Comparative Analysis of Monthly Reports on the Oil Market

Wednesday 13 August 2025

Summary and Oil Market Context

Demand

OPEC’s latest assessment maintains its 2025 global oil demand forecast, projecting year-on-year growth of 1.3 mb/d. Minor adjustments incorporate observed data from the first two quarters. OECD demand rises by approximately 0.1 mb/d, while non-OECD demand increases by 1.2 mb/d. For 2026, global demand is projected to expand by 1.4 mb/d, an upward revision of 0.1 mb/d from the previous estimate, driven by favorable macroeconomic conditions. OECD demand is expected to grow by 0.2 mb/d, with non-OECD demand advancing by 1.2 mb/d.

The EIA’s global liquid fuels demand growth in the second half of 2025 rises by 1.6 mb/d, resulting in a faster inventory buildup of nearly 0.5 mb/d. This equals a 1.0 mb/d year-over-year increase for 2025. In 2026, oil demand grows by an additional 1.2 mb/d y/y, up 0.3 mb/d for the full year compared with last month’s assessment.

The IEA forecasts global oil demand to increase by approximately 0.7 mb/d year-on-year in 2025, reaching 103.7 mb/d. Growth in 2Q25 is driven entirely by non-OECD regions, while OECD consumption remains nearly flat, as Japan records its lowest levels in decades. The 2026 forecast shows a similar pace of expansion, with demand rising by 0.7 mb/d year-on-year to reach 104.4 mb/d.

Projections across agencies continue to diverge, with differences in global demand forecasts reaching up to 0.6 mb/d for 2025 and 0.7 mb/d for 2026 y/y.

Supply

OPEC projects liquids production from countries outside the Declaration of Cooperation (non-DoC) and DoC NGLs to rise by 0.9 mb/d year-on-year in 2025, reaching an average of 62.7 mb/d. Growth is driven primarily by the United States, Brazil, Canada, and Argentina, with the forecast unchanged from the previous assessment. In 2026, non-DoC liquids output increases by 0.7 mb/d year-on-year to average 63.4 mb/d, representing a moderate downward revision from earlier estimates. Brazil, the United States, Canada, and Argentina remain the principal sources of growth.

EIA’s growth forecast for global liquid fuels production shows an average increase of 2.0 mb/d in the second half of 2025 compared with the first half of the year. This growth is driven by contributions from OPEC+ and increased output from non-OPEC producers such as the United States, Brazil, Norway, Canada, and Guyana. Non-DoC supply and DoC NGL growth increase by 0.2 mb/d y/y in 2025 but fall by 0.2 mb/d in 2026.

The IEA projects global oil supply to rise by 2.5 mb/d in 2025 and by 1.9 mb/d in 2026, with non-OPEC+ producers accounting for roughly half of the growth. It expects non-DoC supply and DoC NGLs to increase by 1.4 mb/d y/y in 2025 and by 1.2 mb/d in 2026, while non-OPEC supply and OPEC NGLs are forecast to expand by 1.5 mb/d in 2025 and by 1.4 mb/d in 2026.

