Tight Energy Markets Leave Little Room for U.S. Hurricane Disruptions

By T. Mason Hamilton

This year, tight global markets for crude oil, petroleum products, and natural gas combined with the high concentration of energy infrastructure along the U.S. Gulf of Mexico coastline means that any hurricane-related disruption is likely to have outsized consequences.

Recently released JODI data shows that crude oil and petroleum product stocks, were 438 million barrels below the five-year average level in July. Additionally, as recently highlighted in an IEF-S&P Global report, available global refining capacity is extremely tight. As Europe prepares for winter without supplies of natural gas from Russia, natural gas markets are fragile and LNG markets are closely monitored for fear of disruptions or delays. All these factors combined mean there is little margin for outages or disruptions anywhere in the world – least of all in an energy infrastructure packed region like the U.S. Gulf Coast.

The U.S. Gulf Coast is home to approximately 1.7 million barrels per day (b/d) of offshore crude oil production, 3.2 million b/d of crude oil exports, 8.4 million b/d of refining capacity, 5 million b/d of petroleum product exports, 2 billion cubic feet per day (bcf/d) of offshore natural gas production, 12.1 bcf/d of liquefied natural gas export capacity, and all four of the U.S. Strategic Petroleum Reserve storage sites.

Hurricane Ian made landfall on Thursday 29 September near Fort Myers, Florida. It had a significant and regrettable impact on lives, property, and local infrastructure, but a limited impact on major energy assets.

