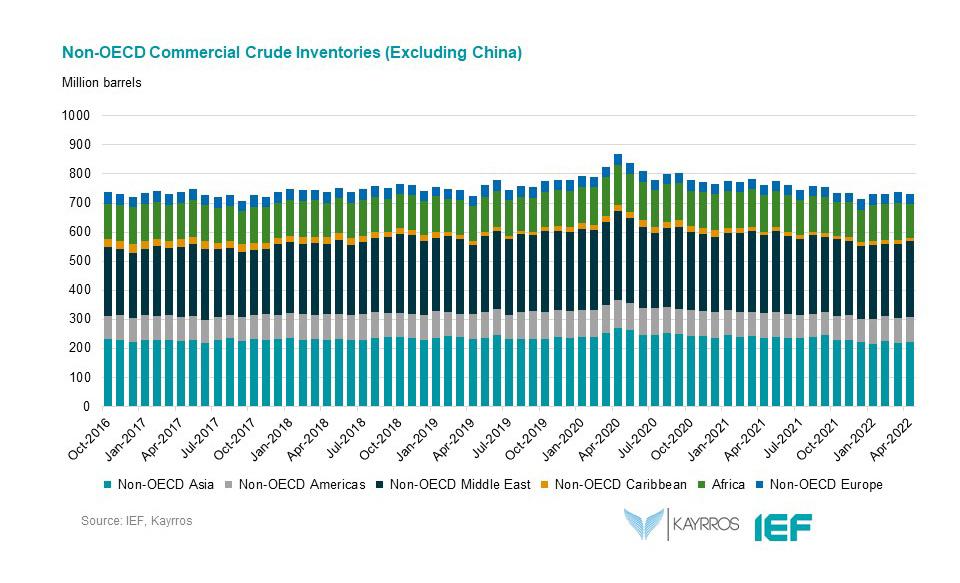

IEF-Kayrros Stock Analysis:

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.