Comparative Analysis of Monthly Reports on the Oil Market

Friday 12 April 2024

Oil Market Context

Oil prices climb with rising geopolitical risk and tightening fundamentals

Brent crude prices have risen nearly 20% since the beginning of the year and have surpassed $90/bbl for the first time since October. The price rally over the last few months has been supported by rising geopolitical tensions, strong speculative activity, and falling inventories.

With the latest hard data, global onshore inventories fell for a seventh consecutive month in February to their lowest level since at least 2016.

US inventories are frequently watched as a bellwether for the global market due to the relative size of inventories and the frequency of data. In 1Q24, US crude and product inventories drew by 27mb compared to a build of nearly 20mb over the same period last year. US product stocks fell by a substantial 56mb in 1Q24 – double the draw rate seen last year.

The drawdown in inventories has been driven by supply management from OPEC+ and robust demand. OPEC+ is currently withholding ~5.8 mb/d from the market through collective official cuts and voluntary measures. The next OPEC+ meeting is scheduled for June 1st.

Rising geopolitical tensions have also contributed to higher prices. More than 10 Russian refineries have been targeted in drone attacks in the past few months and industry reports indicate that ~14% of Russian refining capacity has been partially or fully halted. Russia has also increased attacks on Ukrainian energy infrastructure, including power plants and natural gas storage sites. Additionally, tensions in the Middle East continue to rise with press reports indicating a potential imminent attack on Israel from Iran following a strike on Iran's diplomatic compound in Syria in early April.

Escalating geopolitical tensions have contributed to increased speculative activity. On April 5th, there were more bullish Brent call options bought by traders than any other day since 2019.

EIA warned in this month's STEO that further tightening in the market is expected in 2Q24. The agency estimates there will be global supply deficit of 0.9 mb/d for the quarter and 0.3 mb/d for the year.

