Comparative Analysis of Monthly Reports on the Oil Market

Thursday 11 September 2025

Summary and Oil Market Context

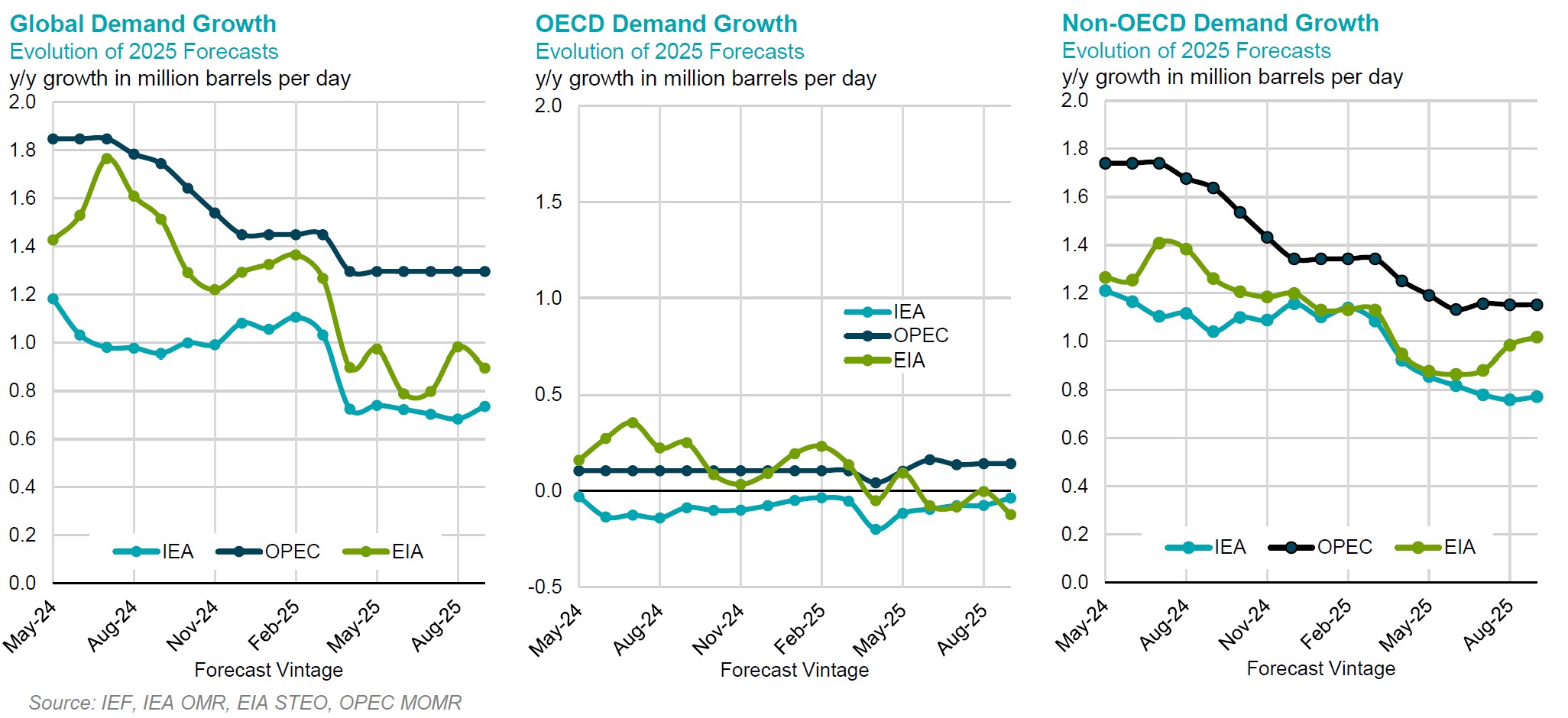

Demand

OPEC sees global oil demand growth of 1.3 mb/d in 2025, with OECD demand rising by 0.1 mb/d and non-OECD demand by 1.2 mb/d. In 2026, demand increases by 1.4 mb/d, split between 0.2 mb/d in the OECD and 1.2 mb/d in the non-OECD. Growth in the OECD is concentrated in the Americas, while Other Asia, China, and India drive the non-OECD expansion.

