The Impact of COVID-19 on Renewables

Key Messages:

- Although the renewable sector supply chains have been impacted by COVID-19, renewable demand has been more resilient due to its power sector integration, which has been relatively insulated from the demand shock felt in other energy sectors.

- Key outlooks predict reduced renewable growth in 2020, but growth in 2021 will depend on the course of the pandemic and the extent of government policy, regulatory, and stimulus support to the renewable sector as part of economic recovery efforts.

- From a demand perspective, shifting consumption patterns have forced a restructure and realignment of the electricity sector. Exceptional circumstances created by COVID-19 requiring extraordinary measures could serve as the catalyst towards achieving net-zero emissions solutions envisioned by green growth concepts such as the Circular Carbon Economy.

- From a supply perspective, supply chain disruptions can result in an increased focus on supply diversity and/or scaling up local manufacturing. Impacts to investment may also lead to new and innovative financial arrangements between investors and developers as a product of a new risk environment.

- The renewable dialogue will continue at various virtual meetings under the IEF platform. The next in-person opportunity will be at the 11th IEA-IEF-OPEC Symposium on Energy Outlooks and the 2nd IEF-IRENA Seminar on Renewable and Clean Technology Outlooks scheduled to take place in early 2021 in Riyadh, Saudi Arabia.

Context:

According to the IMF, global growth is projected at -4.9 percent in 2020, 2 percentage points below the April forecast. The COVID-19 pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast. While renewables have been impacted from a manufacturing standpoint as a result, renewable energy has also been the energy source most resilient to COVID-19 lockdown measures due its substantial application in the power sector. However, overall energy demand declines, project delays due to supply chain disruptions, workforce shortages, and a lack of investment due to financing uncertainties are likely to delay renewable capacity additions in the short-term.

A greater penetration of renewables will be sector-specific and depend on policy support and regulations. Greater uptake will also depend on advances in electricity storage solutions to help address the intermittency of solar and wind and their ability to respond to large fluctuations in demand. Therefore, in the medium- to longer-term, continued growth in renewable capacity will depend upon government policies and stimulus packages tied to clean technologies and sustainability goals, innovative financial arrangements for developers, and a continued willingness by governments to move towards orderly energy transitions.

This will contribute to providing inclusive energy access, help achieve shared goals, and encourage investment in energy systems integration through whole systems solutions such as the Circular Carbon Economy. For now, any renewable evolution will depend on the nature and severity of the current pandemic that continues to impact all facets of the global energy landscape.

Key Outlooks:

Below are two renewable outlooks from several organisations offering differing perspectives.

IEA and IRENA

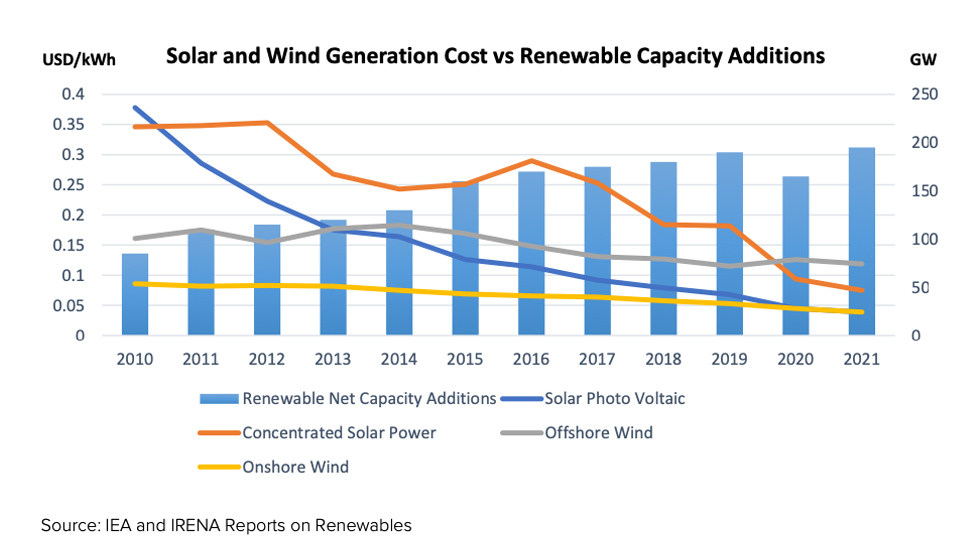

Both the IEA and IRENA forecast a reduction in overall renewable capacity additions in 2020 while reporting a 30 GW rebound in 2021. At the same time, renewable costs have decreased precipitously for both wind and solar over the last decade and will continue to decrease into 2021.

