Comparative Analysis of Monthly Reports on the Oil Market

Tuesday 14 October 2025

Summary and Oil Market Context

Demand

OPEC forecasts global oil demand to grow by around 1.3 mb/d y/y in 2025, with OECD consumption rising modestly by 0.1 mb/d and non-OECD demand increasing by 1.2 mb/d. In 2026, global demand continues to expand by about 1.4 mb/d, following a similar regional distribution. The 2024 review shows a strong annual increase of 1.5 mb/d, driven largely by robust economic activity in non-OECD economies, particularly China and Other Asia. In 2025, demand for refined products is led by the transport sector, with jet/kerosene, diesel, and gasoline consumption projected to rise by 380 tb/d, 300 tb/d, and 280 tb/d y/y, respectively.

EIA projects global liquid fuels demand to rise by 1.1 mb/d in both 2025 and 2026. Growth is led by non-OECD economies, which increase consumption by 1.2 mb/d in 2025 and 1.0 mb/d in 2026, while OECD demand declines by 0.1 mb/d in 2025 before rebounding by the same amount in 2026. Most of the non-OECD expansion occurs in Asia, particularly in India and China, which together add more than 0.4 mb/d of demand by 2026 relative to 2024 levels.

IEA indicates that global oil demand growth remains structurally weak, despite signs of near-term improvement. Annual gains are projected to average around 0.7 mb/d in both 2025 and 2026. The transport sector continues to underpin global consumption, with gasoil, gasoline, and jet/kerosene together accounting for nearly 60% of total demand. Despite the broader deceleration, global demand briefly strengthens in Q3 2025, rising by 750 kb/d y/y versus 420 kb/d in the prior quarter.

Forecasts from leading agencies continue to diverge, reflecting methodological and assumption-based differences, with global demand estimates varying by roughly 0.6 mb/d in 2025 and 0.7 mb/d in 2026.

Supply

OPEC projects non-DoC (countries outside the OPEC+ alliance) liquids production to grow by about 0.8 mb/d in 2025, reaching an average of 54.0 mb/d, driven primarily by the United States, Brazil, Canada, and Argentina. This projection remains consistent with the previous assessment. In 2026, non-DoC liquids output increases by a further 0.6 mb/d to average 54.6 mb/d, with the same countries continuing to lead supply growth. Crude oil production among DoC members rises by 630 tb/d in September, averaging roughly 43.05 mb/d.

EIA sees global liquid fuels production continues to expand steadily, led by countries outside the OPEC+ alliance. Non-OPEC+ producers are expected to increase output by 2.0 mb/d in 2025 and a further 0.7 mb/d in 2026, driven largely by gains in the United States, Brazil, Canada, and Guyana. In parallel, EIA projects OPEC+ production to rise by 0.5 mb/d in 2025 and 0.6 mb/d in 2026 as members gradually unwind voluntary output cuts.

IEA sees global oil supply to continue to expand faster than previously expected, prompting an upward revision in this month’s IEA oil market report. Total production is projected to rise by 3 mb/d in 2025 to reach 106.1 mb/d, followed by an additional 2.4 mb/d increase in 2026. Non-OPEC+ producers account for the bulk of this expansion, contributing 1.6 mb/d in 2025 and 1.2 mb/d in 2026, driven primarily by strong gains in the United States, Brazil, Canada, Guyana, and Argentina. IEA expects OPEC+ output to rise by 1.4 mb/d in 2025 and 1.2 mb/d in 2026.