EIA projects global liquid fuels consumption to rise by 0.9 mb/d in 2025 and 1.3 mb/d in 2026, driven primarily by non-OECD countries. Non-OECD demand rises by 1.0 mb/d in 2025 and 1.1 mb/d in 2026, while OECD consumption falls by 0.1 mb/d in 2025 before rebounding by 0.2 mb/d in 2026. Growth in Asia dominates the expansion, with India and China each contributing between 0.4 and 0.5 mb/d from 2024 to 2026.

IEA's monthly outlook projects global oil demand growth of ~700 kb/d in both 2025 and 2026. The 2025 forecast rises to 740 kb/d year-on-year, slightly above previous estimates, reflecting lower oil prices and a stronger economic outlook. OECD demand remains resilient despite economic headwinds, supported by robust deliveries in the United States, Germany, Italy, and Korea. In 2026, expansion proceeds at a more moderate pace of 700 kb/d year-on-year, accompanied by a widening divergence led by non-OECD growth.

Agency projections remain divergent, with global demand estimates varying by as much as 0.6 mb/d in 2025 and 0.7 mb/d in 2026 year-on-year.

Supply

OPEC projects liquids production from countries outside the Declaration of Cooperation (non-DoC) and DoC NGLs to rise by 0.9 mb/d year-on-year in 2025, reaching an average of 62.7 mb/d. Growth is driven primarily by the United States, Brazil, Canada, and Argentina, with the forecast unchanged from the previous assessment. In 2026, non-DoC liquids output increases by 0.7 mb/d year-on-year to average 63.4 mb/d, representing a moderate downward revision from earlier estimates. Brazil, the United States, Canada, and Argentina remain the principal sources of growth.

OPEC's analysis shows non-DoC liquids production rising by ~0.9 mb/d in 2025 to average 62.7 mb/d, driven by the United States, Brazil, Canada, and Argentina. This outlook remains unchanged from last month's assessment. In 2026, non-DoC liquids expand by a further 0.7 mb/d to 63.4 mb/d, with the same countries leading growth. NGLs and non-conventional liquids from DoC members increase by 0.1 mb/d in both 2025 and 2026, averaging 8.7 mb/d and 8.8 mb/d, respectively.

EIA projects global liquid fuels production to rise by 2.3 mb/d in 2025 and by a further 1.1 mb/d in 2026, driven by planned OPEC+ increases and strong growth outside the group. Non-OPEC+ producers contribute 1.7 mb/d in 2025 and 0.6 mb/d in 2026, led by Brazil, Canada, Guyana, and the United States. OPEC+ crude oil output expands by 0.6 mb/d in 2025 and 0.5 mb/d in 2026, as the group seeks to balance inventories and stabilize prices amid rising supply.

IEA reports that global oil supply reaches 106.9 mb/d in August, with OPEC+ raising output and non-OPEC+ production holding near peak levels. Projections place global supply at 105.8 mb/d in 2025, an increase of 2.7 mb/d, and 107.9 mb/d in 2026, an additional 2.1 mb/d. Non-OPEC+ producers contribute 1.4 mb/d in 2025 and just over 1 mb/d in 2026, while OPEC+ adds 1.3 mb/d this year and 1 mb/d in 2026.