Rystad Energy

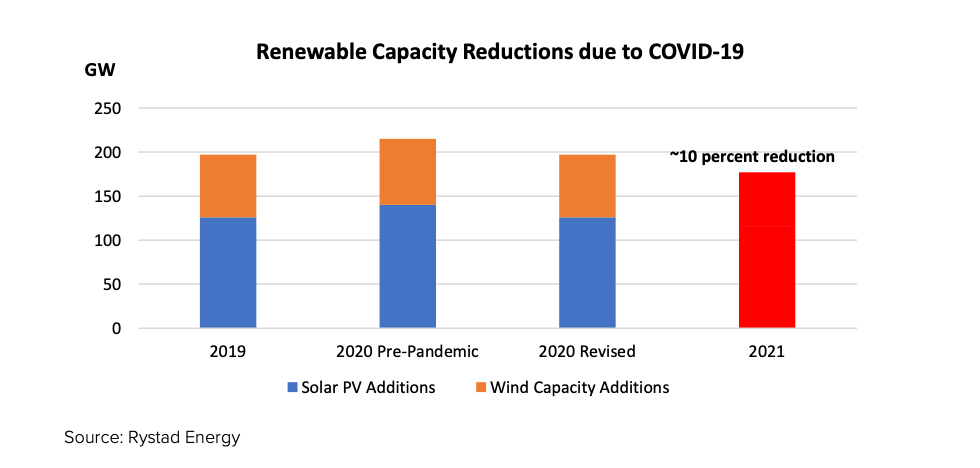

Rystad Energy offers an alternative perspective with a reduction of commissioned projects in 2021 as compared to 2020. Construction delays due to government restrictions on movement along with worker shortages will see a decline in revised 2020 forecast with a further 10 percent reduction in 2021 due to reduced investment.

Global Impacts:

The below points illustrate how COVID-19 may impact renewable supply-demand fundamentals.

Demand:

- In the short-term, COVID-19 will impact renewable growth, but medium and long-term demand will be tied to the recovery of the global economy, continued reductions in renewable costs, and government policies focusing on orderly energy transitions – Although renewables have shown greater resistance to the energy volatility caused by the COVID-19 pandemic, they are still impacted by demand reductions and overall economic uncertainty associated with the pandemic. More importantly, renewable consumption growth will be highly dependent on further cost reductions and government policies that will ensure that renewables continue to play a role in the power sector especially in a time when fossil fuels such as coal and natural gas also remain competitive.

- Low electricity demand and shifting power consumption patterns during COVID-19 could lead to a greater role for variable renewable capacity in the short-term but lower electricity demand long-term could have consequences – Lower electricity demand pushed down wholesale electricity prices thus increasing the share of renewables during the crisis. This resulted in the power mix shifting towards renewables in all major regions. A flatter peak time curve means that there is less need for non-renewable backup and storage. However, severe long-term low demand for electricity could impact renewables as well. For example, wind farms can be turned off in a prolonged low demand scenario to avoid overloading the electricity grid which can lead to temporary blackouts.

Supply:

- The outbreak of COVID-19 has disrupted renewable technology supply chains which has delayed projects – The global renewable energy sector is highly dependent on imports from China. China is a major manufacturer of photovoltaic component parts, including solar panels, inverters, and racks. As a result, developers of renewable energy projects could potentially experience difficulties in getting critical components (e.g., photovoltaic cells, turbines) from suppliers in affected countries, especially those in Asia. This will have immediate impacts on renewable capacity additions in the short- to medium-term.