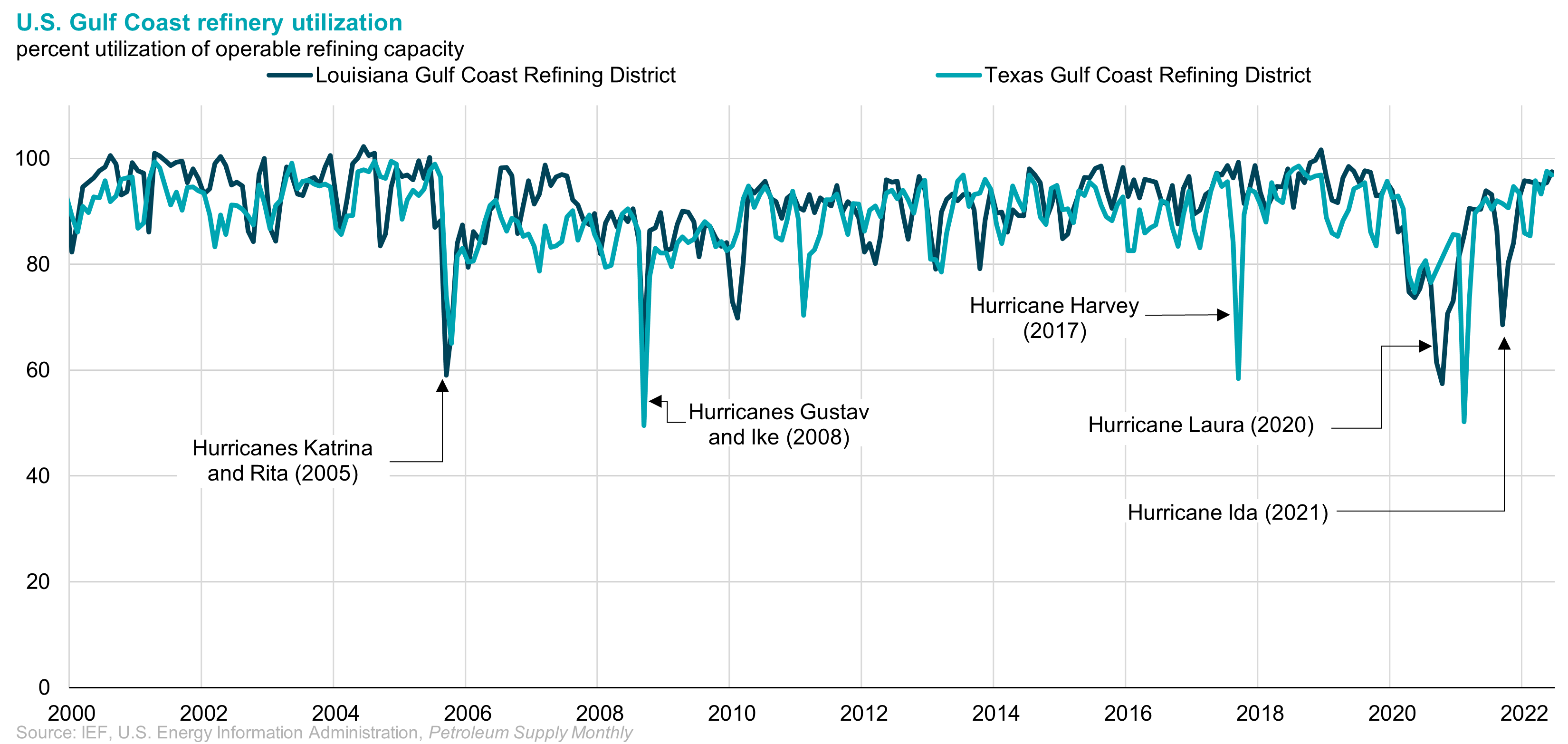

While no single hurricane can threaten the entire region and all its energy infrastructure at once, each storm is unique and can result in a wide variety of unexpected damage or disruptions. Some may impact offshore production facilities; others may directly hit a refinery or port. Although, hurricanes are noted for their windspeeds, the most significant and lasting damage is often done by water – either storm surge or flooding. Hurricane Harvey in 2017 dropped nearly 61 inches (155cm) of rainfall over several days in and around Houston, Texas – disrupting refinery operations and shipping. In 2021, Hurricane Ida caused flooding and damage to the 255,000 b/d capacity Alliance refinery, near Belle Chase, Louisiana, forcing it to close permanently.

