IEA IEF OPEC Symposium on Energy Outlooks

Wednesday 17 February 2021, Virtual Event, Riyadh, Saudi Arabia

- 15:00-19:00 Riyadh/Moscow

- 13:00-17:00 Paris/Vienna

- 7:00-11:00 Washington

- 20:00-24:00 Beijing

Market forecasts and energy policy scenarios require collective and continued focus to capture the systemic shock that the COVID-19 pandemic dealt to energy market security and stability, social equity, and sustainable growth. The 11th Session of the IEA-IEF-OPEC Symposium on Energy Outlooks considered the degree to which new government and industry responses brought clean technologies to scale and how they affected energy supply and demand balances on the long-term. The symposium also considered how the shock altered or reinforced energy market trends and if they energized a reliable recovery to sustainable and inclusive economic growth.

Held under the patronage of the Minister of Energy of Saudi Arabia HRH Prince Abdulaziz bin Salman Al Saud, the 11th Joint Symposium was structured in three virtual sessions.

- Welcome and scene setting remarks by the host and co-hosts on the impact of COVID-19 on energy markets with invited guests from IEF partner organizations,

- Presentation of the latest IEA and OPEC energy outlooks and key findings from the IEF-RFF Comparative Analysis of the IEA and OPEC short-, medium-, and long-term projections in the context of global energy outlooks on the post COVID era,

- Stakeholder views on energy investment, non-OPEC supply, and clean energy technology on the road to recovery.

Guest Speakers

HRH Prince Abdulaziz bin Salman Al Saud

Minister of Energy, Saudi Arabia

HE Shri Dharmendra Pradhan

Minister of Petroleum, Natural Gas and Steel, India

HE Joseph McMonigle

Secretary General, IEF

HE Fatih Birol

Executive Director, IEA

HE Mohammad Sanusi Barkindo

Secretary General, OPEC

HE Yury Sentyurin

Secretary General, Gas Exporting Countries Forum (GECF)

View presentation

Vicki Hollub

President and CEO, Occidental Petroleum

HE Francesco La Camera

Director General, International Renewable Energy Agency (IRENA)

View presentation

Spencer Dale

Group Chief Economist, BP plc

View presentation

Kaare Sandholt

Chief Expert, China National Renewable Energy Centre (CNREC), Energy Research Institute of NDRC

Coby van der Linde

Director, Clingendael International Energy Programme (CIEP)

Ayed Al Qahtani

Director, Research Division, OPEC

View presentation

Keisuke Sadamori

Director of the Office for Energy Markets and Security, IEA

View presentation

Richard Newell

President and CEO, Resources for the Future, RFF

View presentation

Jamie Webster

Senior Director, Center for Energy Impact, Boston Consulting Group (BCG)

View presentation

Felipe Bayón

CEO, Ecopetrol Group

View presentation

IEF RFF Report on Energy Outlooks

Sessions were informed by the IEF Report on Energy Outlooks developed in collaboration with Resources For the Future (RFF) providing a comparative analysis of the IEA and OPEC short-, medium-, and long-term projections placed in the context of global energy outlooks published in 2020 and made available in advance of the meeting.

Download the full report PDF

Download the full report PDFKey Observations

The key observations summarise the detailed discussion of energy outlooks that follows in the chapters below to inform dialogue at the 11th Session of the IEA-IEF-OPEC Symposium on Energy Outlooks hosted virtually by the IEF on 17 February 2021.

The COVID-19 pandemic impact on energy demand and supply balances is unparalleled in the history of energy markets. Restrictions imposed on the world economy caused a systemic shock that most severely struck short-range trends in liquids supply, demand, and stock changes as sweeping revisions show. The production adjustments that OPEC and Non-OPEC producers agreed to under the 2016 Vienna Declaration, and the wider support obtained at the extraordinary G20 Energy Ministers Meeting that the Presidency of Saudi Arabia convened early April 2020, cushioned the blow COVID-19 dealt energy markets as subsequent data series underscore.

The structural energy policy and market shifts that COVID-19 brings shall influence future energy supply and demand modelled in long-term scenarios greatly as well. A swift and inclusive global economic recovery depends on how various public health, macroeconomic, and other variables will reinforce domestic and international energy policy, sustainable development, and climate goals. This not only adds an additional layer of complexity over the energy outlooks that this report compares, but also makes dialogue on the evolution of energy markets even more relevant than before.

The G20 Energy Ministers meeting in September 2020 invited the IEF to take forward the work of the G20 Energy Focus Group on more comprehensive data coverage and analysis in cooperation with the IEA, OPEC, and other international and regional organisations under the G20 Presidency of Italy in 2021.

