Comparative Analysis of Monthly Reports on the Oil Market

Tuesday 15 October 2024

Summary and Oil Market Context

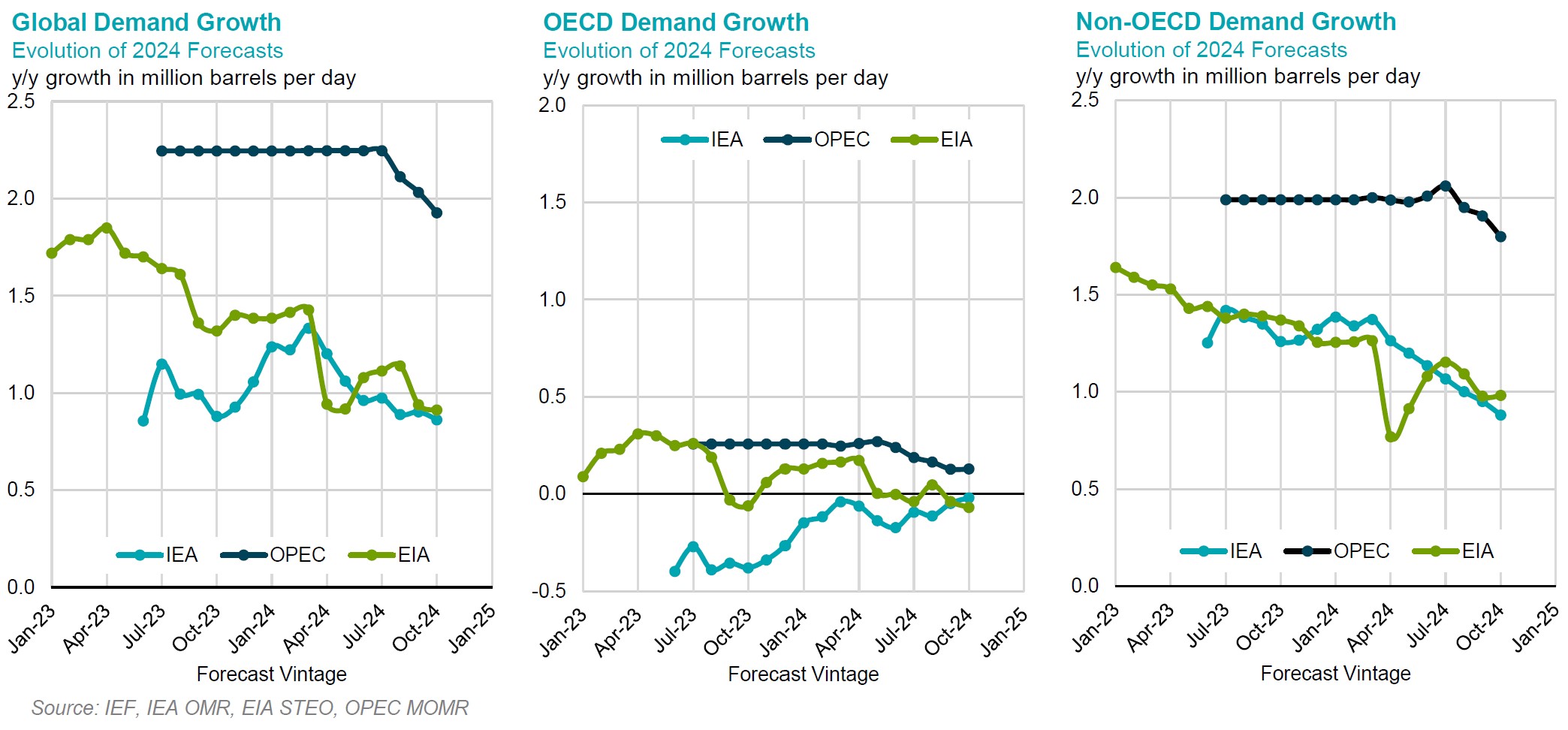

Demand

EIA has adjusted its global demand growth forecast downward by 0.2 mb/d in the third quarter and 0.1 mb/d in the fourth quarter of 2024, while also revising down the full-year growth for 2025 by 0.2 mb/d. This reduction is largely driven by adjustments to OECD demand and a decrease in Chinese fuel consumption. The EIA observed that despite the announcement of Chinese monetary stimulus measures supported by the government, concerns are still reflected in the short-term forecasts.

OPEC has adjusted its global demand growth projection downward by approximately 0.1 mb/d to 1.9 mb/d for 2024 year-on year (y/y) and has also reduced its 2025 global demand growth forecast by 0.1 mb/d to 1.6 mb/d y/y. These revised modifications are due to incorporating real data collected along with reduced projections for certain areas. However, this forecast remains substantially higher, by one million barrels per day, than the estimates provided by the IEA and EIA for 2024.