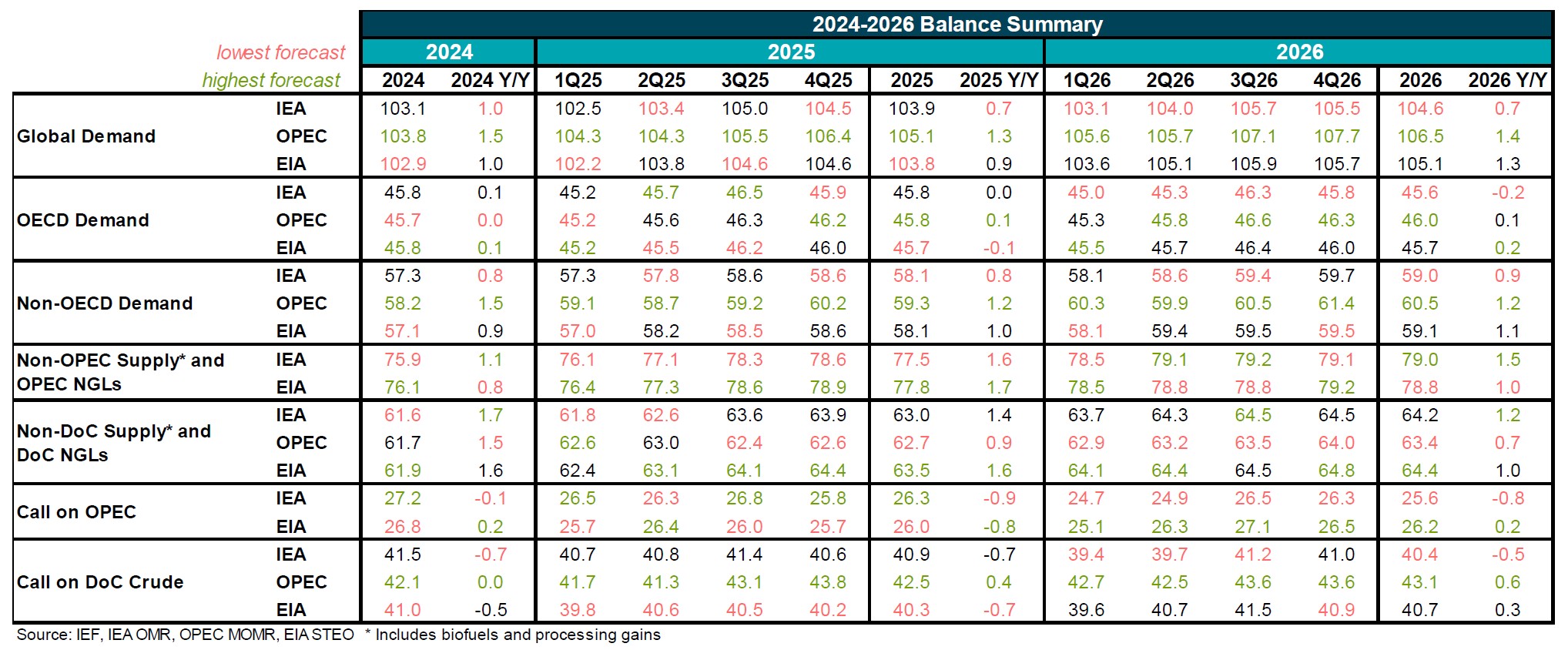

Summary of 2024-2026 Balances

- Across agencies, demand growth spans 0.7–1.3 mb/d in 2025 and 0.7–1.4 mb/d in 2026.

- Non-OECD economies account for almost all net growth in global demand.

- IEA continues to project global demand growth of 0.7 mb/d in both 2025 and 2026.