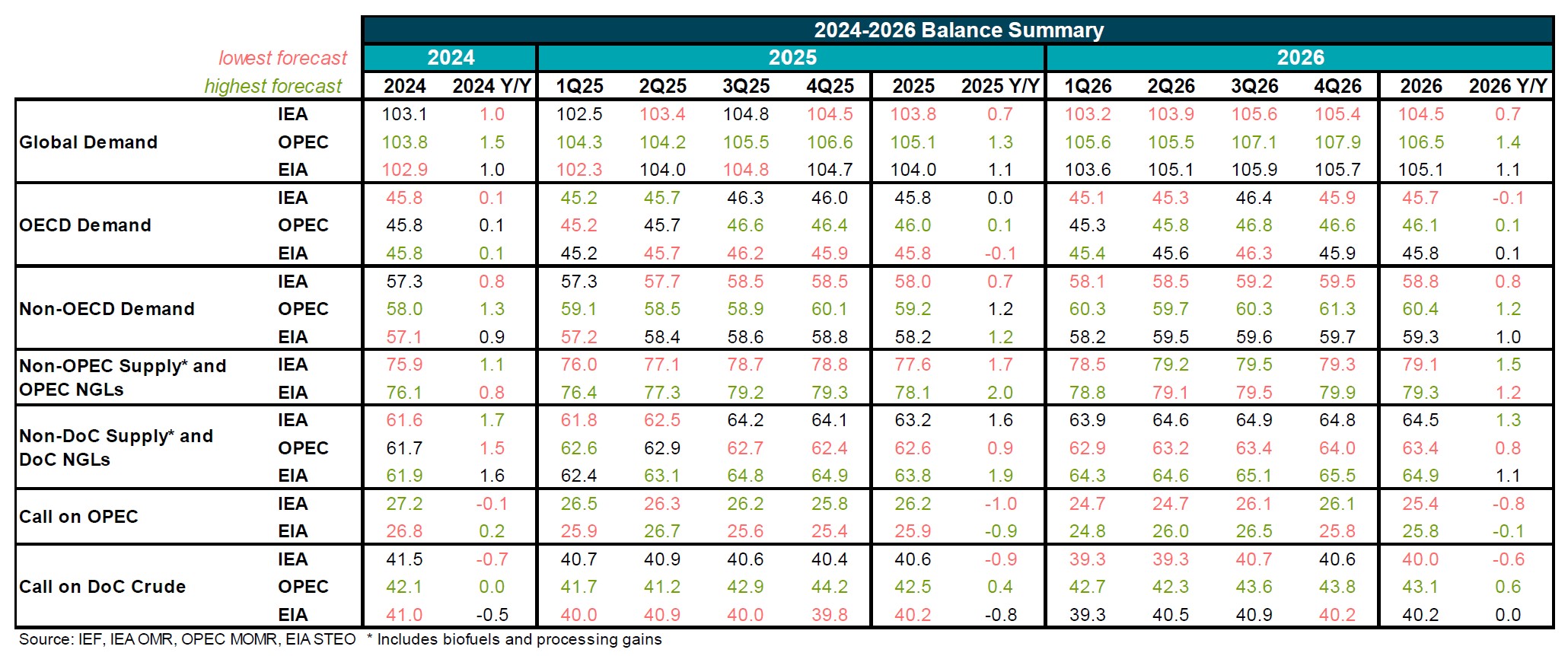

Summary of 2024-2026 Balances

- Agency projections for global oil demand growth vary between 0.7 and 1.3 mb/d in 2025, and between 0.7 and 1.4 mb/d in 2026.

- Non-OECD demand growth in EIA and OPEC forecasts exceeds IEA estimates by 0.5 mb/d in 2025.

- Differences in non-DoC supply and DoC NGL projections across agencies reach about 1 mb/d this year and 0.5 mb/d in 2026.

Summary of 2025 Balances and Revisions

- IEA maintains its global demand growth forecast at 0.7 mb/d for 2025.

- EIA projects global oil demand to grow by 1.1 mb/d y/y, reflecting an upward revision of 0.2 mb/d from last month’s assessment.

- OPEC keeps its global oil demand growth forecast unchanged at 1.3 mb/d, with gains of 0.1 mb/d in OECD economies and 1.2 mb/d in non-OECD regions.