The IEA has revised its global demand growth forecasts down by 0.1 mb/d for the full year 2024 and by the same amount for the full year in 2025. However, year-on-year growth forecasts have remained unchanged for both 2024 and 2025, driven by IEA’s subdued projections for growth in China this year, which accounts for 20% of the total gains, compared to 70% in 2023.

The divergence in global demand growth forecasts across the three agencies for 2025 shows more alignment than the 2024 forecasts, with 2025 differences reaching 0.6 mb/d y/y compared to around one million for 2024 y/y.

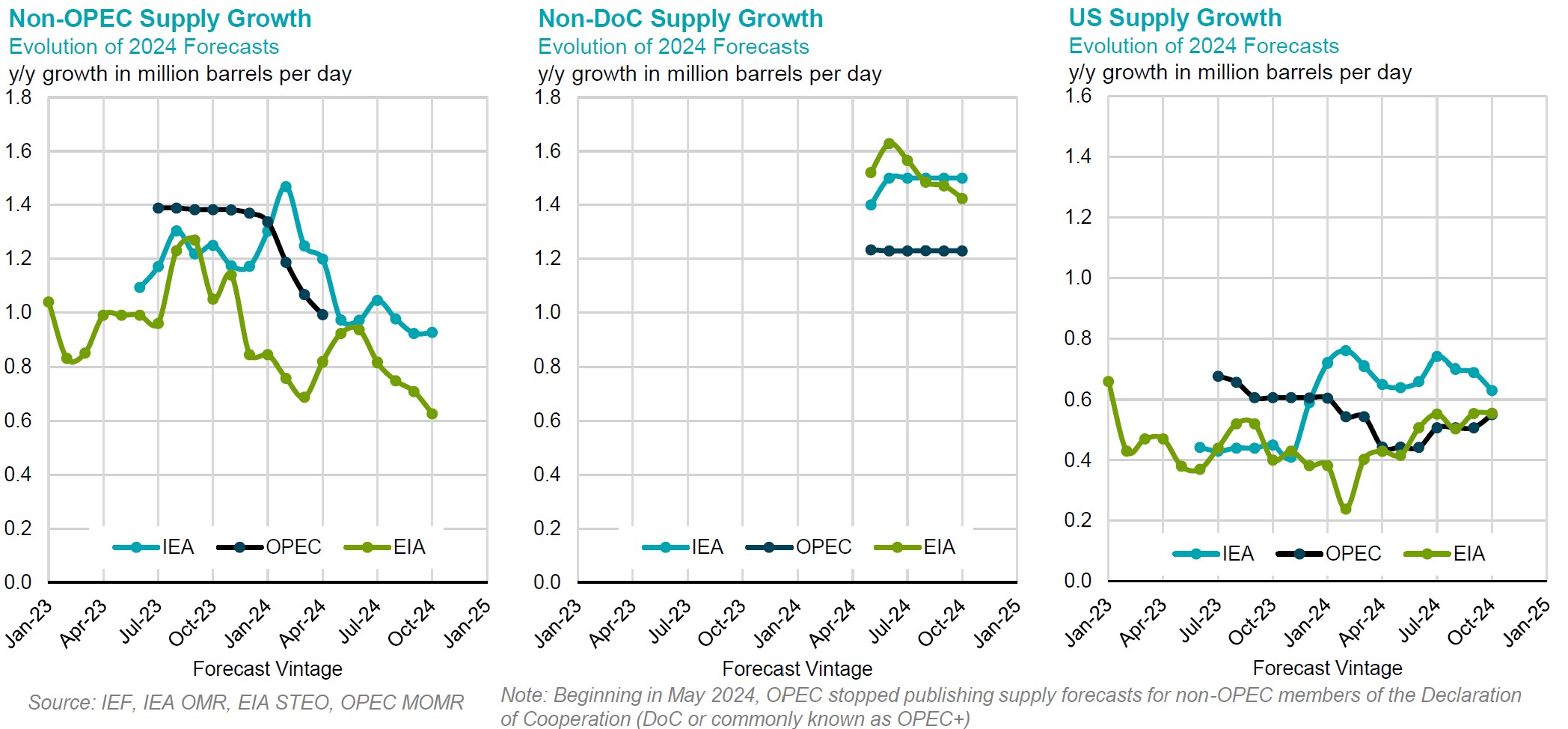

Supply

OPEC has maintained its oil supply growth forecasts for non-Declaration of Cooperation (non-DoC) at approximately 1.3 mb/d for 2024 and 1.2 mb/d for 2025, y/y. This growth is primarily driven by the United States, Canada, and Brazil in both years, while OPEC anticipates a decline in supply from Angola in 2025.