- Uncertainty about economic recovery and duration of the pandemic will impact renewable investment in the short - to medium-term – Continued investment in renewables will be a key to greater renewable capacity in the short-to medium-term, however uncertainties associated with COVID-19 means an increased risk for both public and private investors. Challenges due to economic shutdowns, workforce shortages, and public debt downgrading country-ratings can influence investment behaviour. Banks generally will practice greater scrutiny during a pandemic and place greater emphasis on contingency planning. However, financing uncertainties can be partially mitigated by government policies such as extensions for project construction and/or tax credit incentives.

Implications:

- Electricity system restructuring due to COVID-19 provides an opportunity for greater renewable penetration and forward momentum towards orderly energy transitions – The COVID-19 pandemic has forced regulatory agencies into realigning and restructuring how electricity is being delivered. Operators have activated emergency plans to ensure the security of supply, stability of the grid, and to maintain staff levels which has allowed renewables to take a more active role. A dynamic regulatory restructuring effort in a short period of time without impacting security of supply points to the real possibility of renewables playing a vital and increased role necessary towards achieving orderly energy transitions and energy systems integration.

- An uncertain economic landscape due to COVID-19 and constraints on debt financing may result in new and innovative financing arrangements between developers and investors – There may be a greater role for more private investors entering the renewable energy market to fill the gap between senior debt and equity that may become less available during times of uncertainty. At the same time, force majeure clauses will see greater importance with more precise rules of action and obligations pertaining to each party in the case of a crisis. At the same time, companies’ environmental, social and governance practices (ESG) and their connection to long-term profitability and sustainable value-creation may attract future investment and benefit renewables in the long run.

- Developers may seek to scale up local manufacturing or diversify supply chains for renewable technology in the future rather than maintain dependence on limited markets – Supply chain disruptions to many operations will encourage developers to seek and build relationships with several manufacturers of component parts and renewable technology to prevent project delays. Part of this calculus could include attempts to build battery, solar, and wind components locally and accept the increased costs as part of the new risk environment. In diversifying suppliers, developers may take extra measures to ensure that new suppliers are the owners of the original equipment, have localised supply chain relationships, and have a long-term track record of success with an emphasis on quality assurance.

Recommendations:

- Collaborate on competitive renewable sector technologies, examine the role and potential of renewable integration in the energy system, and mitigate risks associated with adopting new technologies to continue the momentum towards orderly energy transitions.

As the full potential of renewables becomes more apparent during the pandemic, it is necessary for governments to capitalise on this momentum and examine the role renewables can play, not only for electricity generation, but to supplement the energy system as envisioned by green growth concepts such as the Circular Carbon Economy. The risks of adopting new technologies by operators or financial partners can be mitigated by investment in greater industry-wide product testing and certification. Reducing uncertainty around renewable resource levels and characteristics could be supported through the establishment of transparent measurement methods and resource monitoring that can be standardised across industry participants.

- Improve global energy data transparency, especially on renewable data and electricity through the Joint Organisations Data Initiative (JODI).

To restore energy market stability and meet globally shared goals, energy data requirements will demand greater transparency to deepen market insight across countries and organisations. JODI is the only database and repository with government provided oil and gas data. JODI could improve visibility and transparency of monthly electricity data with breakdown of feeds from all energy sources (both hydrocarbons, nuclear, and renewables) and build upon existing datasets. This can be extended by collaborating with its international partners to build datasets on renewable energy consumption and electricity storage.

- Continue to engage in inclusive energy dialogue at various virtual meetings on the IEF platform including the 11th IEA-IEF-OPEC Symposium on Energy Outlooks and the 2nd IEF-IRENA Seminar on Renewable and Clean Technology Outlooks scheduled to take place in-person in early 2021.

Finding solutions to renewable challenges such as grid access, mitigating the effects of random variability, increasing local manufacturing capacity, diversifying supply, and attracting greater investment will require ongoing and inclusive dialogue on the neutral platform that the IEF provides. The role of utilities will be paramount in this regard as even when technology manufacturers, project developers, and investors are comfortable with new technologies, utilities may remain resistant to their inclusion unless these risks or costs can be better addressed. Outcomes will depend on the nature of the global economy, its pace of recovery, and how government stimulus measures impact energy policies and help the industry adapt to a new risk environment.