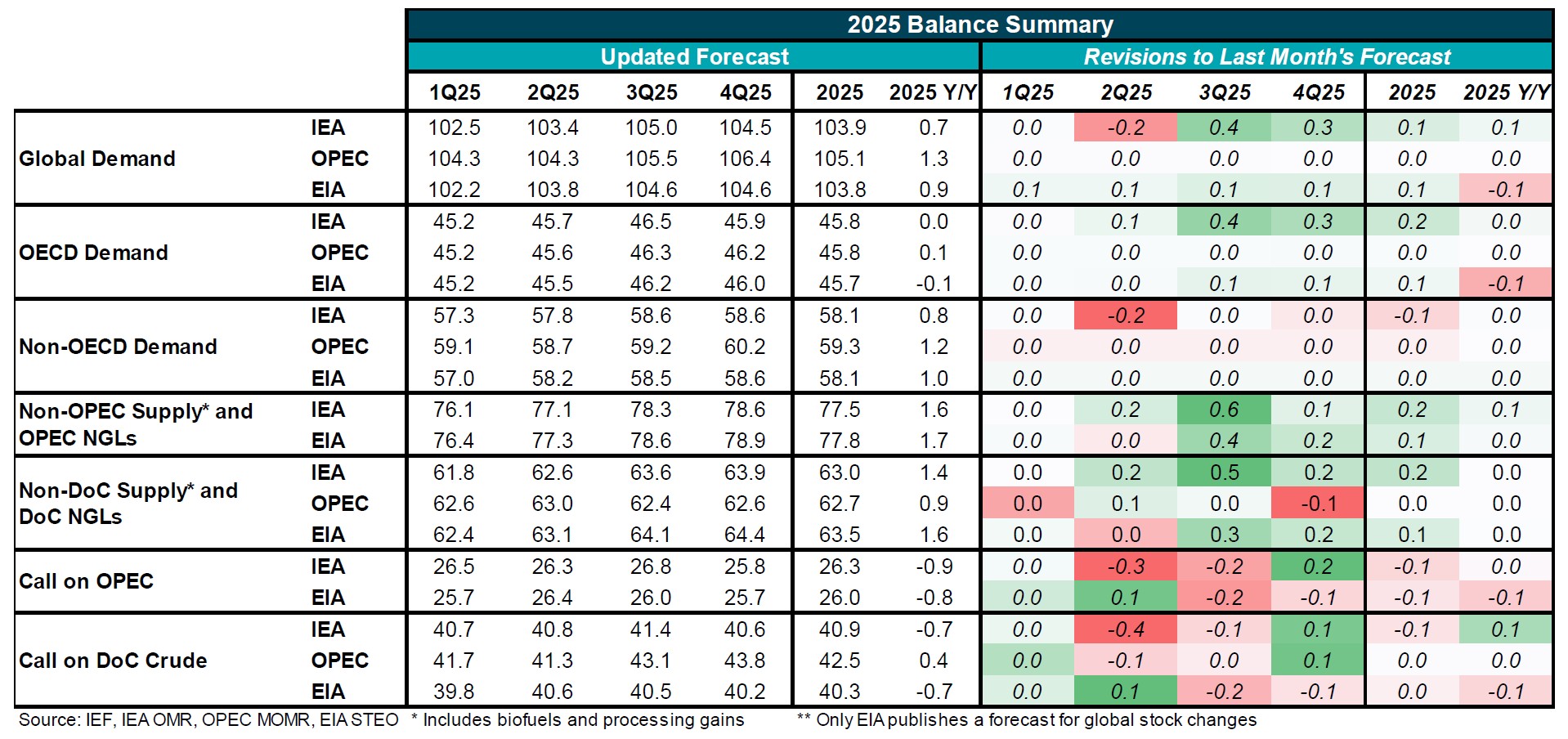

Summary of 2025 Balances and Revisions

- IEA slightly revises its global demand forecast upward by 40 kb/d, to 0.74 mb/d for 2025.

- The EIA projects global demand growth of 0.9 mb/d y/y.

- OPEC maintains its global demand growth forecast at 1.3 mb/d, with OECD demand rising by 0.1 mb/d and non-OECD demand by 1.2 mb/d.

Evolution of 2025 Annual Demand Growth Forecasts

- OPEC maintains the highest forecast for global demand growth in 2025.

- IEA maintains global demand growth at ~0.7 mb/d for six consecutive months.

- EIA lowers its global growth estimate by 0.1 mb/d this month, to 0.9 mb/d.