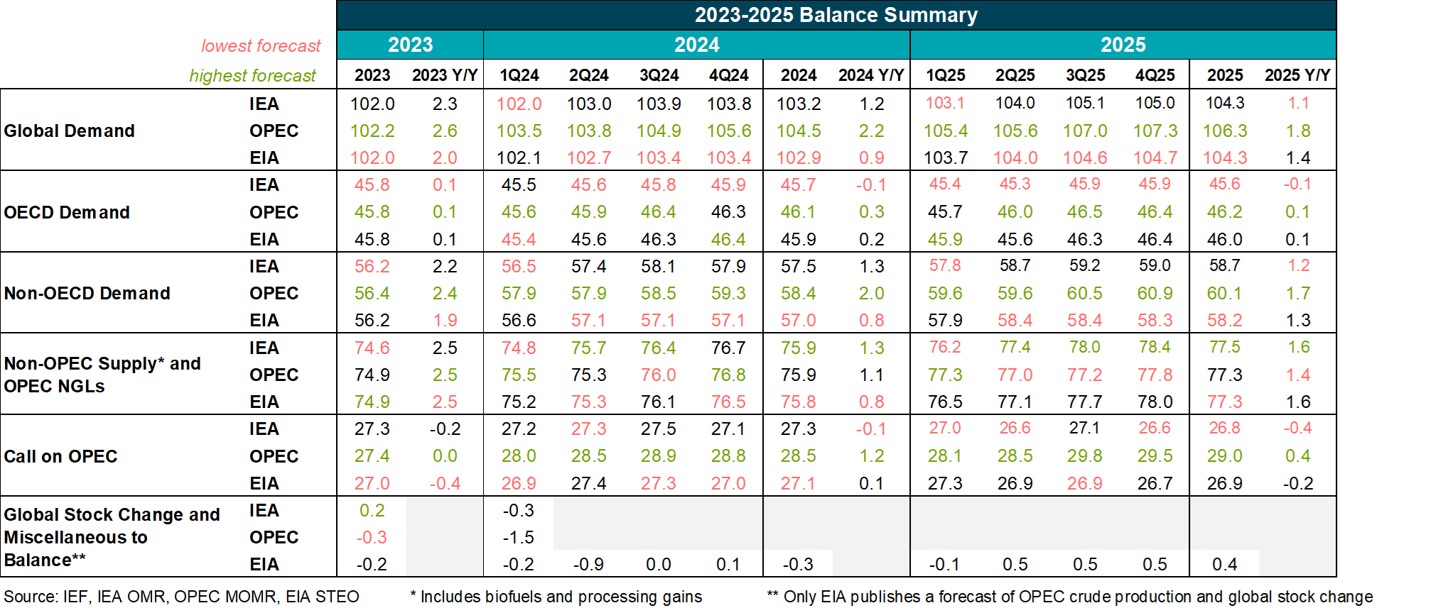

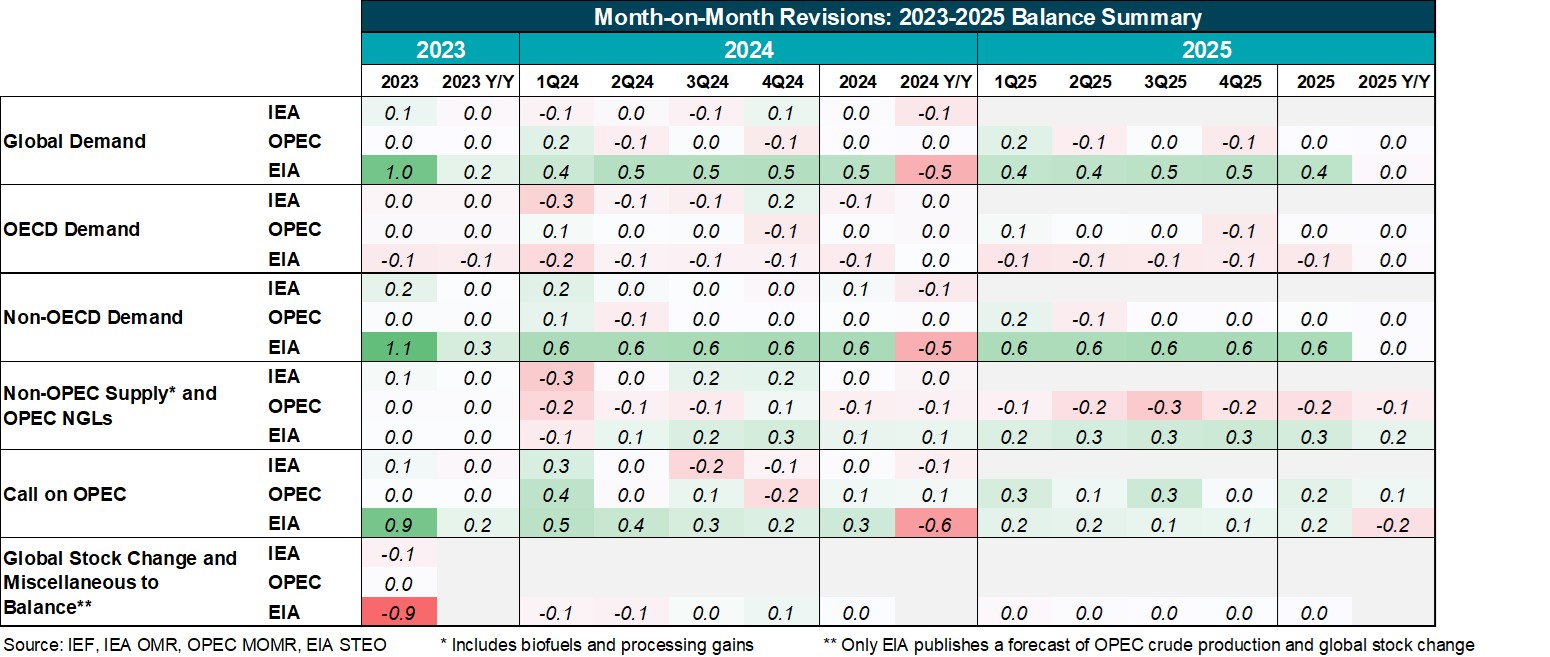

Summary of 2023-2025 Balances

- IEA released its inaugural 2025 forecast this month and sees global demand growth at 1.1 mb/d, down from 2.3 mb/d seen last year and 1.2 mb/d expected this year. IEA sees a slight contraction in OECD demand this year and next.

