Comparative Analysis of Monthly Reports on the Oil Market

1. International Policy and Market Context

G7, EU and Australia agree to Russian oil price cap

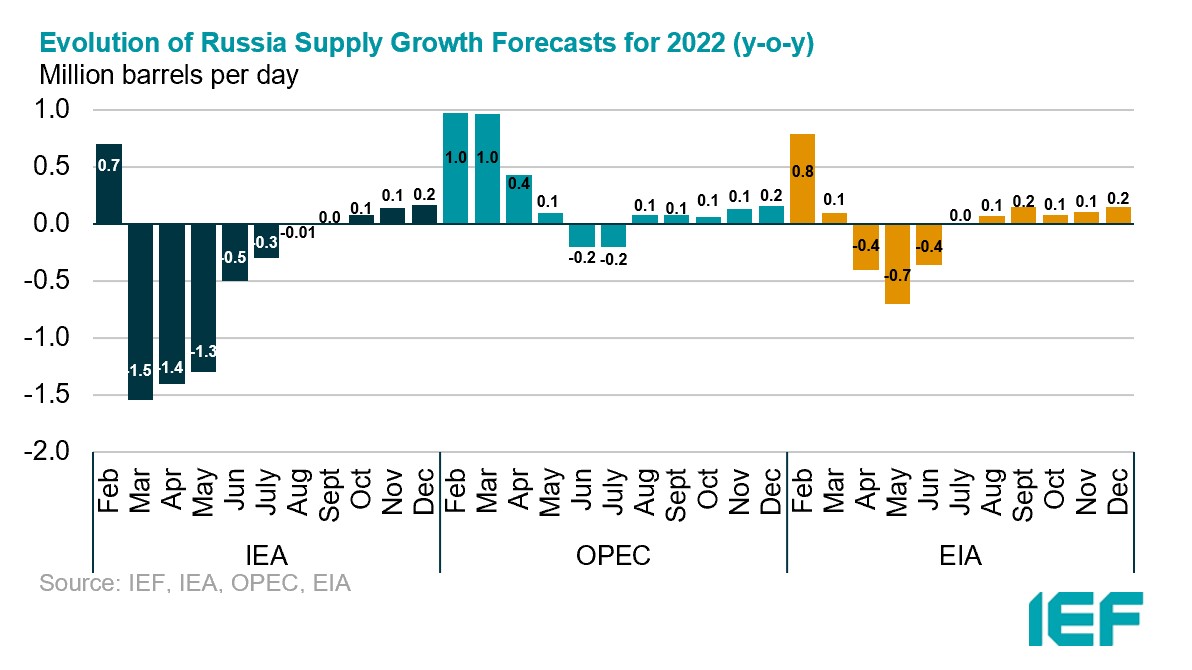

- On 2 December, the G7, EU, and Australia agreed to set a limit on the price of Russian oil at $60 per barrel to "prevent Russia from profiting from its war of aggression against Ukraine". The plan allows shipping service providers to carry Russian oil, but only at enforced low prices. The price cap, effective from 5 December, comes on top of the EU's embargo on imports of Russian crude by sea and similar pledges by the United States, Canada, Japan, and the UK. A separate price cap will be introduced on 5 February 2023 for Russian petroleum products. Russia has threatened to cut oil production in response.