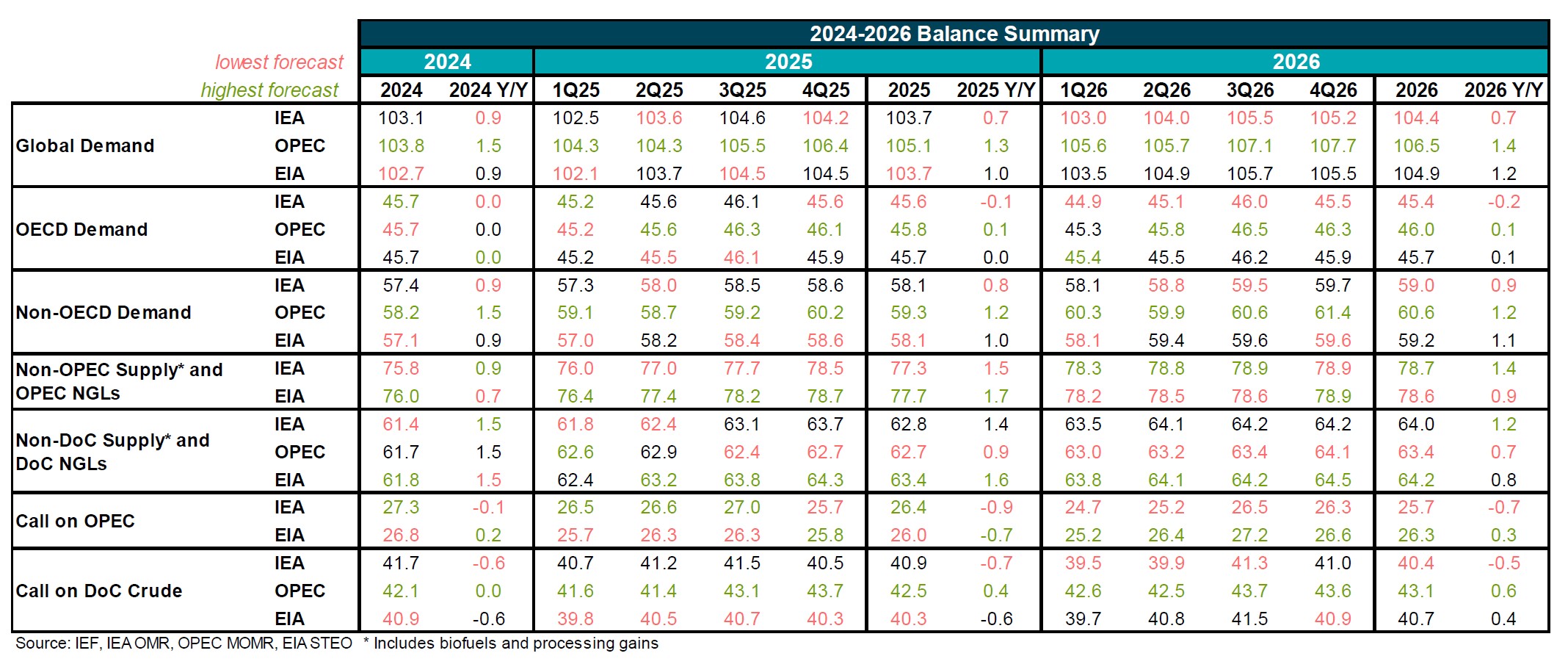

Summary of 2024-2026 Balances

- Across agencies, demand growth ranges from 0.7 to 1.3 mb/d in 2025 and from 0.7 to 1.4 mb/d in 2026.

- Non-OECD consumption accounts for the entirety of net demand gains.

- IEA sees global demand growth at 0.7 mb/d in both 2025 and 2026.

