Comparative Analysis of Monthly Reports on the Oil Market

Thursday 18 January 2024

Oil Market Context

Oil prices remain range-bound despite rising geopolitical risk in the Middle East

More shippers are avoiding the Red Sea following a series of attacks on transiting ships by Yemen-based Houthis. The Suez Canal and Bab al-Mandeb Strait carried nearly 10% of all seaborne oil trade last year. Several oil companies have suspended shipments through the area and elected to reroute cargos around Africa’s Cape of Good Hope, adding 10-14 days to the voyage time. As a result of the attacks, a US-led coalition has launched a series of strikes on Houthi targets in Yemen.

Additionally in the region, Iran carried out strikes in Iraq, Syria, and Pakistan earlier this week. Pakistan then carried out a retaliatory strike into Iran.

Despite the geopolitical escalation, physical oil and gas production have not yet been impacted and Brent crude prices have remained range-bound in the upper-$70s. Economic headwinds and negative sentiment have helped keep prices capped.

Extreme cold and winter weather disrupt US production and refineries

Oil production in North Dakota, the US’ third largest producing state, has fallen by nearly 50% (~700 kb/d) this week because of operational challenges from extreme cold temperatures. Freezing weather in Texas has also resulted in reduced operations at numerous refineries. US physical oil prices have seen some upward pressure, but the outage is expected to be temporary, and the futures market remains largely unaffected.

Angola leaves OPEC

Angola announced in late December it was leaving OPEC after 16 years of membership. Angola was the 7th largest OPEC member, producing ~1.1 mb/d of crude. There are now 12 OPEC members.

This edition of the Comparative Analysis report includes Angola in non-OPEC production figures and has adjusted the month-on-month revisions to account for its reclassification from OPEC to non-OPEC.

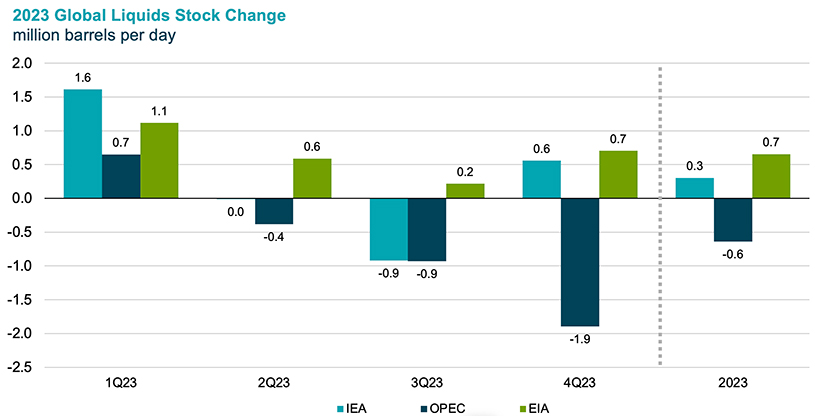

2023 has come to an end, but oil balances still show unusually large divergences

- Data, particularly for demand, is revised routinely for years to come, but this large of a divergence at the end of the year is uncommon.

- The 2023 annual balances from IEA, OPEC, and EIA imply global oil inventories either grew by 0.3-0.7 mb/d or drew by 0.6 mb/d.

- This is a 1.3 mb/d range for 2023 and is more than 3x the range in estimates for 2022 (a 0.4 mb/d gap).

- 4Q23 data is still considered a forecast and the current estimates of the global supply-demand balance diverge by 2.6 mb/d.

- However, data for 1Q23 is 9+ months old and balance estimates still diverge by 0.9 mb/d.

- All three forecasters are fairly aligned on non-OPEC production estimates for the year, but their estimates on global demand levels differ by 1 mb/d and on OPEC supply differ by 0.6 mb/d.

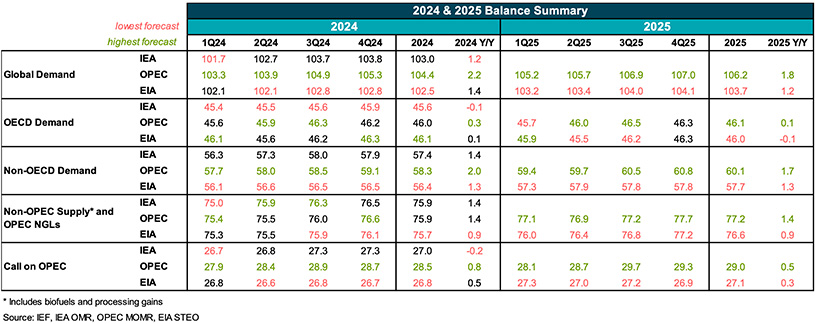

Summary of 2024-2025 Balances

OPEC and EIA published inaugural 2025 forecasts this month. IEA is scheduled to introduce its 2025 forecast in April.

- Demand growth forecasts diverge by 1.0 mb/d in 2024 and 0.6 mb/d in 2025. OPEC sees the most robust growth both years. IEA sees OECD demand contracting this year and EIA sees it contracting next year.

- OPEC and EIA’s 2025 global demand level forecasts diverge by 2.5 mb/d – roughly equivalent to the current consumption levels of South Korea or Canada.

- Non-OPEC supply is forecast to grow by 0.9-1.4 mb/d in both 2024 and 2025.

- OPEC and EIA both see the call on OPEC rising in 2024 and 2025 as demand growth outpaces non-OPEC supply growth in both years.