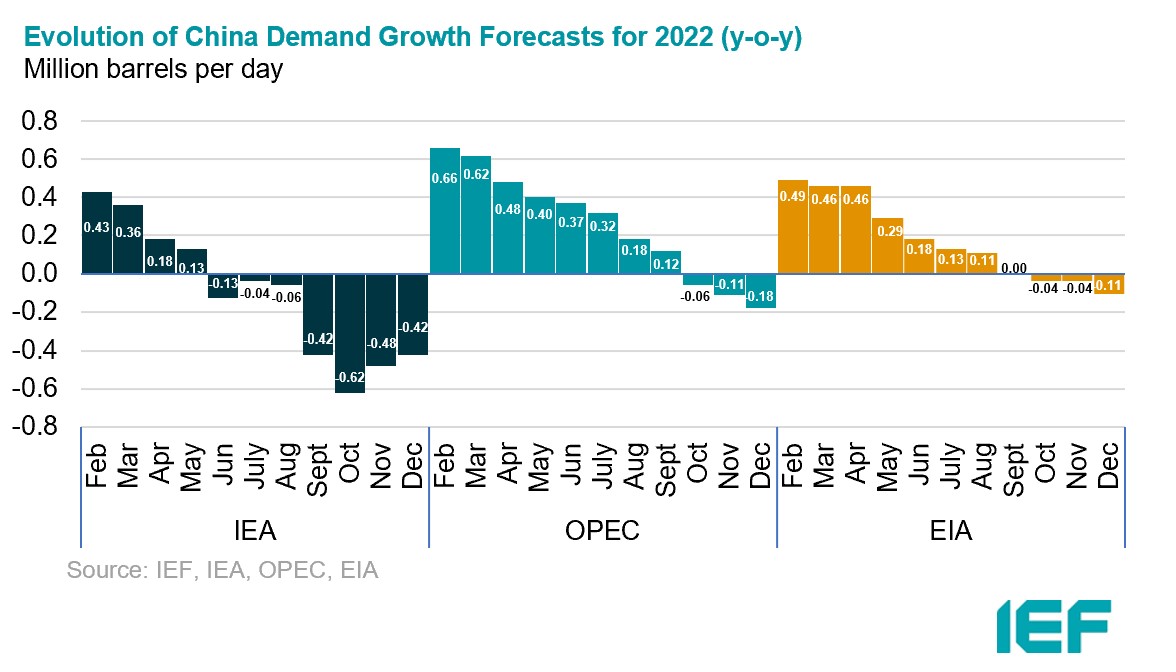

Chinese re-opening raises optimism for short-term demand

- On 7 December, China eased COVID-19-related checks and other barriers for movement within regions in the country, allowing patients with less severe symptoms to quarantine at home instead of staying in isolation facilities along with other measures. This shift in China's zero-COVID policy could revive demand in the world's largest crude market though a sudden relaxation of zero-COVID rules could also pose downside risks.

Spain, France, and Portugal agree to build hydrogen pipeline

- On 9 December, Spain, France, and Portugal agreed Friday to build a major undersea pipeline to transport green hydrogen from the Iberian Peninsula to France and eventually to the rest of Europe. The H2Med pipeline will first connect two plants in northern Portugal and northern Spain and then travel under the Mediterranean Sea from Barcelona to Marseille. The pipeline will carry about 2 million tonnes of hydrogen to France annually — 10 percent of the EU´s estimated hydrogen needs. The project is expected to cost $2.6 billion and be ready by 2030.

UK approves first coal mine in 30 years

- The UK will build its first coal mine since 1991 which will produce an estimated 2.8 million tonnes of coking coal a year – 85 percent of which will be exported. The coal is intended largely for steelmaking and not to generate electricity. The mine is planned to shut down by the end of 2049, thus not affecting the UK's goal to reach net zero emissions by 2050. The mine will produce an estimated 400,000 tonnes of greenhouse gas emissions a year, increasing the UK's emissions by the equivalent of putting 200,000 cars on the road.

OPEC+ policy on oil production remains unchanged

- On 4 December, OPEC and non-OPEC producers decided to stay the course on reducing oil production by 2 million barrels per day, or about 2 percent of world demand, from November until the end of 2023. The agreement was put into effect at the 33rd OPEC and Non-OPEC Ministerial Meeting on 5 October 2022. The 35th OPEC and non-OPEC Ministerial meeting is scheduled for 4 June 2023.