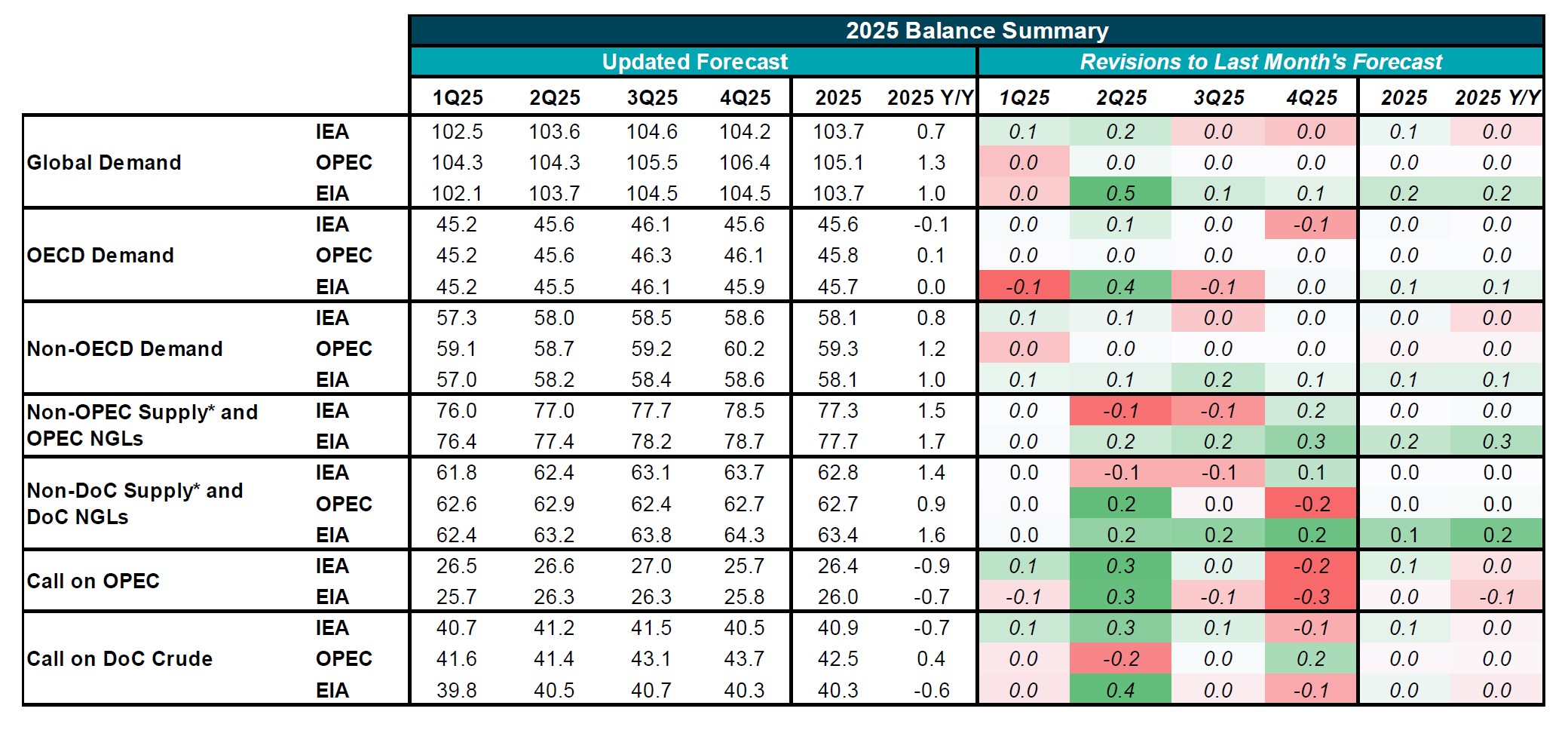

Summary of 2025 Balances and Revisions

- The IEA maintains its forecast for 2025 global oil demand growth at 0.7 mb/d y/y, reflecting moderate upward revisions in early-year projections.

- The EIA projects global demand growth of 1.0 mb/d y/y, supported by a substantial upward revision for 2Q25.

- OPEC holds global demand growth at 1.3 mb/d, with OECD up 0.1 mb/d and non-OECD up 1.2 mb/d.