The EIA has revised its projections for non-OPEC supply growth downward by 0.1 mb/d y/y to 0.7 mb/d, with a further decline in 2025 by 0.1 mb/d to 1.4 mb/d y/y. In contrast, the EIA has increased its non-DoC supply growth forecast by 0.1 mb/d for the full year of 2024 but has muted the forecasts for 2025 compared to last month's assessment. The EIA's short-term supply forecasts indicate that, at this time, there is currently substantial spare capacity available, which could be activated in the event of supply disruptions.

The IEA has kept its supply growth forecasts for non-DoC and non-OPEC unchanged. The divergence in short-term non-DoC supply growth forecasts among these three entities is expected to reach 0.2 mb/d for 2024 y/y and 0.4 mb/d for 2025 y/y.

Oil market volatility

Oil market volatility increased this month, driven by Hurricane Milton's impact, and mixed macroeconomic and geopolitical signals regarding global oil demand trajectories and potential supply disruptions, respectively. However, despite further military escalation in Europe and the Middle East where risk to energy infrastructure and trade routes are manifest and persist, perception of a relatively well supplied market and lower demand growth moderate market responses so far.

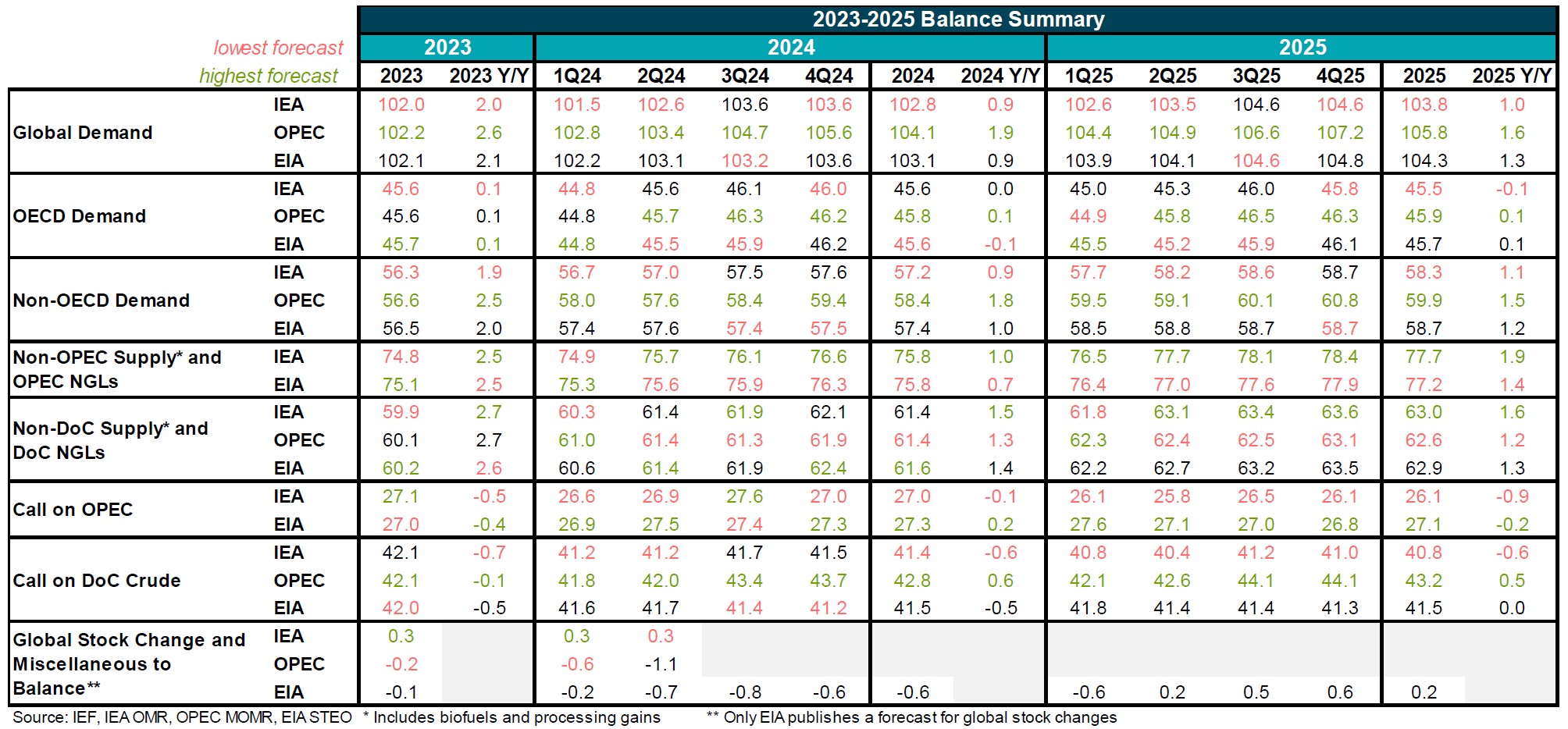

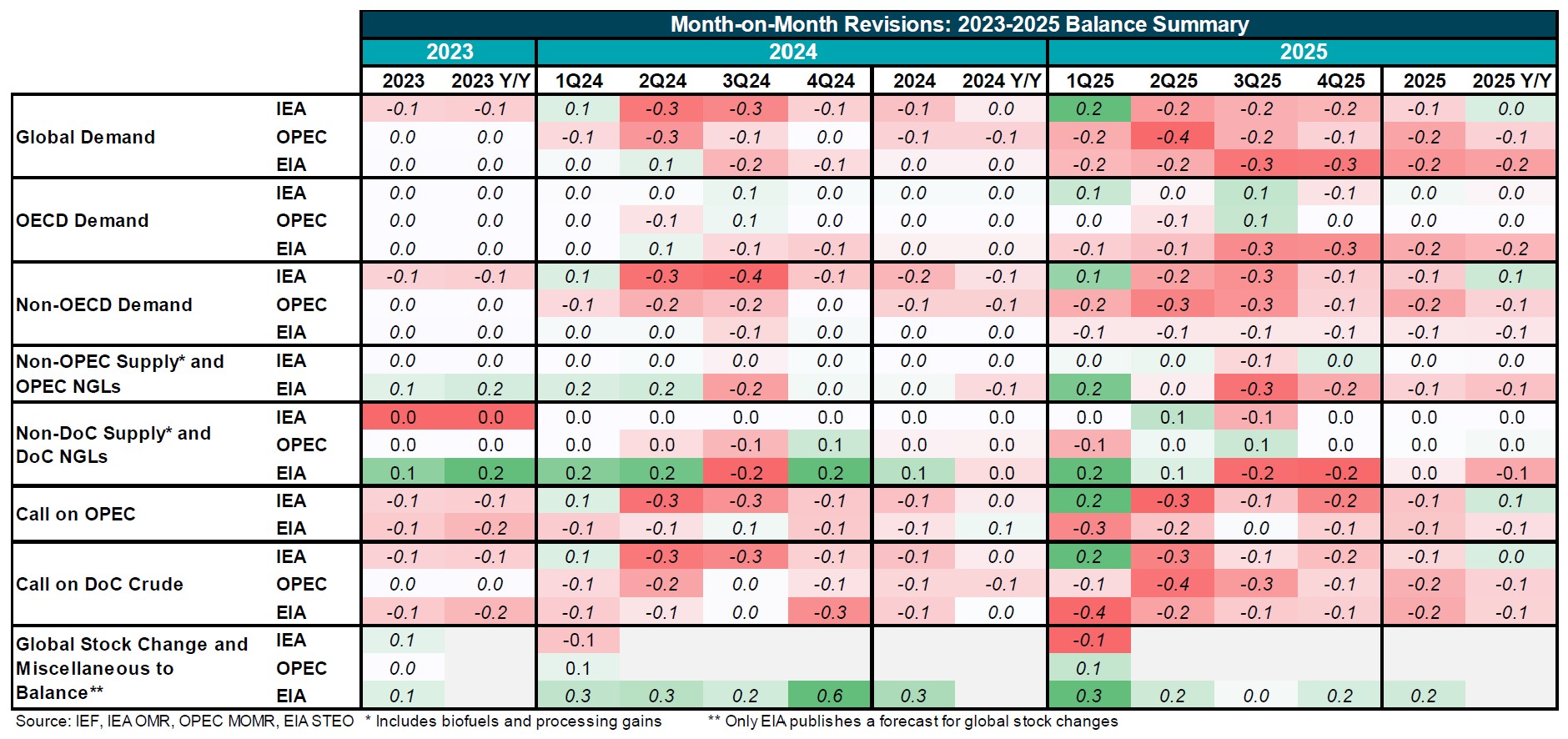

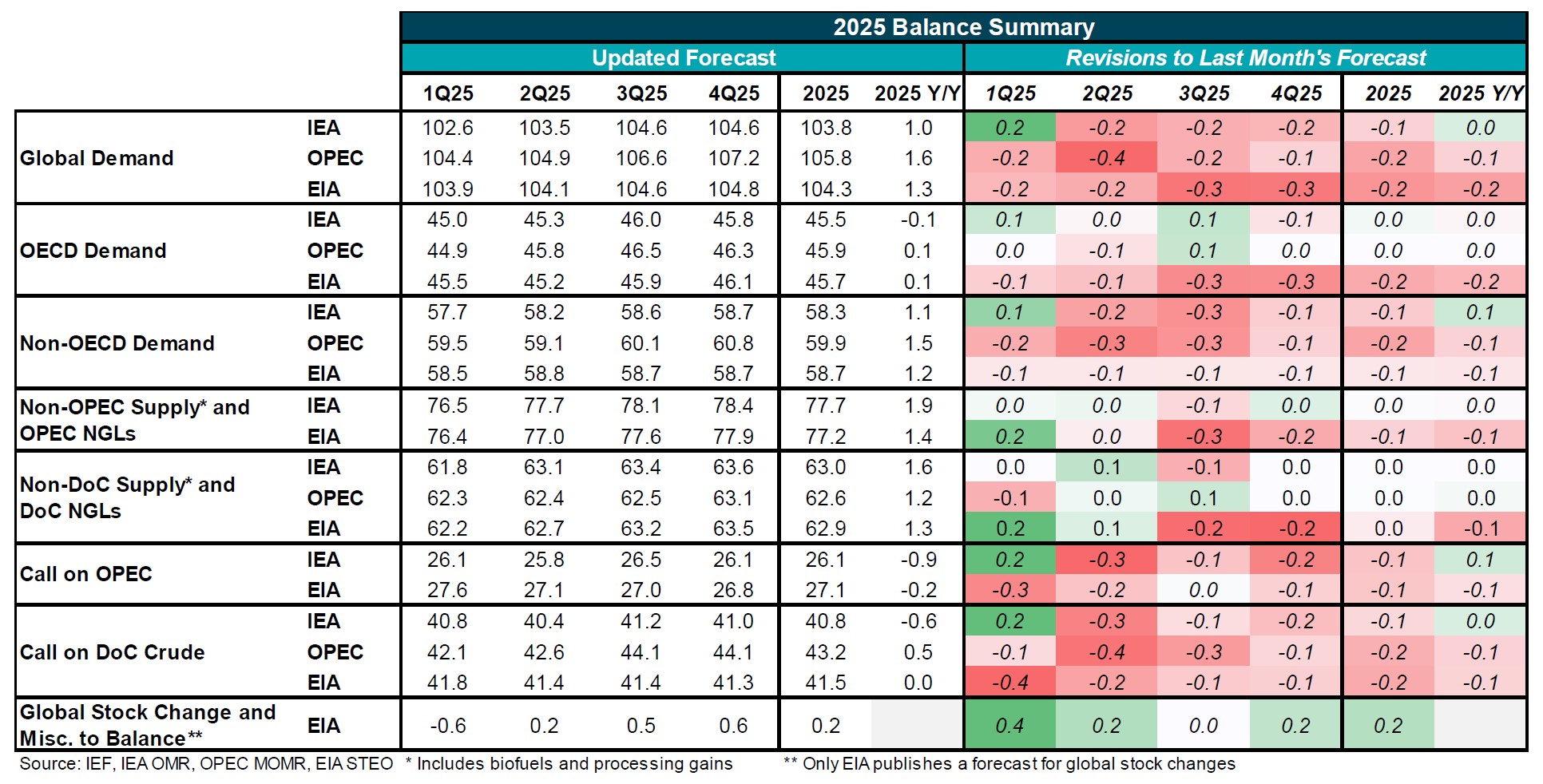

Summary of 2023-2025 Balances

- OPEC has revised its global oil demand growth forecasts downward for the third consecutive month, affecting both 2024 and 2025 projections. For 2024, the growth estimate has been adjusted down by approximately 0.1 bpd to 1.9 bpd y/y. Similarly, for 2025, OPEC has lowered its demand growth estimate by 0.1 bpd, bringing it down to 1.64 million bpd y/y from the previously anticipated 1.74 mb/d.

- Despite this reduction in OPEC's projections this month, the disparity in global oil demand growth estimates among the three agencies remains considerable, with a variation of one million barrels per day anticipated for y/y figures in 2024.

- The IEA has maintained its forecast for global demand growth for 2024 at 0.9 mb/d year-over-year.

- The EIA has maintained its global demand growth forecasts unchanged for the full year 2024, with the decline in 3Q and 4Q was offset by an upward revision in 2Q. For 2025, EIA has revised down its global demand growth forecast by 0.2 mb/d for the full year.