2. KEY POINTS

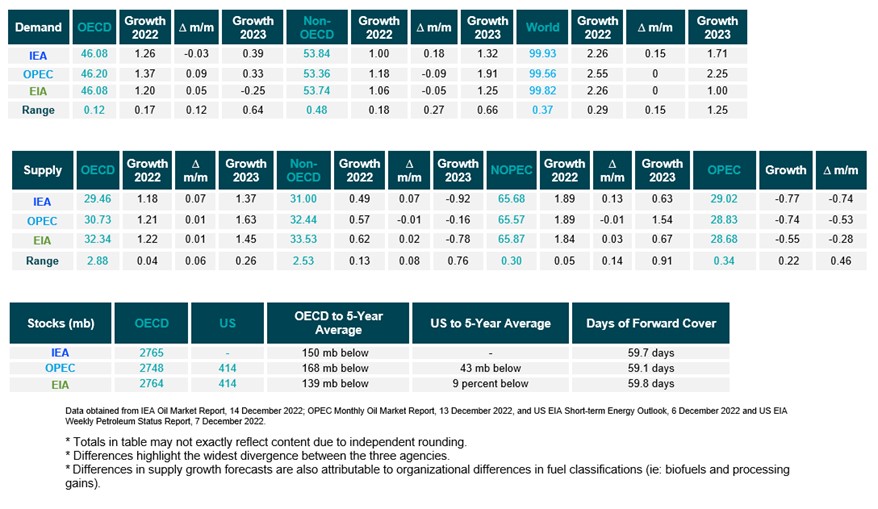

2.1 DEMAND

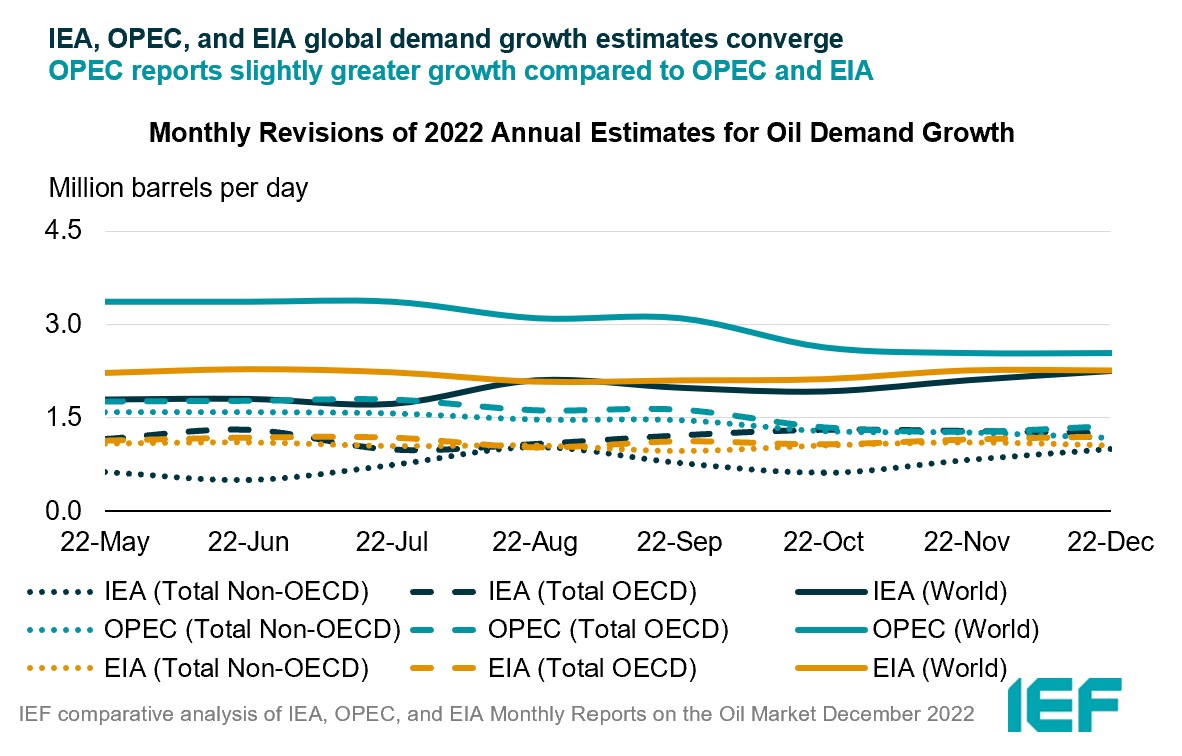

IEA's demand growth estimate rises while OPEC and EIA remain unchanged.

- The IEA's demand growth assessment for this year rises by 150 kb/d to 2.26 mb/d (y-o-y).

- OPEC and EIA year-on-year (y-o-y) forecasts stay the same at 2.55 mb/d and 2.26 mb/d in 2022, respectively.

- The IEA, OPEC, and EIA estimates for absolute world demand are now 99.93 mb/d, 99.56 mb/d, and 99.82 mb/d for 2022, respectively.

IEA non-OECD demand growth rises and is now close to OPEC and EIA estimates.

- The IEA's assessment of y-o-y non-OECD demand growth rises by 180 kb/d to 1.00 mb/d, while OPEC's estimate falls by 90 kb/d to 1.18 mb/d. EIA non-OECD demand growth also falls by 50 kb/d to 1.06 mb/d.

- The IEA's estimate for OECD demand growth falls by 30 kb/d to 1.26 mb/d for 2022 while OPEC's projection rises by 90 kb/d for a growth of 1.37 mb/d. EIA demand growth rises by 50 kb/d for a growth of 1.20 mb/d.