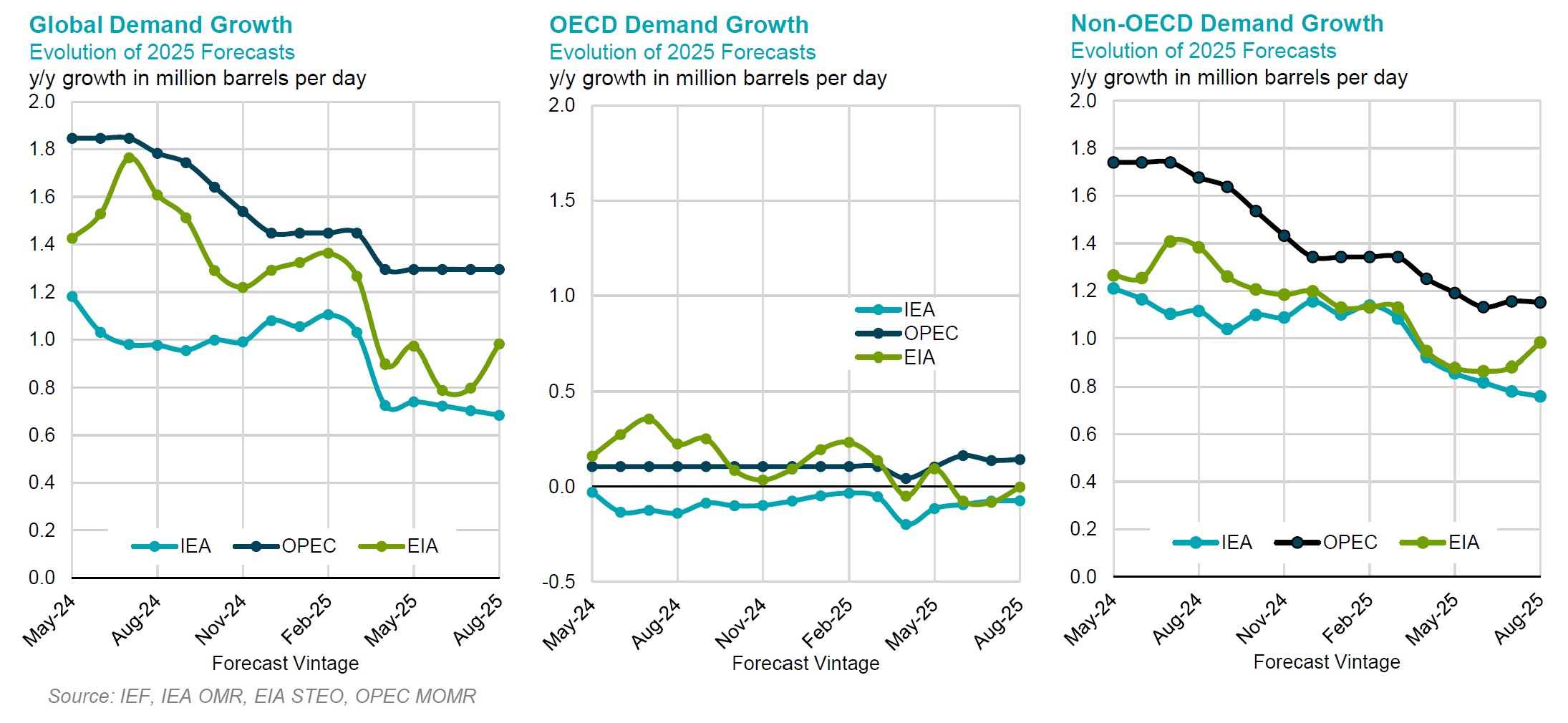

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC’s 2025 global demand growth forecast remains the highest.

- Non-OECD demand growth remains largely unchanged in OPEC and IEA assessments, while the EIA shows a modest recovery from last month’s low.

- EIA’s global growth estimate rises to 1.0 mb/d this month, rebounding from around 0.8 mb/d last month.