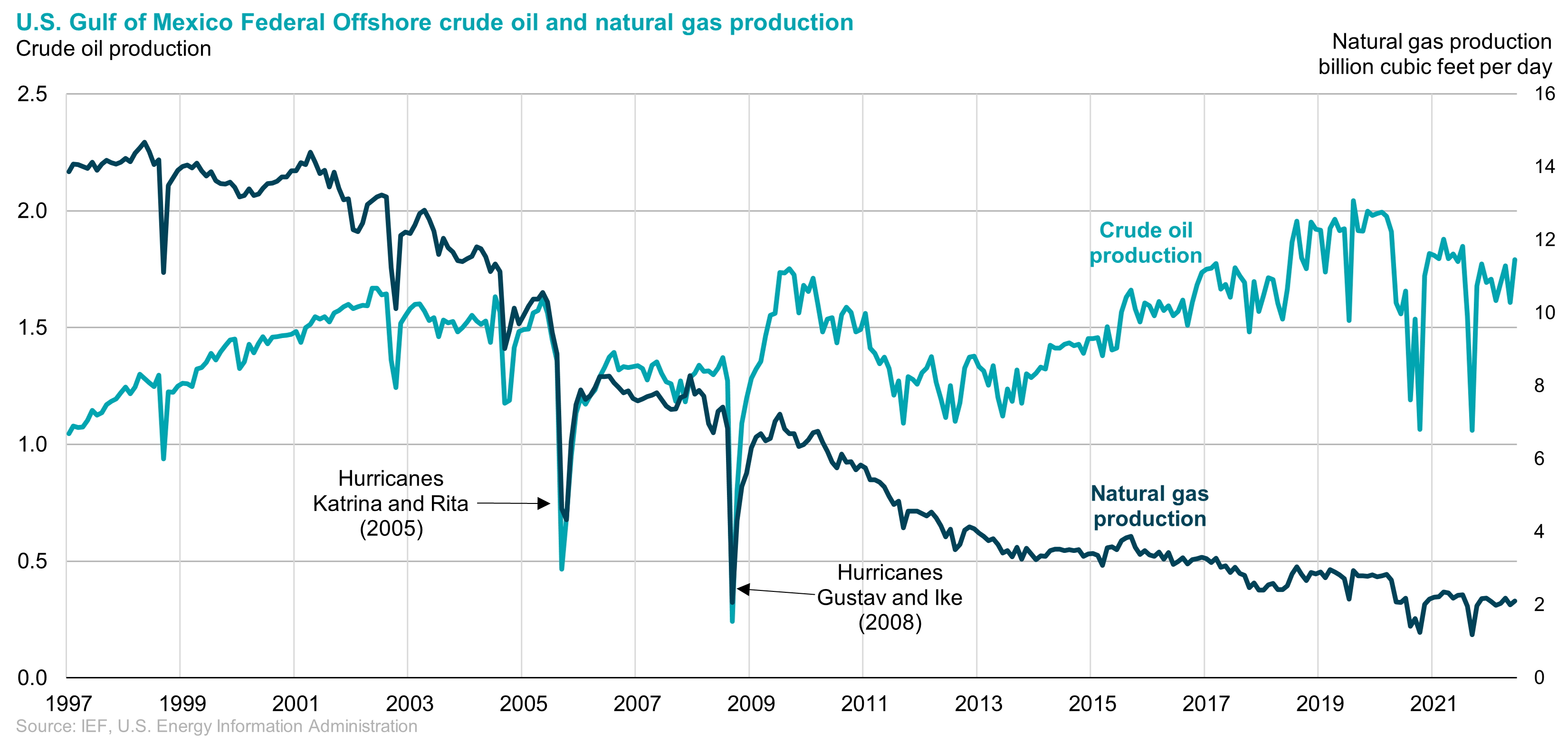

Approximately 1.7 million b/d of crude oil and 2 bcf/d of natural gas is produced from wells and platforms in waters off the coast of Texas, Louisiana, Mississippi, and Alabama – this production is highly sensitive to hurricane related disruptions. If a platform is in the path of an oncoming storm, workers must shut-in wells and cease production activities before evacuating. Then after the storm passes workers must return and inspect facilities before resuming production.