- The largest divergence in OECD and non-OECD demand growth estimates are between OPEC and EIA at 0.17 mb/d and between IEA and OPEC at 0.18 mb/d, respectively.

2.2 SUPPLY

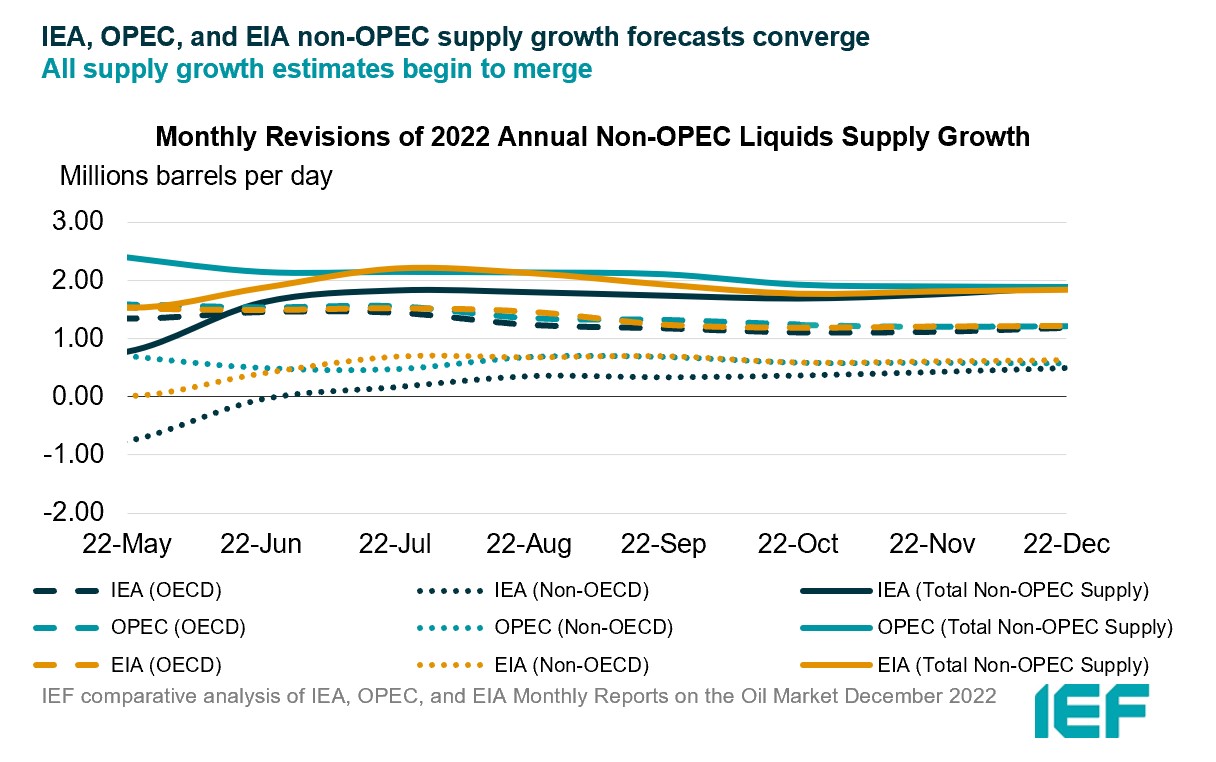

The IEA, OPEC, and the EIA non-OPEC supply growth estimates see alignment.

- The IEA's December assessment for non-OPEC supply rises by 130 kb/d to reach a growth of 1.89 mb/d while OPEC's estimate falls by 10 kb/d for a growth of 1.89 mb/d. The EIA's assessment rises by 30 kb/d for an overall growth of 1.84 mb/d. In absolute values, the IEA, OPEC, and the EIA estimate non-OPEC supply at 65.68 mb/d, 65.57 mb/d, and 65.87 mb/d, respectively for 2022.

- The IEA estimates OECD oil supply growth this year at 1.18 mb/d, OPEC pegs it at 1.21 mb/d, and EIA reports growth at 1.22 mb/d, an increase of 70 kb/d, 10 kb/d, and 10 kb/d, respectively. In absolute terms, the IEA, OPEC, and the EIA estimate OECD oil supply at 29.46 mb/d, 30.73 mb/d, and 32.34 mb/d, respectively for 2022. The largest divergence of OECD supply growth estimates is between EIA and IEA at 40 kb/d.

The IEA, OPEC, and EIA non-OECD supply growth forecasts move closer.