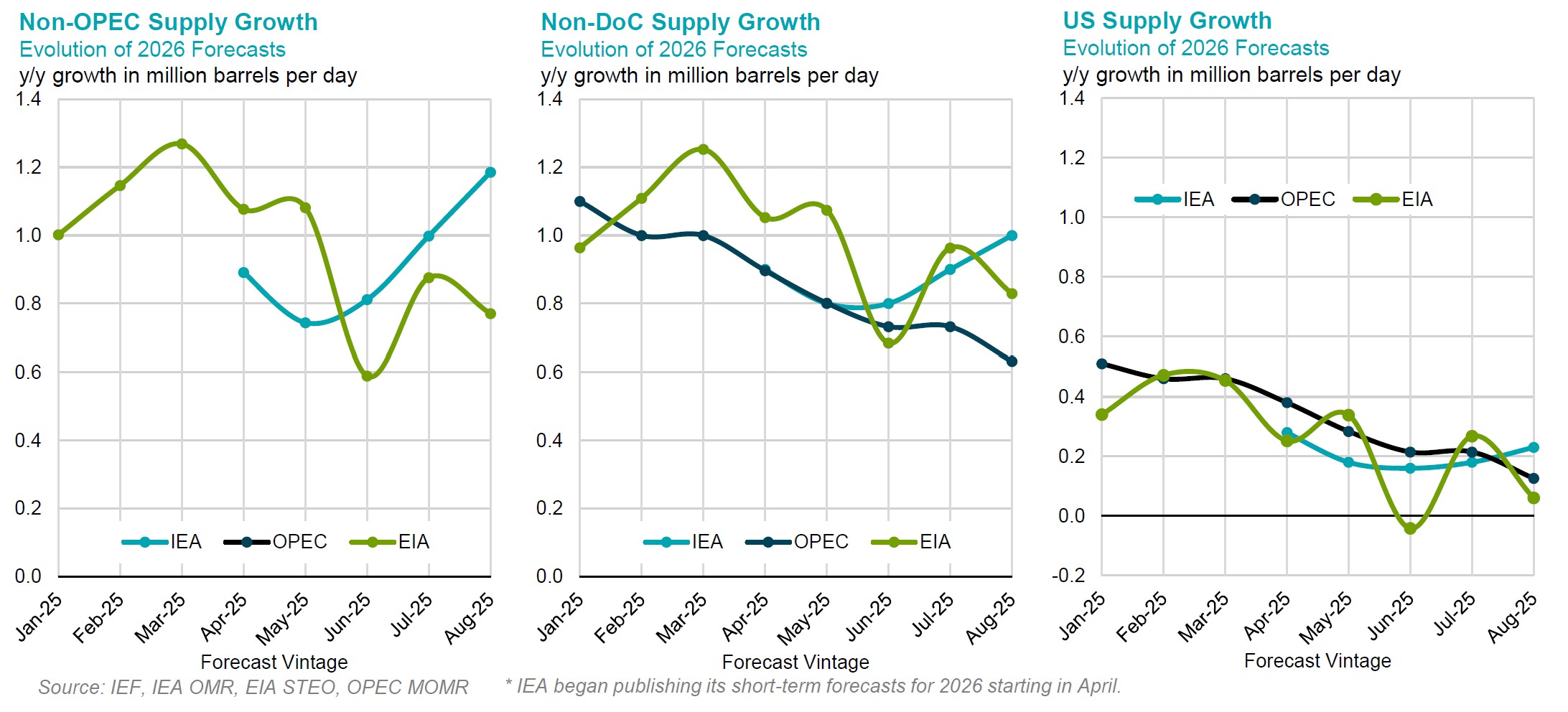

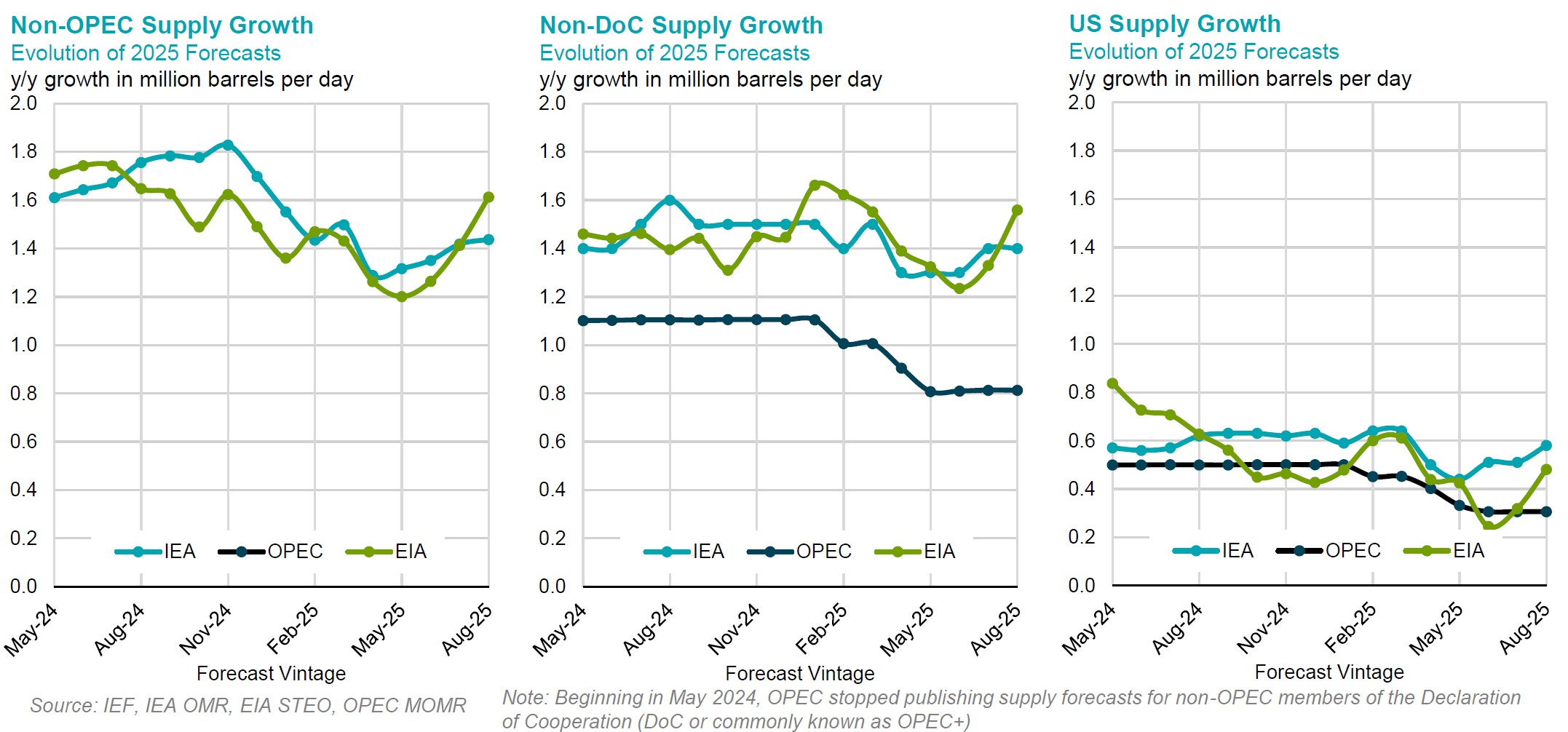

Evolution of 2025 Annual Supply Growth Forecasts

- OPEC maintains its projection for non-DoC supply growth at 0.8 mb/d y/y, unchanged from last month’s assessment.

- US supply growth is higher in IEA and EIA assessments, while remaining broadly flat in OPEC projections.

- EIA’s non-OPEC supply forecast recovers to about 1.6 mb/d, matching August 2024 levels after mid-year declines.