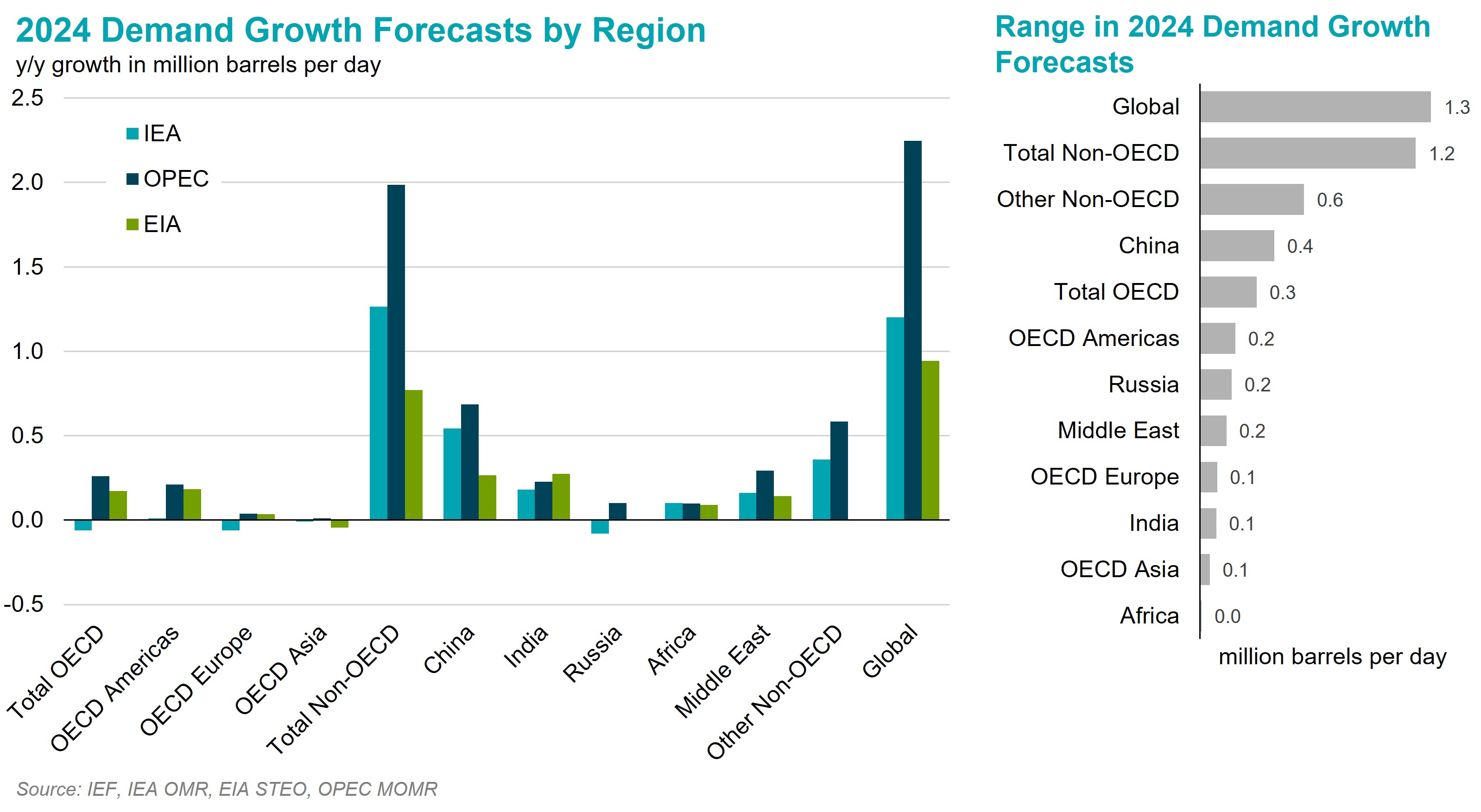

- Demand growth forecasts diverge by 1.3 mb/d in 2024 and 0.7 mb/d in 2025. The global demand levels for 2025 diverge by 2 mb/d with OPEC at 106.3 mb/d and IEA and EIA both at 104.3 mb/d.

- OPEC sees the "call on OPEC" rising both this year and next year while IEA sees a decline both years. OPEC's 2025 "call on OPEC" is 2.2 mb/d higher than IEA's primarily due to OPEC's higher demand forecast.