- The IEA's assessment for non-OECD supply rises by 70 kb/d to a total growth of 0.49 mb/d in 2022.

- OPEC's growth dips slightly by 10 kb/d for a growth of 0.57 mb/d while the EIA revised its non-OECD growth forecast up by 20 kb/d to a growth of 0.62 mb/d.

- In absolute values, the IEA, OPEC, and the EIA non-OECD supply estimates are 31.00 mb/d, 32.44 mb/d, and 33.53 mb/d, respectively for 2022 with the largest divergence in growth estimates between the IEA and EIA at 0.13 mb/d.

The IEA, EIA, and OPEC report a decline in OPEC output in November.

- The IEA reported OPEC production declined by 770 kb/d in October to 29.02 mb/d.

- OPEC also showed OPEC production fell month-on-month by 744 kb/d to 28.83 mb/d.

- EIA assessed OPEC production at 28.68 mb/d, down 550 kb/d month-on-month.

2.3 STOCKS

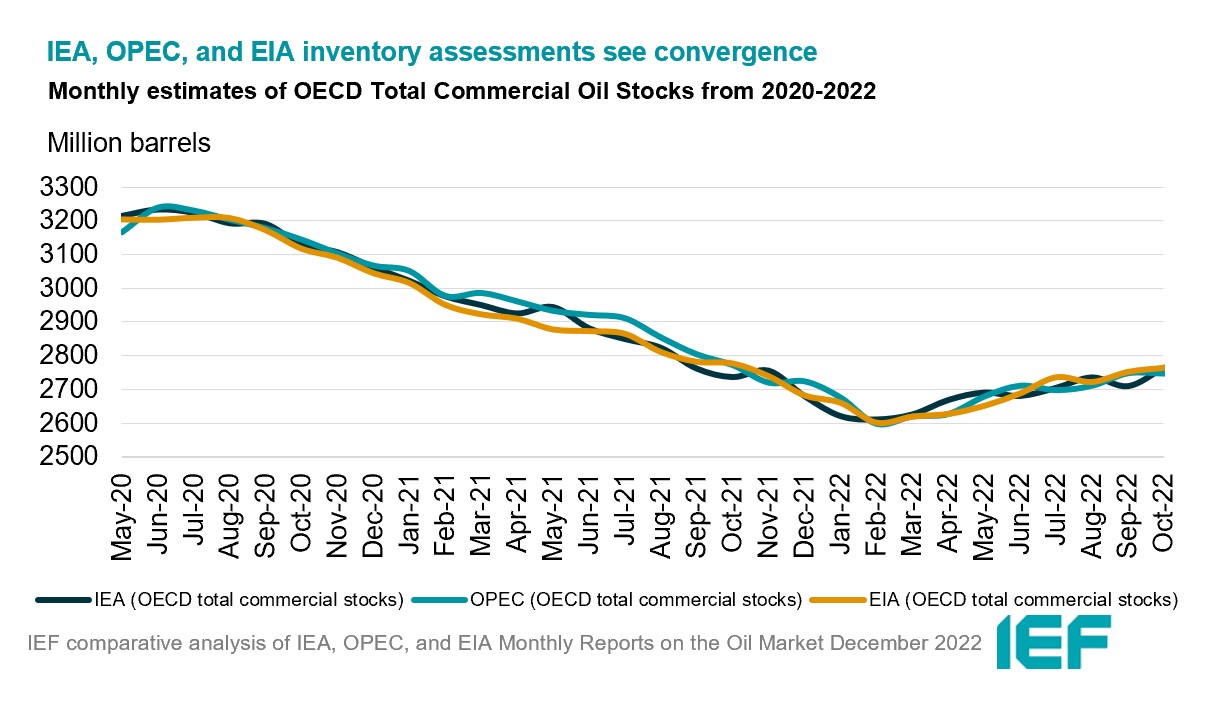

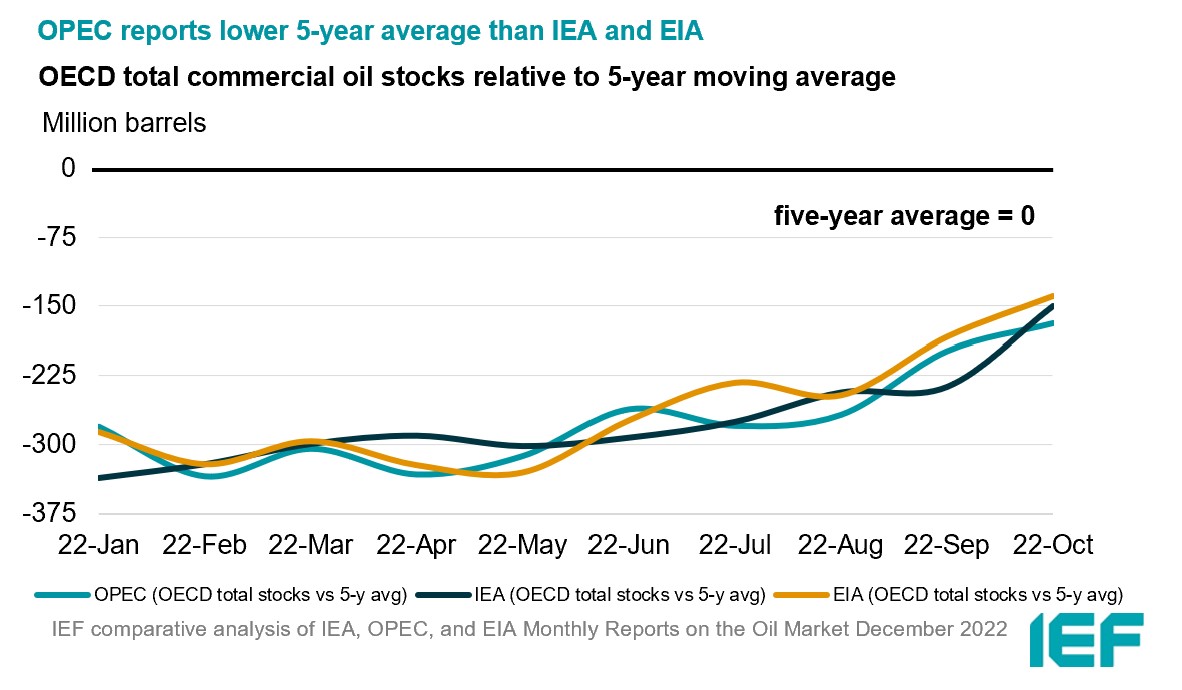

The IEA, OPEC, and EIA continue to display strong alignment on stock figures which are below the five-year average and close to 60 days forward cover.

- The IEA reports OECD stock levels at 2765 mb, which is close to OPEC's assessment of 2748 mb and EIA's assessment of 2764 mb. These are around 150 mb, 168 mb, and 139 mb below the five-year average, respectively.

- According to the IEA, crude oil inventories built by 14.2 mb while product stocks drew by 2.8 mb. Other oils, including NGLs and feedstocks built by 5.9 mb. According to OPEC, crude oil stocks built by 12.9 mb while products built by 9.5 mb.

- The EIA estimates OECD inventories rose by 25 mb in September to 2764 mb – 139 mb below the five-year average.

- The widest divergence in inventories is between the IEA and OPEC at 17 mb. Total US crude inventories (excluding SPR) amount to about 414 mb, according to the EIA, which is 9 percent below the five-year average for this time of year.