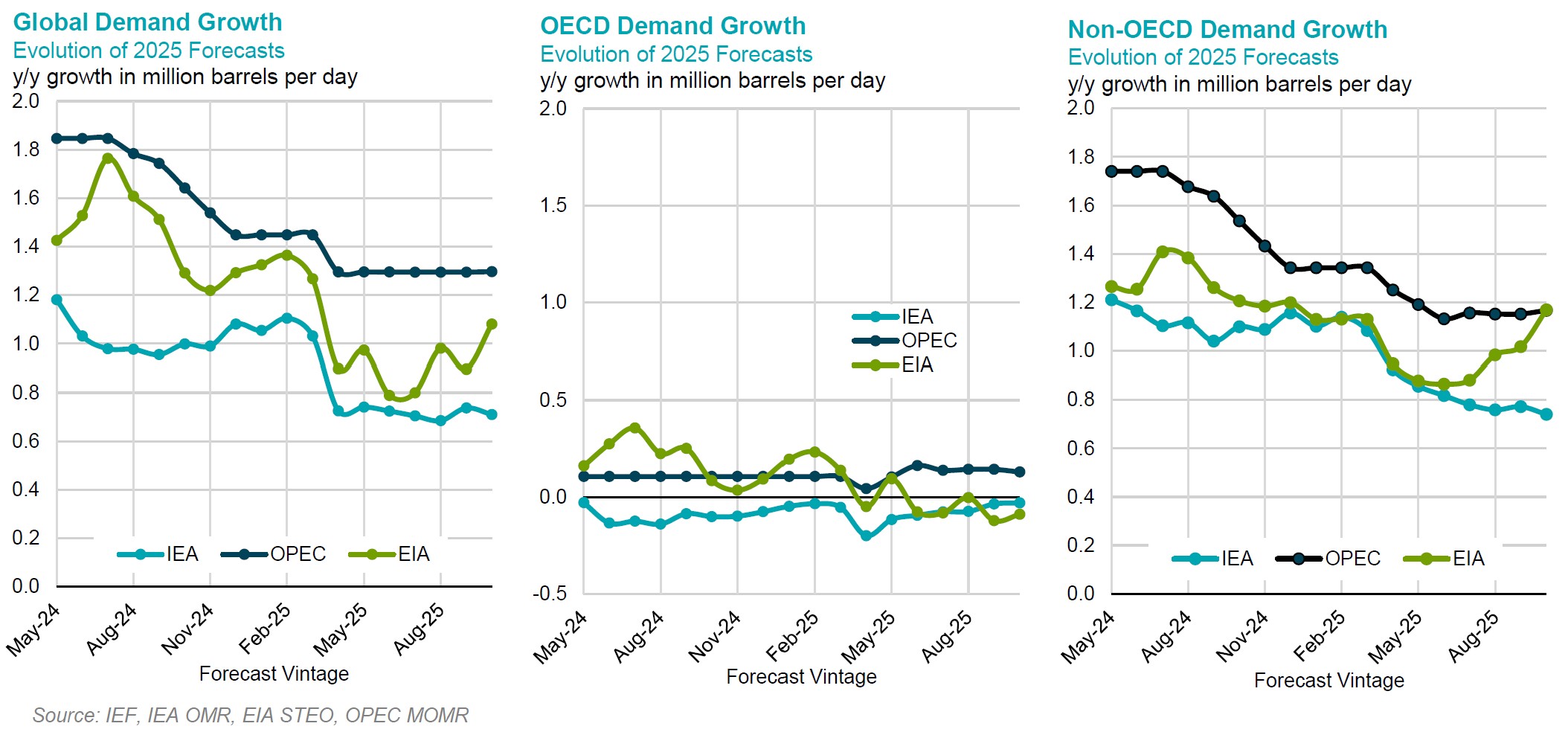

Evolution of 2025 Annual Demand Growth Forecasts

- IEA has maintained its global demand growth forecast at around 0.7 mb/d for seven consecutive months.

- OPEC holds its projection steady near 1.3 mb/d, while EIA raises its estimate by 0.2 mb/d this month to 1.1 mb/d.