- The IEA has kept its OECD demand growth forecasts unchanged for both 2024 and 2025 y/y, while it has revised down its non-OECD demand growth forecast by 0.2 mb/d for the full year in 2024 and by 0.1 mb/d for the full year in 2025.

- OPEC revised its non-OECD demand growth downward for the full years 2024 and 2025 by 0.1 mb/d and 0.2 mb/d, respectively.

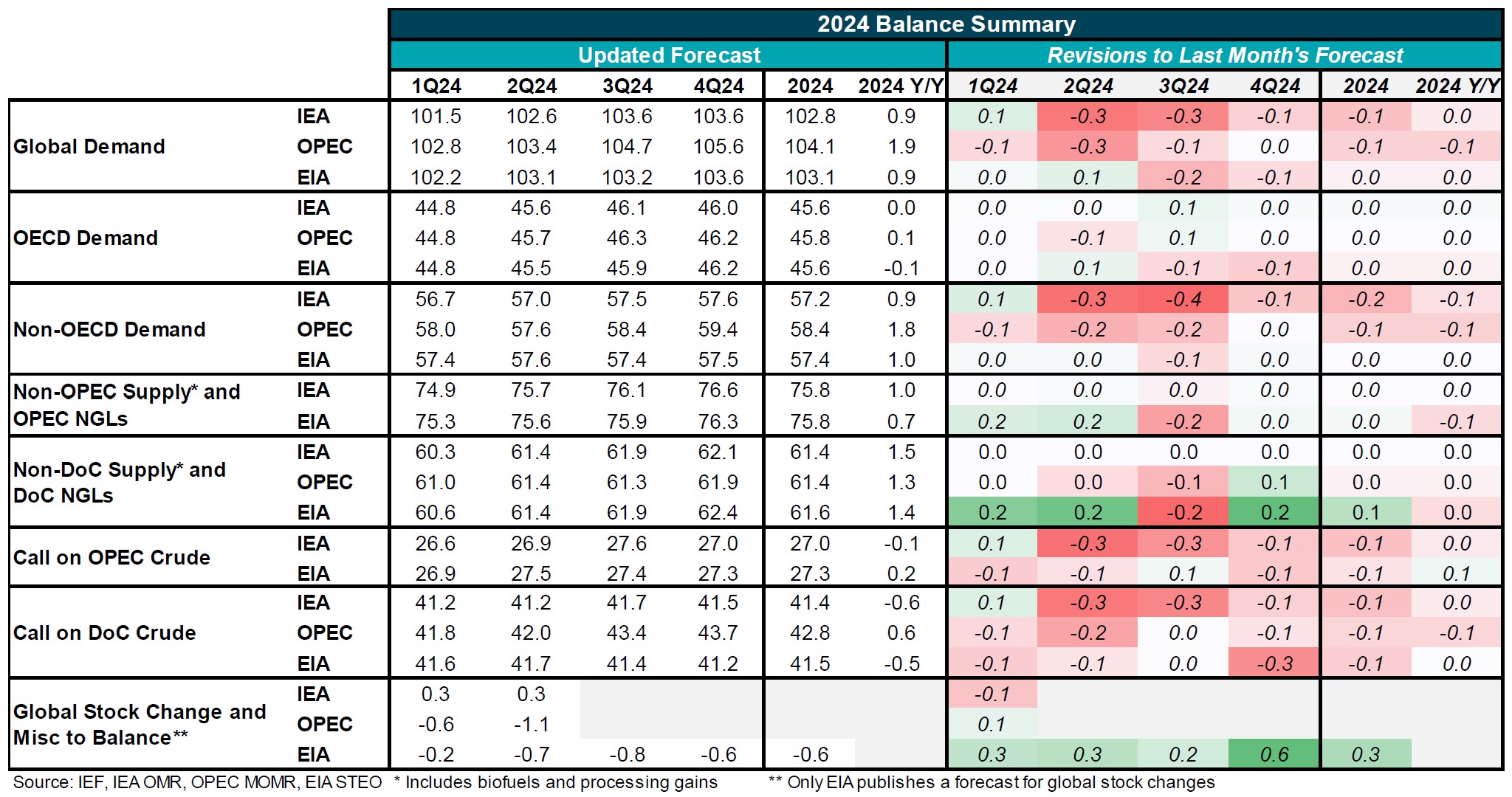

Summary of 2024 Balances and Revisions

- OPEC has adjusted its global demand growth forecast downward by 0.1 mb/d to 1.9 mb/d y/y, down from 2.0 mb/d in last month's revision.

- The EIA and IEA have kept their global demand growth forecasts unchanged y/y.