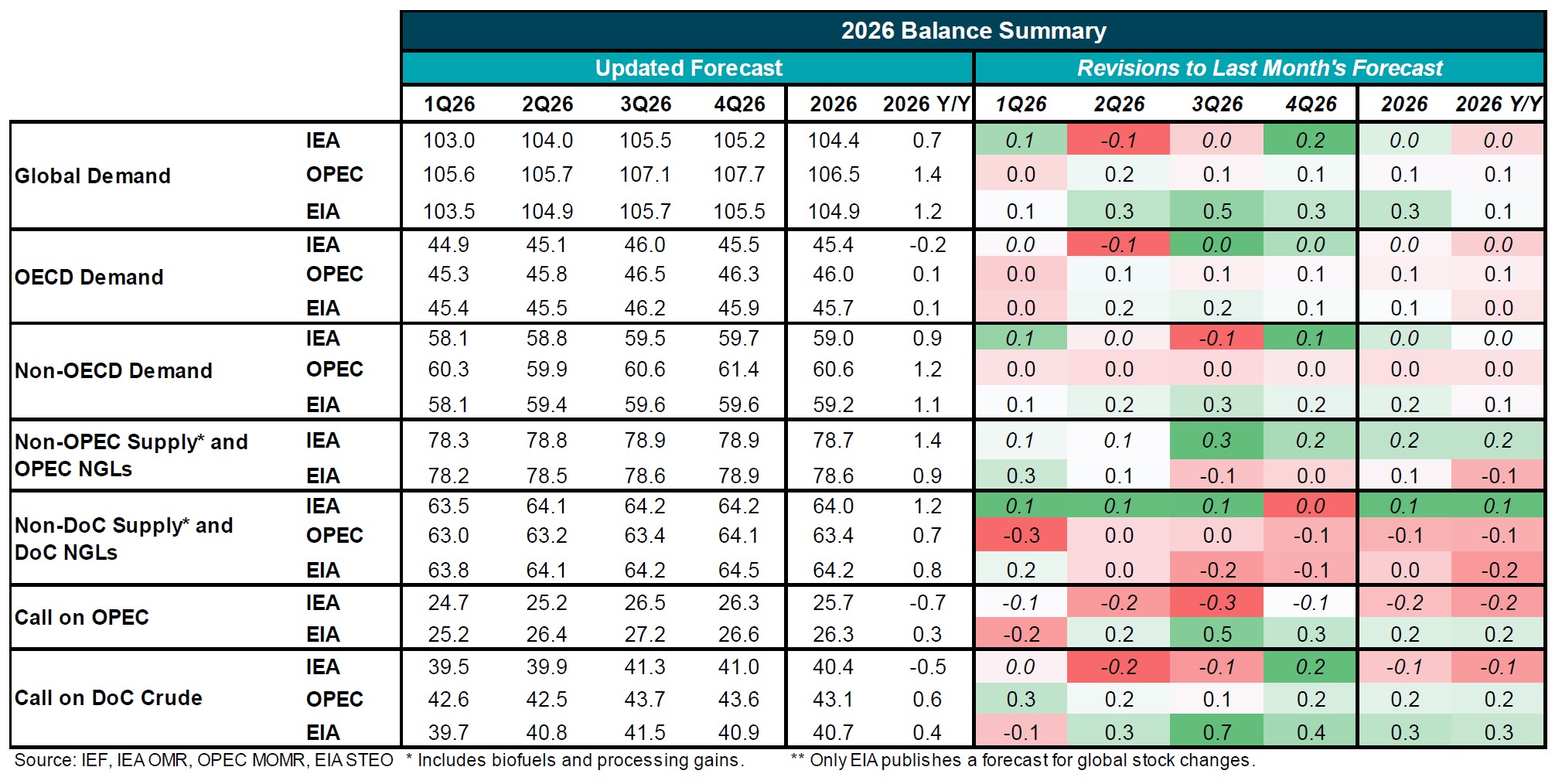

Summary of 2026 Balances and Revisions

- OPEC projects the highest 2026 global demand growth at 1.4 mb/d, with modest quarterly upward revisions of 0.1–0.2 mb/d.

- EIA sees 1.2 mb/d global growth in 2026, supported by consistent upward revisions across all quarters.

- OECD demand remains flat or slightly negative for IEA, marginally positive for OPEC, and slightly higher for EIA.