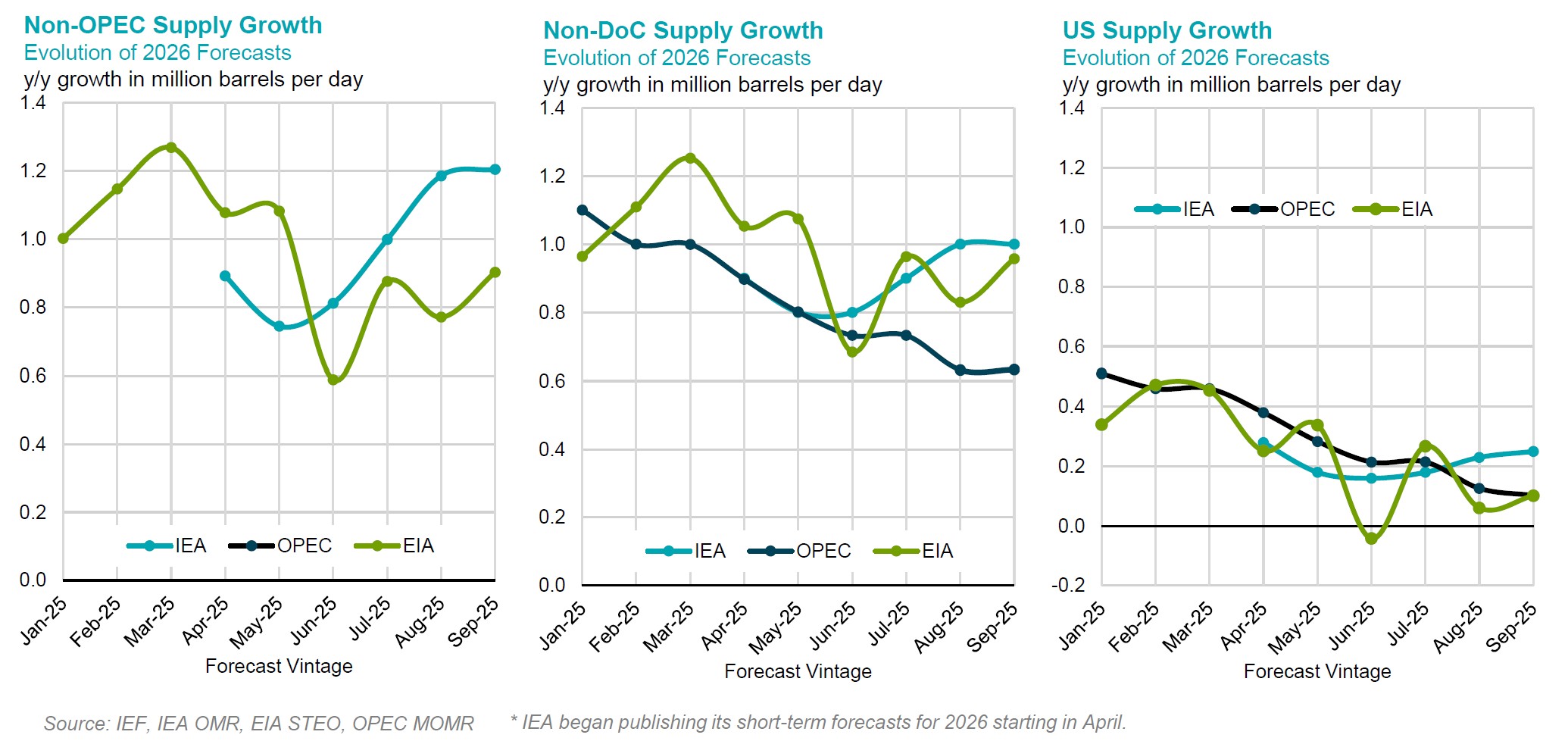

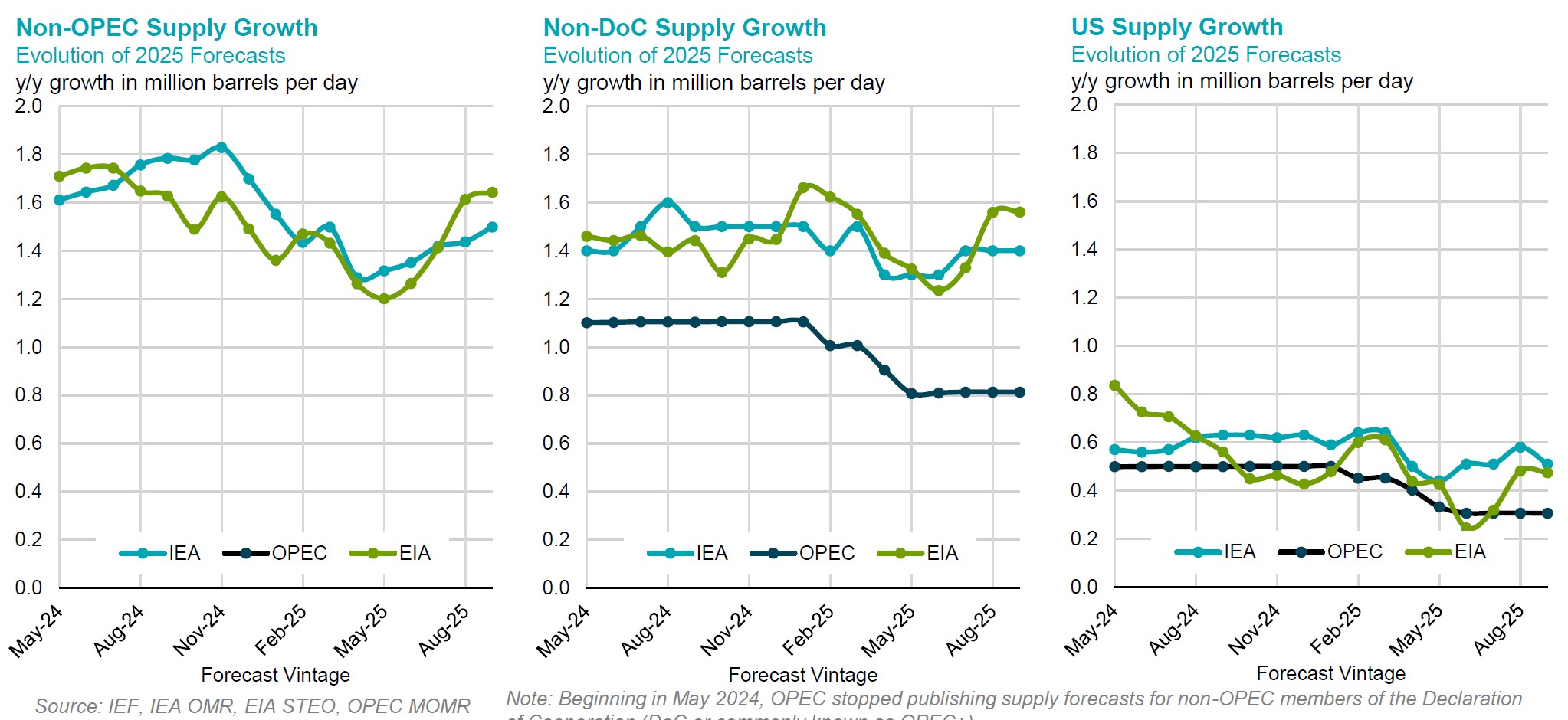

Evolution of 2025 Annual Supply Growth Forecasts

- OPEC maintains its projection for non-DoC supply growth at 0.8 mb/d y/y for five consecutive months.

- IEA and EIA narrow their differences on US supply growth after three months of divergence.

- EIA maintains its non-OPEC supply growth forecast at ~1.6 mb/d for the second consecutive month.