Evolution of 2024 Annual Demand Growth Forecasts

- OPEC has adjusted its forecast for global oil demand growth in 2024, reducing it by approximately 0.1 mb/d based on newly acquired data.

- The EIA has maintained its global demand growth forecast for 2024 unchanged.

- The IEA has made a modest decline in its global demand forecasts, with the decrease in non-OECD demand offset by an increase in OECD demand.

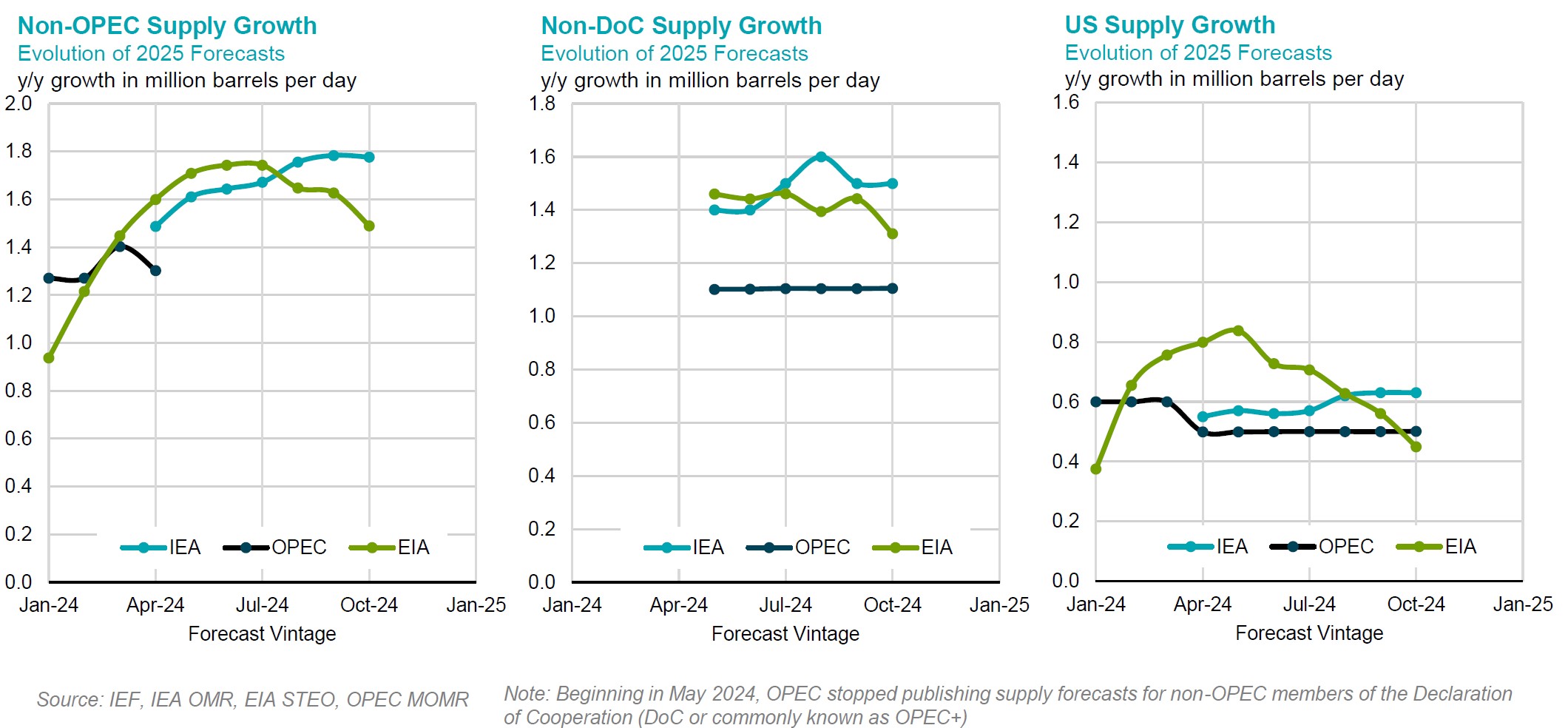

Evolution of 2024 Annual Non-OPEC Supply Growth Forecasts

- The EIA has downgraded its forecast for non-OPEC supply growth for the fifth consecutive month, reducing it by approximately 0.1 mb/d y/y.

- The IEA, OPEC, and EIA continue to display strong alignment regarding U.S. supply growth in recent months, compared to their estimates at the beginning of this year.

Summary of 2025 Balances and Revisions

- OPEC revised its forecasts for global demand growth down by 0.2 mb/d for the full year in 2025, driven by a reduction in non-OECD demand growth and lower expectations for some regions.

