JODI Data Puts Focus on Lower Natural Gas Inventories Compared With 2020

By T. Mason Hamilton

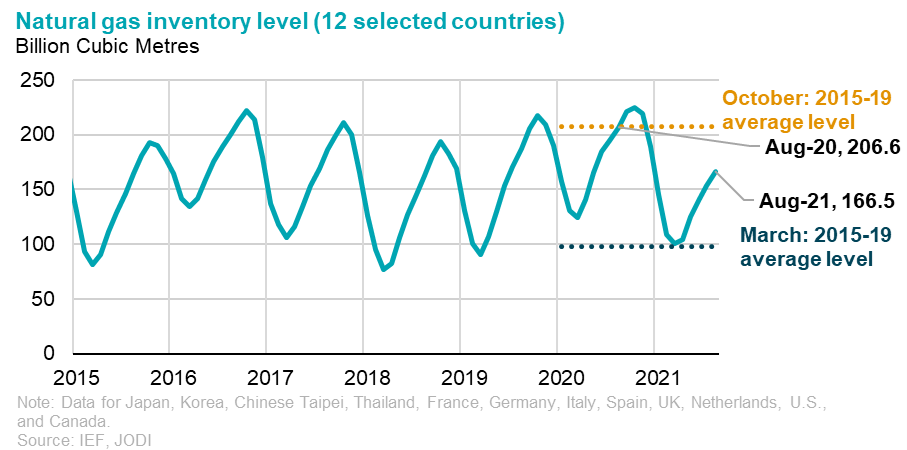

Incoming JODI data for natural gas inventories give an indicator of how lower than normal natural gas inventories this year are contributing to the record high natural gas prices in Asia and Europe. Data from a selection of 12 countries across Asia, Europe, and North America, which collectively represent approximately 40 percent of global natural gas consumption in 2020, shows that natural gas inventory levels in August 2021 were 19 percent lower than a year earlier. This slower-than-normal pace of inventory building has only two months left until the typical peak inventory month of October, just prior to the start of winter.

In October 2020, natural gas inventory levels were 8 percent higher than the average October level between 2015 and 2019. In March 2021, those inventories had been drawn down to within 3 percent of the average March level between 2015 and 2019.

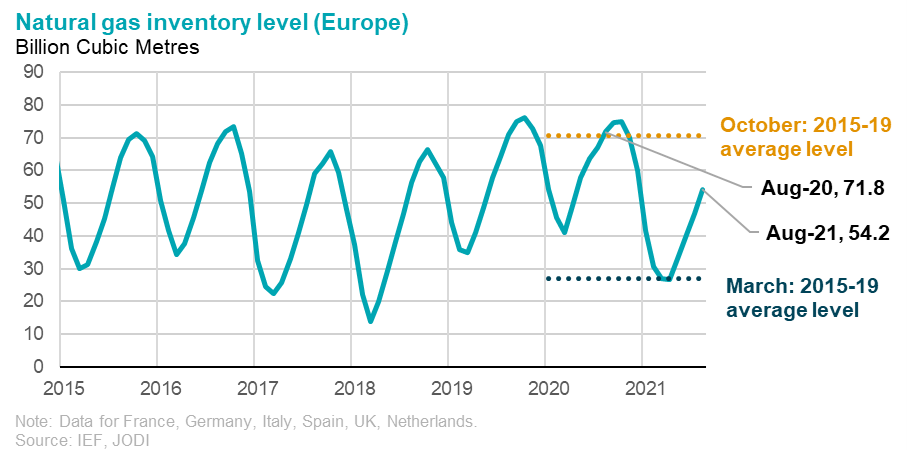

In Europe, natural gas inventories in the top five natural gas net importers (France, Germany, Italy, Spain, and the U.K.) and a major inventory holder (Netherlands) were 24 percent lower in August 2021 than at the same time in a year earlier. Natural gas inventories in these countries started the heating season in October with inventories 6 percent higher than the 2015-2019 average, and then were drawn down to 1 percent below the 2015-19 average by March 2021.

A selection of large natural gas consumers in Asia, which has limited natural gas storage capacity compared with consumption, shows lower inventory levels as well. In August 2020, these countries had a collective 9.6 BCM in storage compared to 9.0 BCM in August 2021. With limited capacity for storage, Asian markets are more dependent on imported LNG gas supplies. This can sometimes cause LNG prices in Asia – most notably the Japan/Korea Marker – to surge when demand increases during cold periods such as in January 2021.

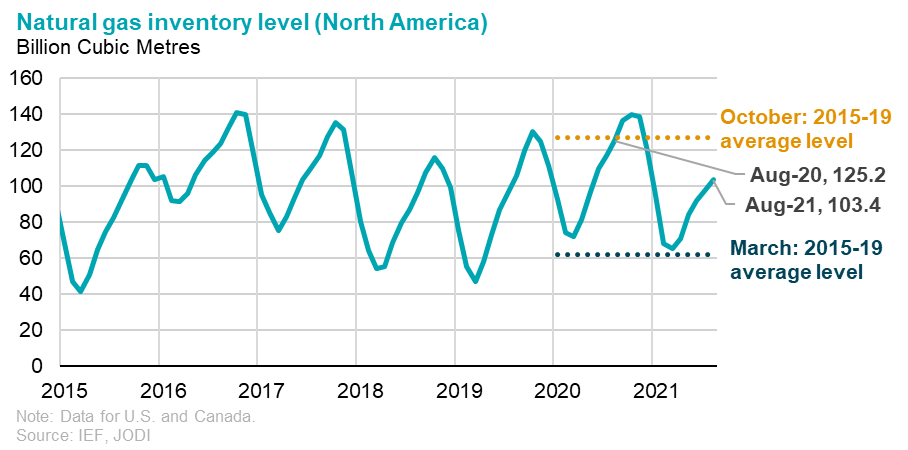

In North America (U.S. and Canada) — where natural gas prices are currently ~$5/MMBtu compared with ~$30/MMBtu in Europe and Asia — inventories in August 2021 were also lower than in last year by 17 percent.

Commenting on the low inventory levels, IEF Secretary General Joseph McMonigle said: "Low inventory levels are a challenge for energy security and market stability, with impacts that will be costly and potentially dangerous for consumers."