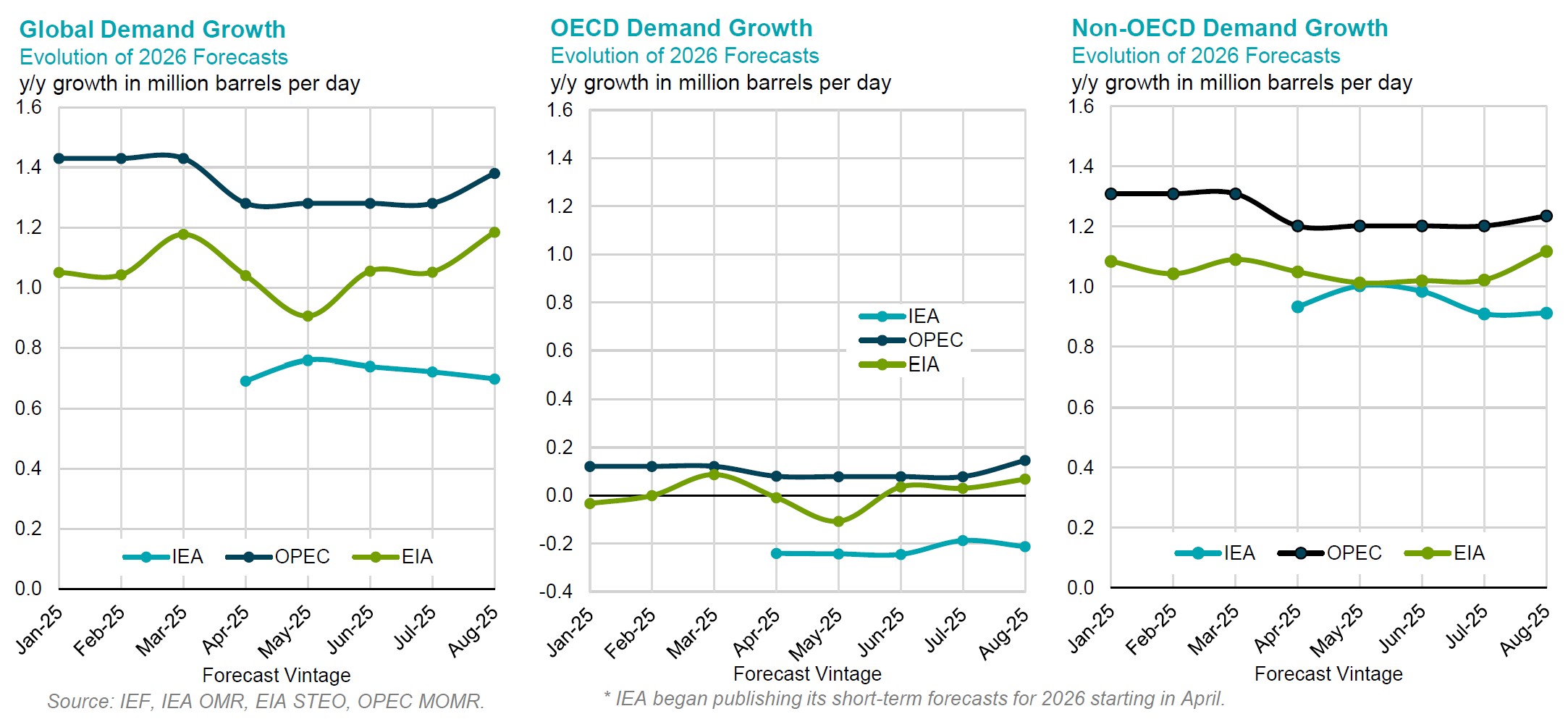

Evolution of 2026 Annual Demand Growth Forecasts

- IEA’s forecast for global demand growth edged down slightly, maintaining the lowest outlook among agencies.

- EIA’s projection for global demand rises by over 0.1 mb/d y/y, representing the largest upward adjustment among the three agencies.

- OECD demand growth rises moderately in OPEC and EIA, while the IEA maintains a negative estimate of around −0.2 mb/d.

Evolution of 2026 Annual Supply Growth Forecasts

- The gap between IEA and OPEC in non-DoC supply growth widened to about 0.4 mb/d, the largest so far this year.

- IEA’s non-OPEC supply forecast has strengthened over the summer.

- Despite early-year strength, the EIA’s projections now fall below the IEA’s for both non-OPEC and non-DoC supply.