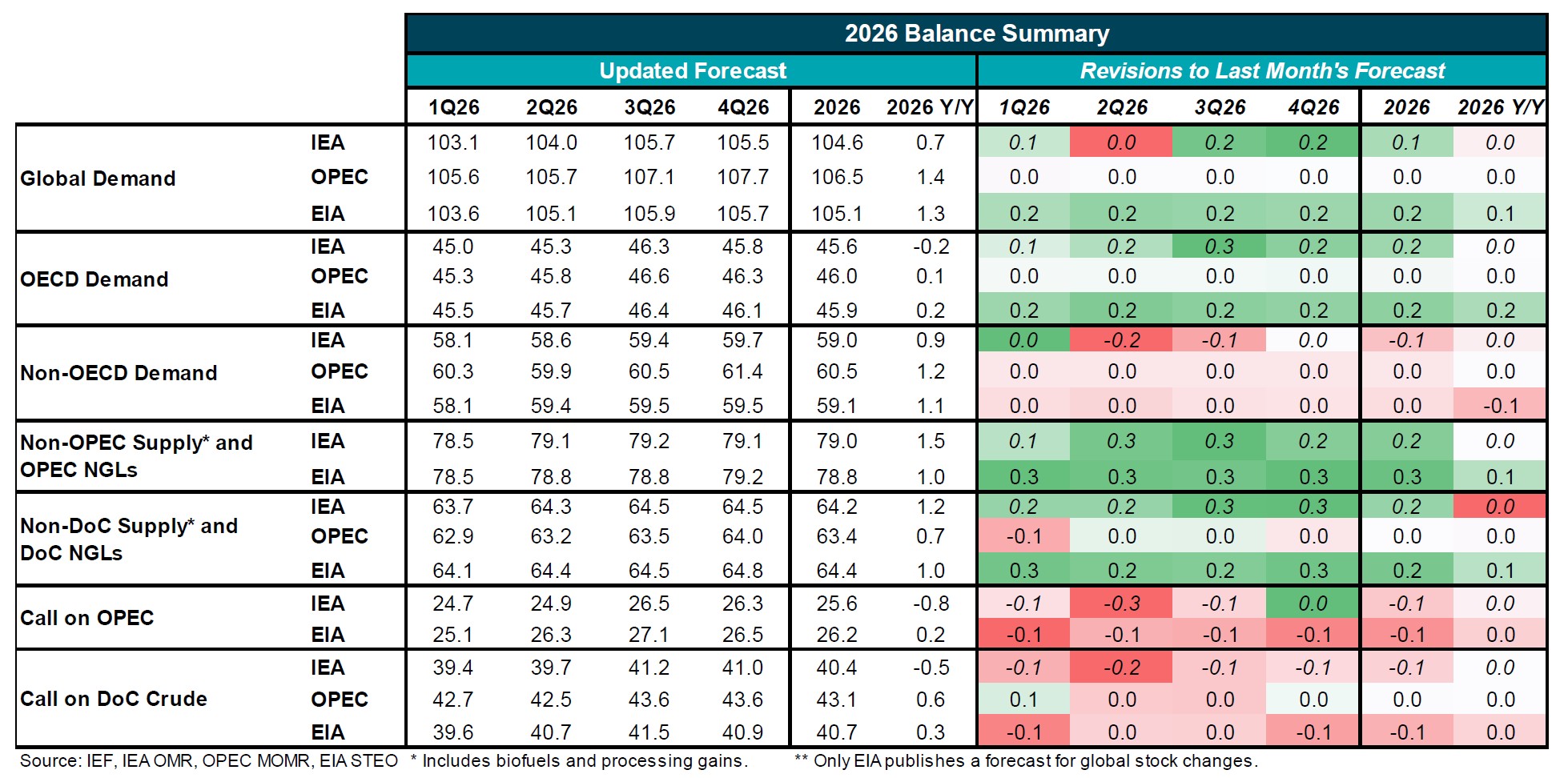

Summary of 2026 Balances and Revisions

- OPEC projects the strongest global demand growth for 2026 at 1.4 mb/d.

- EIA projects global growth of 1.3 mb/d in 2026, driven by robust non-OECD demand and consistent upward revisions to OECD demand across all quarters.

- IEA maintains its global demand forecast for next year at 0.7 mb/d.