2.4 SNAPSHOT (mb/d)

3. Global Analysis

Explanatory Note

The IEF conducts a comprehensive comparative analysis of the short-, medium-, and long-term energy outlooks of the IEA, OPEC, and the EIA to inform the IEA-IEF-OPEC Symposium on Energy Outlooks that the IEF hosts in Riyadh as part of the trilateral work programme on a yearly basis.

To inform IEF stakeholders on how perspectives on the oil market of both organisations evolve over time regularly, this monthly summary provides:

- An overview of key events and initiatives in the international policy and market context.

- Key findings and a snapshot overview of data points gained from comparing basic historical data and short-term forecasts of the IEA Oil Market Report, the OPEC Monthly Oil Market Report, and the EIA Short-term Energy Outlook.

- A comparative analysis of oil inventory data reported by the IEA, OPEC, and EIA, and secondary sources in collaboration with Kayrros (added in an updated report on the IEF website).

The International Energy Forum

The International Energy Forum is the leading global facilitator of dialogue between sovereign energy market participants. It incorporates members of International Energy Agency and the Organization of the Petroleum Exporting Countries, and also key players including China, India, Russia and South Africa. The forum's biennial ministerial meetings are the world's largest gathering of energy ministers, where discussions focus on global energy security and the transition towards a sustainable and inclusive energy future. The forum has a permanent secretariat of international staff based in the Diplomatic Quarter of Riyadh, Saudi Arabia. For more information visit www.ief.org.