- EIA updated its historical demand estimates after incorporating recent updates to its International Energy Statistics for 2022. The revisions were primarily to historical demand in Russia, the Middle East, Non-OECD Asia (outside China and India), and Brazil. The baseline revisions for 2022 were fully carried forward to 2023 with a 1 mb/d upward revision to global demand and partially carried forward to 2024 and 2025 with an 0.5 mb/d and 0.4 mb/d upward revision, respectively. While 2024 global demand levels were revised higher by 0.5 mb/d, the demand growth for 2024 was revised down by 0.5 mb/d.

- Other notable revisions this month include IEA's 0.3 mb/d downward revisions to 1Q24 OECD demand (Japan and US) and 1Q24 non-OPEC supply (US). OPEC also revised down its 2025 non-OPEC supply by 0.2 mb/d on a lower US forecast.

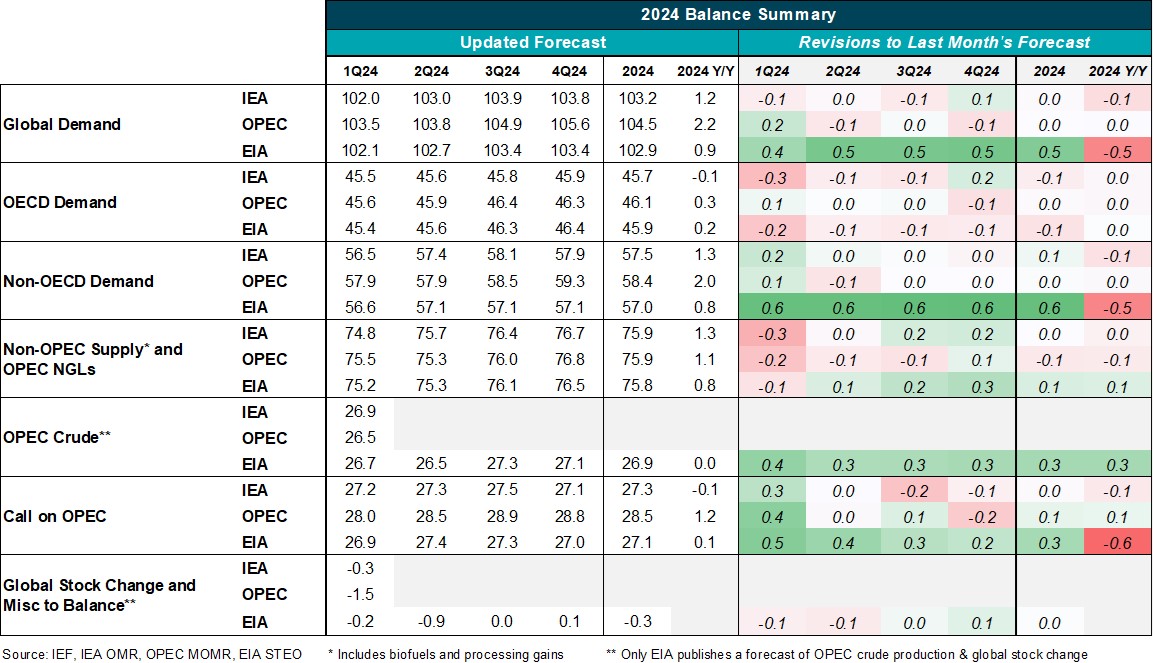

Summary of 2024 Balances and Revisions

- EIA's upward baseline adjustment that was partially carried through to 2024 resulted in a 0.5 mb/d higher global demand level forecast, but a 0.5 mb/d lower demand growth outlook compared to last month (see page 3 for more information).

- Global demand growth for 2024 now diverges by 1.3 mb/d with EIA seeing only 0.9 mb/d growth and OPEC seeing 2.2 mb/d. The largest divergences are in non-OECD demand, where EIA sees only 0.8 mb/d growth this year vs. OPEC's 2.0 mb/d growth.

- All three balances show there was a global supply deficit in 1Q24. However, the estimates of deficit range from OPEC's 1.5 mb/d to EIA's 0.2 mb/d.

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC's 2024 global demand growth forecast remained unchanged this month while EIA and IEA revised lower.