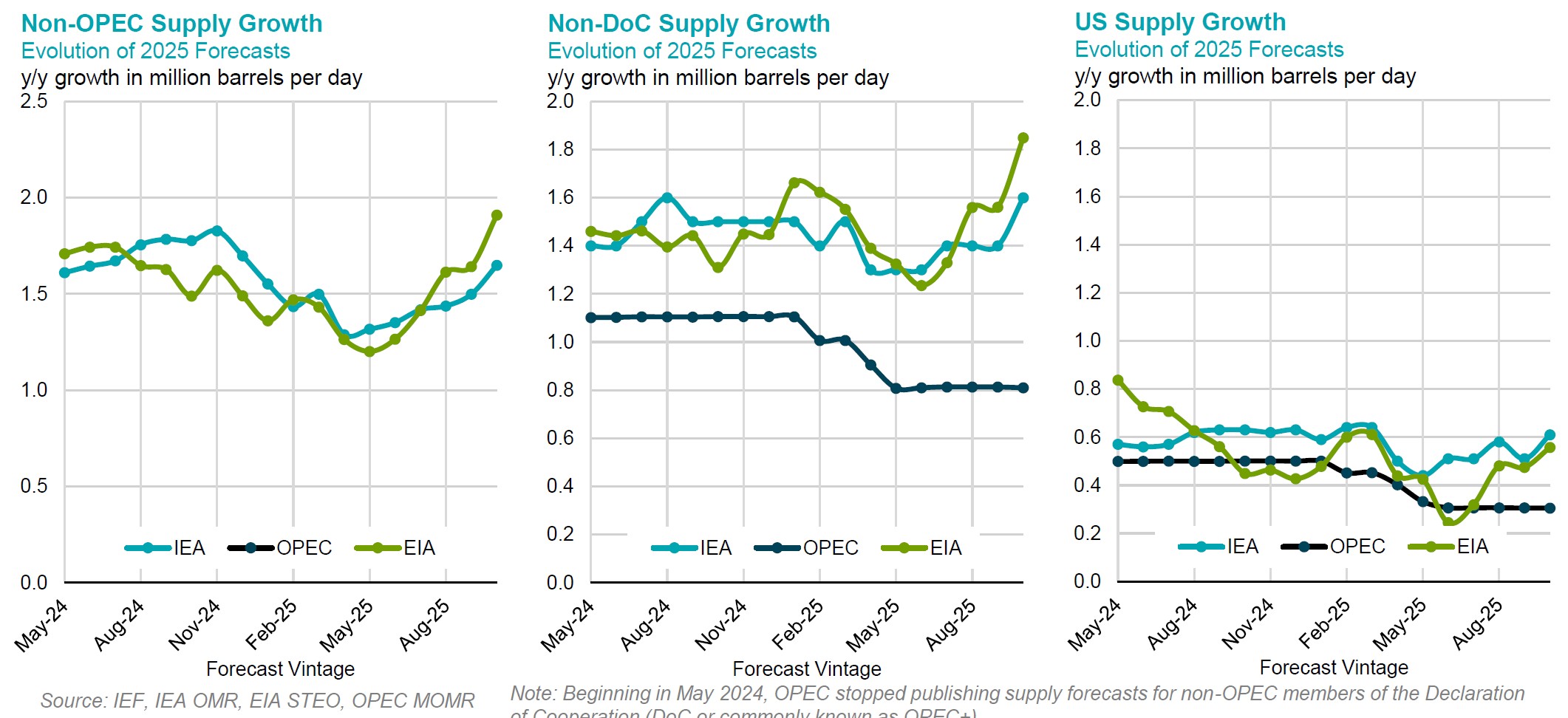

Evolution of 2025 Annual Supply Growth Forecasts

- OPEC holds its non-DoC supply growth estimate steady at 0.8 mb/d y/y for the sixth straight month.

- IEA revises its non-DoC supply growth forecast upward by 0.2 mb/d to 1.6 mb/d.

- EIA projects non-OPEC supply growth of about 1.9 mb/d, the highest level in more than a year.

Summary of 2026 Balances and Revisions

- OPEC maintains its global demand growth forecast at 1.4 mb/d, while EIA lowers its projection by 0.2 mb/d to 1.1 mb/d.

- IEA keeps its global oil demand growth forecast for next year unchanged at 0.7 mb/d.