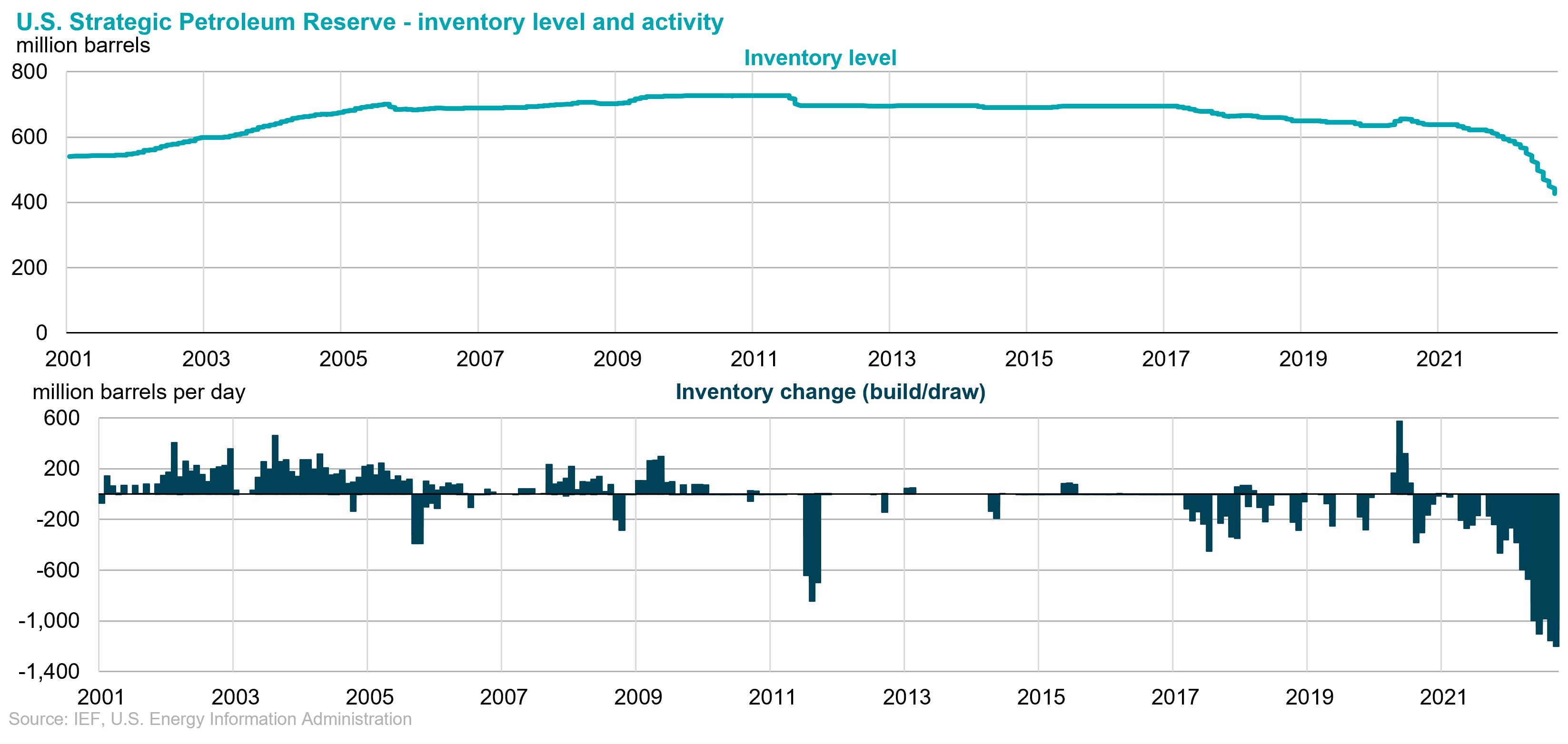

In the past, hurricane-related crude oil production disruptions have triggered releases/sales/exchanges from the U.S. Strategic Petroleum Reserve (SPR). However, this year the U.S. SPR is already drawing down and delivering crude oil to the market at an average rate of 888,000 b/d since the first week of June – the start of the Atlantic hurricane season. Although, the maximum drawdown rate of the U.S. SPR is 4.4 million b/d, meaning the U.S. SPR still has the capacity to add even more barrels to the market in the event of a hurricane disruption, U.S. SPR facilities themselves, and their means of distribution (ports, pipelines, etc.) are also vulnerable to hurricane disruptions and damage. In September 2020, Hurricane Laura made near direct landfall over the reserve's 220-million-barrel West Hackberry site in Louisiana, severely damaging the facility.

Along the U.S. Gulf Coast, or a short distance inland, is approximately 8.4 million b/d of refining capacity processing crude oil into petroleum products. While many refineries along the U.S. Gulf Coast are built and designed to withstand hurricanes to some degree, the conditions needed for safe refinery operations are often disrupted because of hurricanes – power outages, flooding, site access, etc. Globally, refineries are running at high utilization rates to keep up with demand, any prolonged disruption to U.S. Gulf Coast refinery runs would put additional stress on markets. Additionally, as noted in the recent IEF-S&P report on refining, any refinery damaged by storms or accidents will face a merciless cost-benefit analysis given a looming peak in petroleum-derived transportation fuels demand.

The U.S. Gulf Coast is also where 97 percent (or 3.3 million b/d) of the country's crude oil exports, and 82 percent (or 4.9 million b/d) of the country’s petroleum product exports depart. Large petroleum ports like those of Houston, Port Arthur, New Orleans, Corpus Christi, and others typically will close to all incoming and outgoing ship traffic in poor weather, disrupting and delaying shipments.

In the first half of 2022, the U.S. became the largest LNG exporter in the world, and of the country’s 13.2 Bcf/d total operating peak LNG export capacity, 12.1 Bcf/d of it is in the U.S. Gulf Coast. Currently, U.S. LNG exports are playing a key role in European natural gas markets, as Europe imports LNG to replace natural gas supplies from Russia before winter. However, this means any disruption to U.S. LNG exports will have a significant effect on global natural gas prices. This happened in June, when the Freeport LNG export terminal experienced a fire and outage that contributed to non-U.S. global natural gas prices jumping close to $5/MMBtu in a single day. Any prolonged disruption to U.S. LNG exports will likely have a similar influence on prices.

Prior to Hurricane Ian, the 2022 Atlantic Hurricane season has been quiet, despite the fact that the U.S. weather agency, NOAA, predicted a 65 percent chance of an above-normal season, with up to 21 named storms. However, the season does not end until November, with the possibility of a December storm not outside the realm of historical norms.