- IEA revised up OECD demand growth slightly lower this month following 5 consecutive months of upward revisions. IEA sees a slight contraction in OECD demand this year while OPEC and EIA see growth.

- EIA's significant downward revision to non-OECD demand was the result of some baseline adjustments that were only partially carried through to 2024 (see slide 3 for more details).

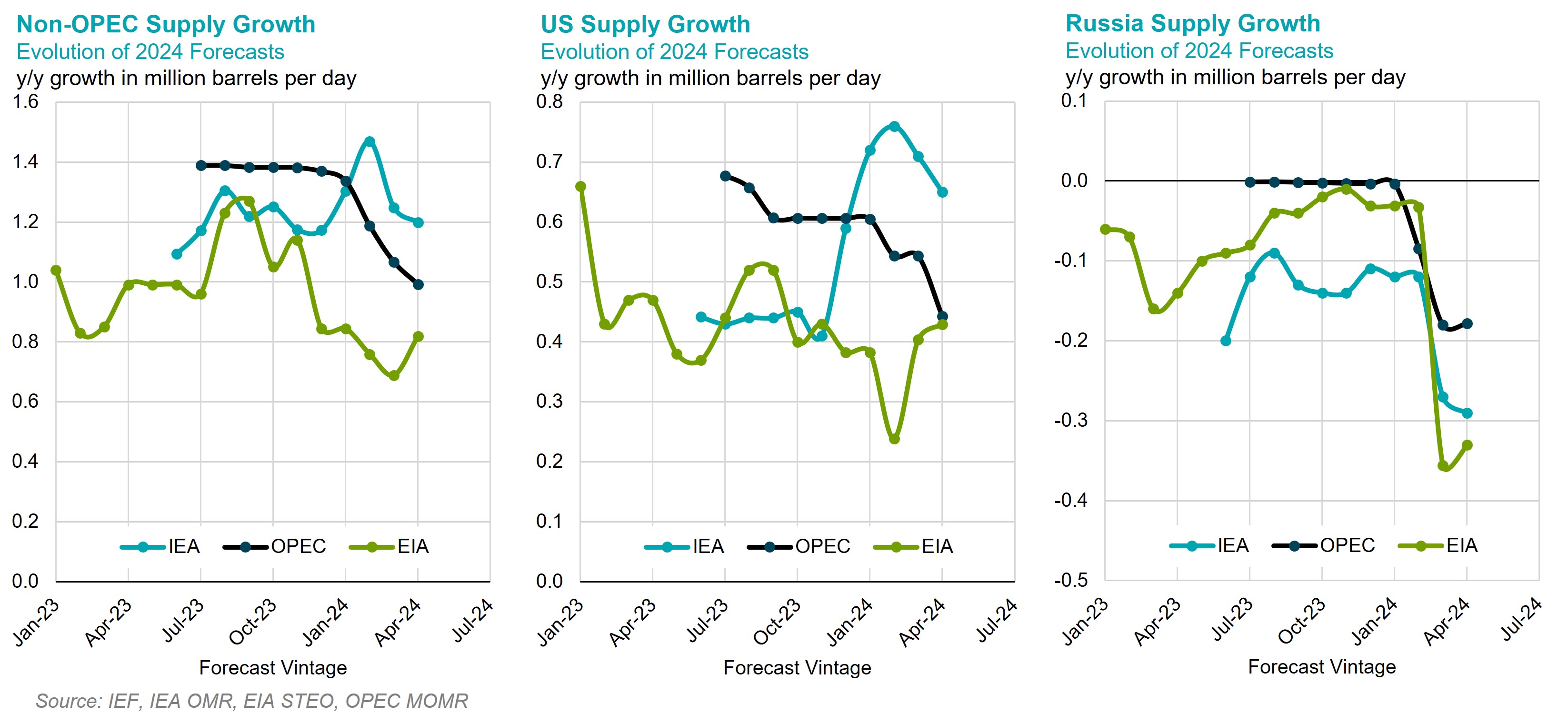

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- IEA continues to see the most robust non-OPEC supply growth this year, led by a higher US outlook. IEA sees about ~0.25 mb/d stronger US growth compared to OPEC and EIA.

- Russian production is expected to contract by ~0.20-0.35 mb/d this year as it continues voluntary cuts with other OPEC+ members.