- IEA projects OECD demand to decline by 0.1 mb/d, while EIA forecasts a 0.1 mb/d increase.

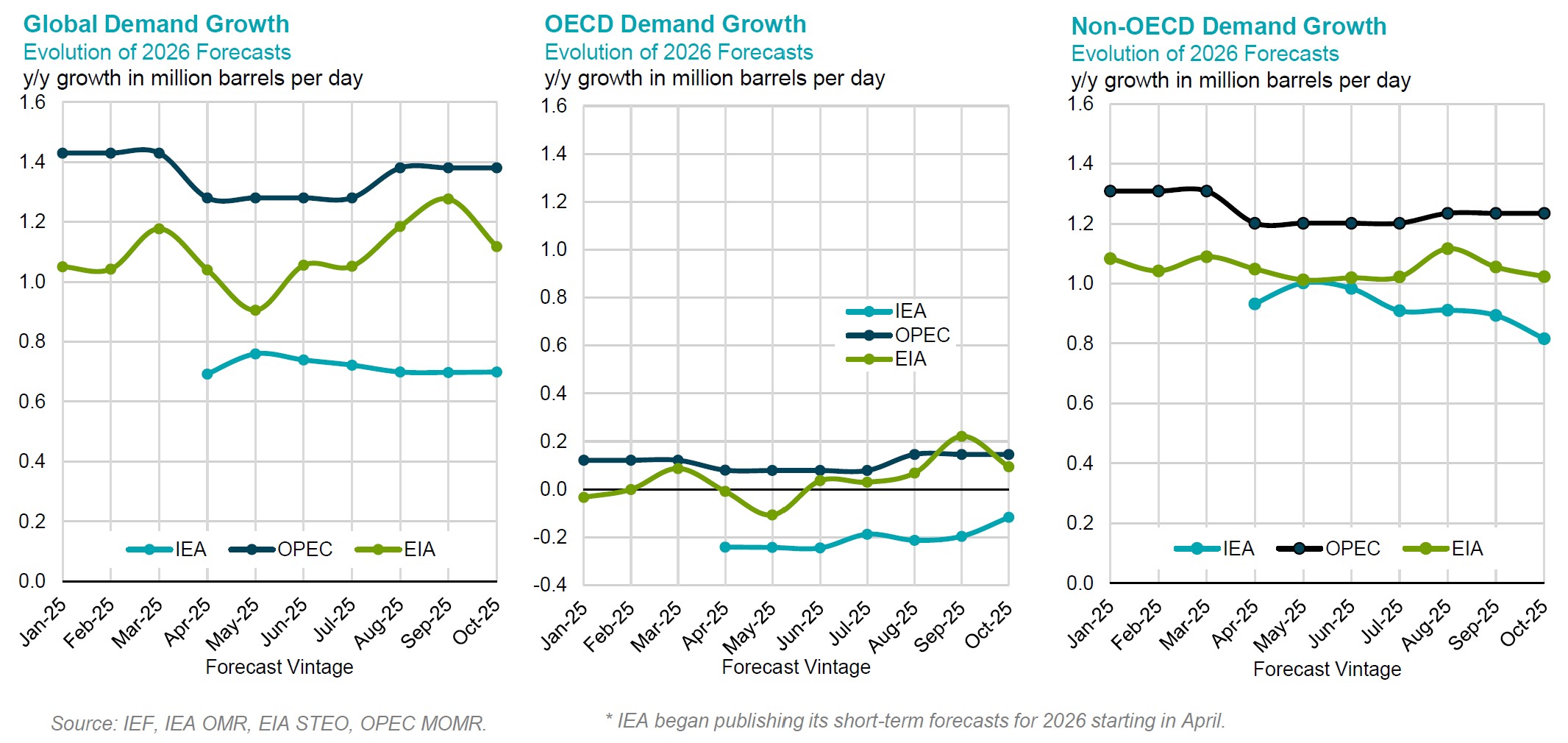

Evolution of 2026 Annual Demand Growth Forecasts

- OPEC projects global oil demand growth in 2026 to be roughly twice the level estimated by the IEA.