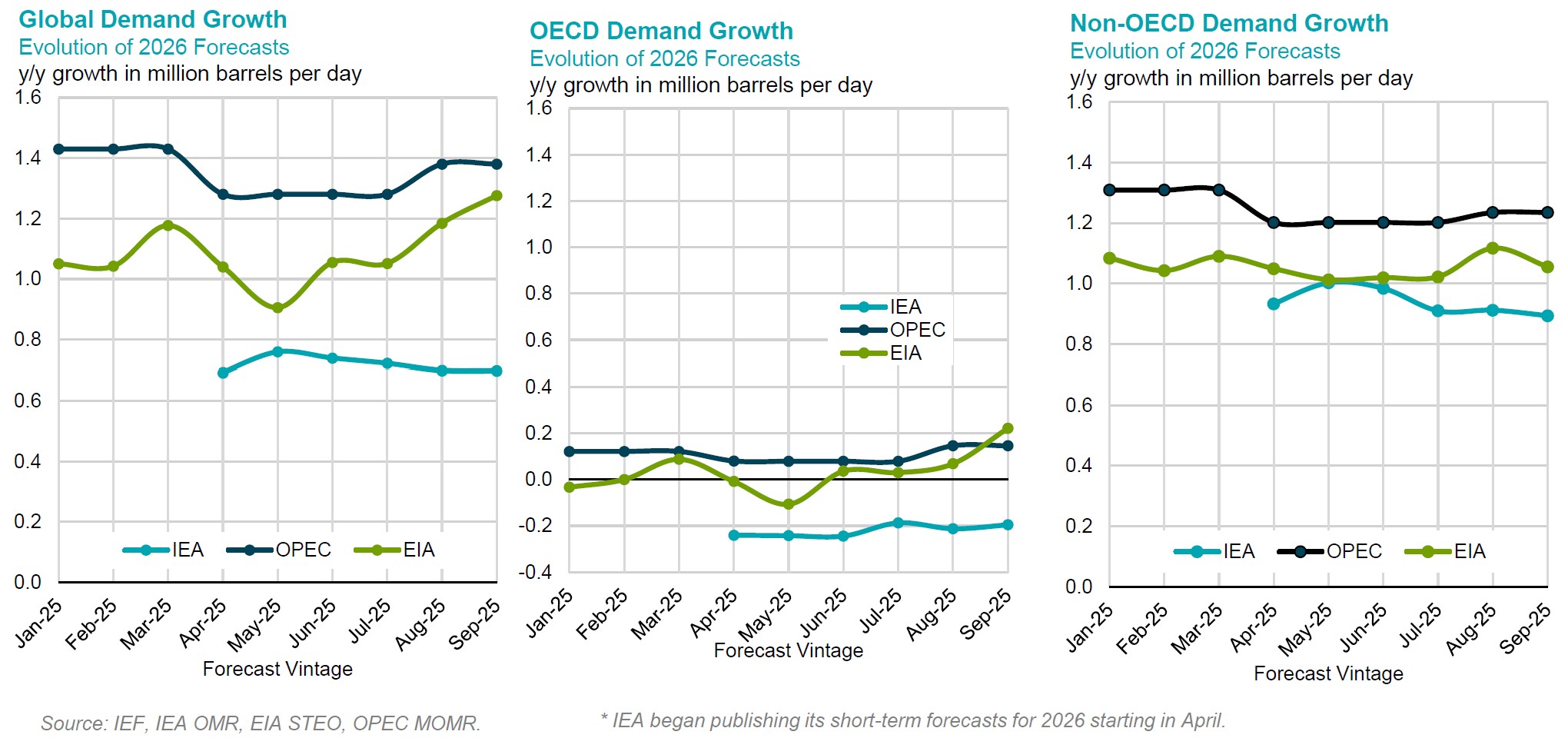

Evolution of 2026 Annual Demand Growth Forecasts

- OPEC projects double the global demand growth of the IEA in 2026 (1.4 mb/d vs. 0.7 mb/d).

- EIA's global demand projection increases by more than 0.1 mb/d year-on-year.

Evolution of 2026 Annual Supply Growth Forecasts

- IEA maintains its non-OPEC supply growth forecast at 1.2 mb/d for a second consecutive month.

- EIA raises its non-OPEC supply growth estimate to 0.9 mb/d this month.

- OPEC and EIA project similar US supply growth this month at ~0.1 mb/d.