- The EIA has revised its global demand growth forecast downward by approximately 0.2 mb/d y/y.

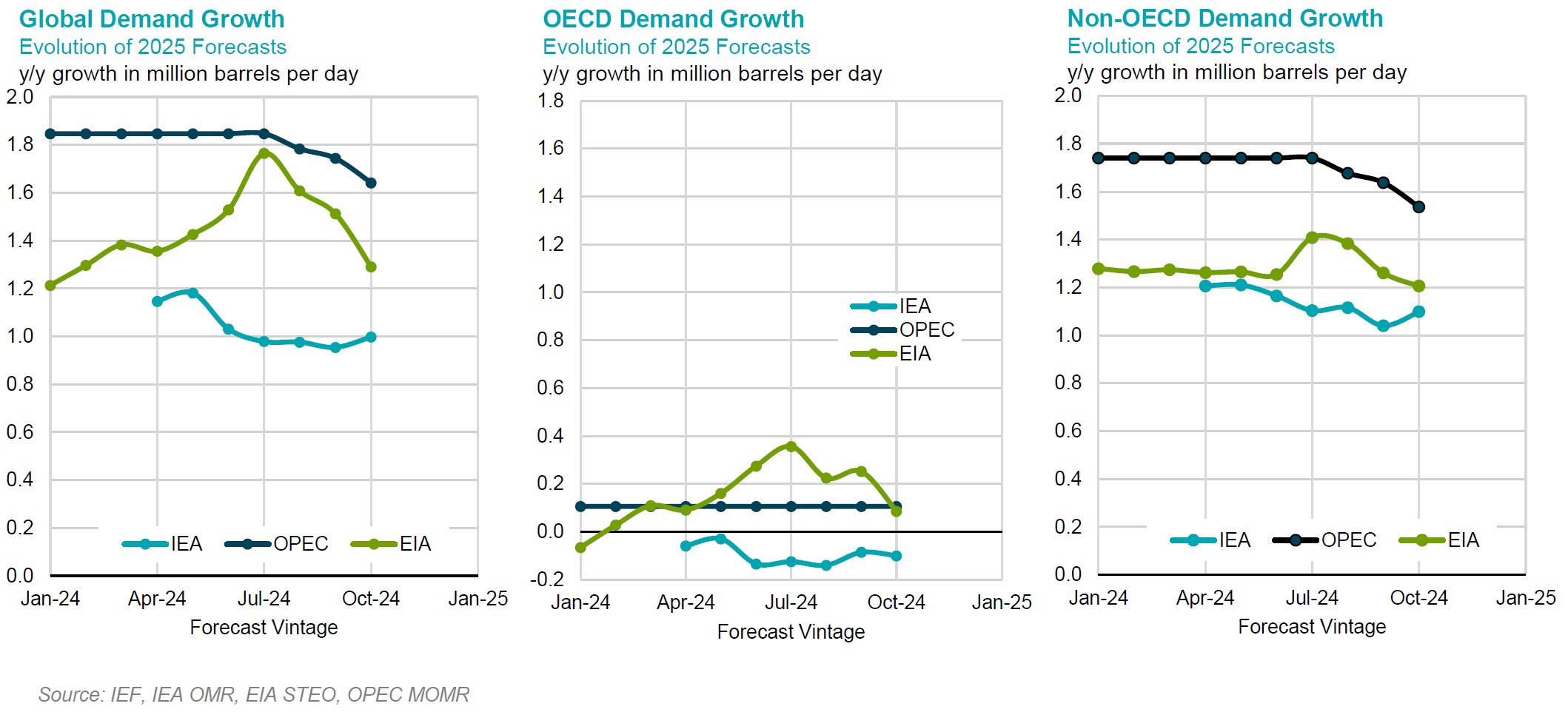

Evolution of 2025 Annual Demand Growth Forecasts

- The EIA has revised its global demand growth forecast downward for the third consecutive month by more than 0.2 mb/d y/y, bringing it to approximately 1.3 mb/d y/y.

- OPEC has adjusted its global oil demand growth forecast downward; however, it remains 0.6 mb/d higher than the IEA estimates.

- The IEA has almost maintained its global demand growth for 2025 unchanged y/y.

Evolution of 2025 Annual Non-OPEC Supply Growth Forecasts

- The gap in non-OPEC supply growth projections between the IEA and EIA has approached nearly 0.29 mb/d y/y, with the EIA continuing to implement its downward adjustments.

- The EIA has adjusted its forecast for U.S. oil supply growth from being approximately 70% higher than the estimates developed by OPEC a few months ago to less than OPEC's forecasts in this month's assessment.