- EIA revises its global demand growth forecast downward by 0.2 mb/d compared with last month’s assessment.

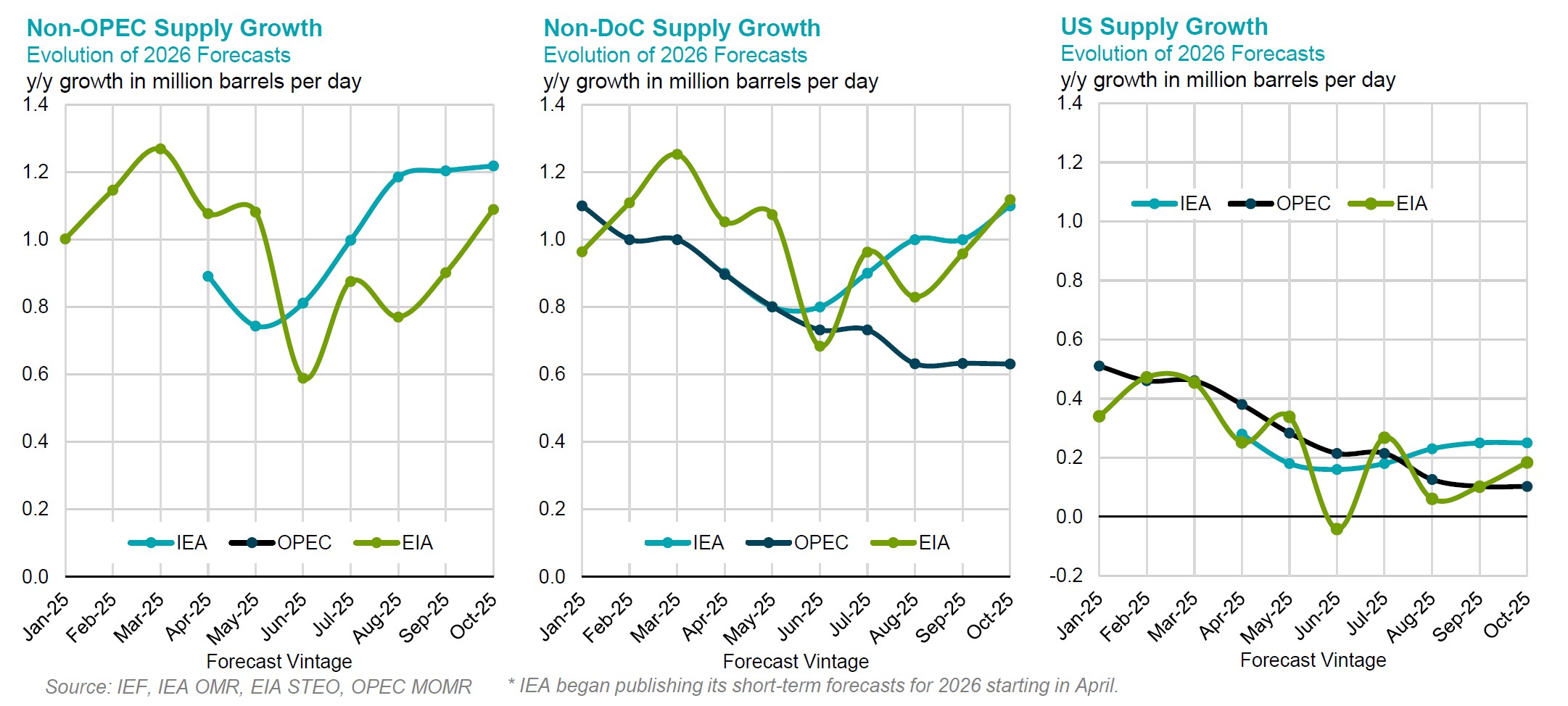

Evolution of 2026 Annual Supply Growth Forecasts

- OPEC expects non-DoC supply growth to fall short of IEA and EIA estimates by more than 0.5 mb/d.

- The difference in non-OPEC supply growth estimates between the EIA and IEA declines to 0.1 mb/d from 0.4 mb/d two months earlier.