Mindful of the above developments and the exceptional circumstances in which the 11th IEA-IEFOPEC Symposium on Energy Outlooks convenes, the IEF has invited the Gas Exporting Countries Forum (GECF) the International Renewable Energy Agency (IRENA), and United Nations (UN) to join. In addition to the comparative analysis of short-, medium, and long-term energy outlooks that OPEC and the IEA published in 2020, this report places the long-term outlooks of these key producer and consumer organisations in the context of those that other key stakeholders issued last year.

IEA and OPEC Short-Term Oil Outlooks

Economic contraction and recovery

For 2020, the IEA and OPEC projected a global GDP contraction of 4.1% and 4.2%, respectively, in their forecasts published in December 2020. This is in stark contrasts to their previous growth estimates of 3.4% and 3.0% given just a year earlier. For 2021, both organisations projected a resumption of global growth. The IEA projected a growth rate of 5.2%, while OPEC projected more modest growth of 4.4%.

The IEA largely estimates higher economic growth in 2021, compared to OPEC, for most regions. Though there is substantial regional variation, China stands out as the only major economy to retain some growth in 2020 and regain robust growth over 2021. The IEA estimates an increase in China's GDP of 7.8% and OPEC of 6.9% in 2021. Both the IEA and OPEC project India had a steep economic contraction of 8.4% and 9.2% in 2020, respectively. However, the IEA projects notably higher growth of 9.3% in 2021 compared to the OPEC estimate of 6.8% for India during the same time.

Liquids Demand

Between January and December this year, estimates for global 2020 liquids demand by the IEA and OPEC fell by 10.0 mb/d and 11.0 mb/d, respectively, to reach 91.2 and 90.0 mb/d, respectively.

Estimates for both OECD and non-OECD nations saw drastic revisions to negative demand growth in April. Overall, OPEC continued to slightly revise down its estimates of global oil demand from April to December. The IEA estimates for the OECD made a sharp downward revision in April, followed by a modest recovery in May and broadly remained at that level for the rest of the year.

Non-OECD nation estimates followed a more gradual decline over the first five months. Throughout the year and despite sweeping revisions in April, both organisations projected that non-OECD nations would continue to have more modest declines as compared to the OECD for 2020.

In 2021, both organisations project a significant demand growth recovery of roughly 6 mb/d when the IEA and OPEC estimate liquids demand will reach 96.9 mb/d and 95.9 mb/d, respectively. However, OPEC expects the contraction in 2020 to be more severe and the recovery in 2021 to remain further below world liquids demand levels observed in 2019 than the IEA.

Demand is notably higher in the IEA's forecast for many non-OECD regions. The IEA is also more bullish on demand growth in the OECD for both 2020 and 2021. OPEC, on the other hand, projects a sharper decline in many regions in 2020 but also estimates a mildly greater recovery in the non-OECD region in 2021.

Liquids Supply

2020 annual supply growth estimates were also abruptly revised downward from March to April and May. Non-OPEC supply growth projections from both organisations fell by around 5.3 mb/d in just two months. Data of the IEA and OPEC shows that world liquids supply reached 91.2 mb/d and 90.0 mb/d in 2020.

Supply forecasts for 2020 by both organizations reached their lowest point in May and were then revised slightly upward over the remainder of 2020. Both the IEA and OPEC projected that the OECD would see less negative growth by the end of the year compared to non-OECD non-OPEC producers. Non-OPEC liquids supplies suffered a steep contraction in 2020 estimated at –2.6 mb/d and –2.5 mb/d by the IEA and OPEC, respectively.

For 2021, data of the IEA and OPEC indicates world liquids supply reaches 96.9 mb/d and 95.9 mb/d. In their December 2020 reports, they estimated Non-OPEC liquids supply in 2021 to increase by 0.5 mb/d and 0.8 mb/d in 2021, respectively. However, substantial differences were noted in the OECD. The IEA projected a decrease of -0.1 mb/d in OECD supplies, while OPEC projected a 0.6 mb/d increase from 2020 to 2021, mostly from growth forecast in OECD Americas. This pointed at differing assumptions on US tight oil supply resilience, among other factors.

Notable differences also emerged for non-OECD Europe and FSU, which OPEC now summarizes under the grouping "Eurasia". The IEA projected 0.3 mb/d and 0.6 mb/d in additional supplies relative to OPEC in 2020 and 2021, respectively.

IEA and OPEC Medium-Term Oil Outlooks

Growth Projections

Both organisations make their medium-term projections through 2025, using 2019 as a base year. The eight-month gap between publication dates, and the excessive volatility witnessed in that time interval make the comparison both more complex and instructive. Apart from 2021, the IEA's GDP assumptions are higher than OPEC's. Like OPEC, however, the IEA's GDP assumptions have declined substantially. Overall, the IEA estimates average annual growth globally of 3.3% and OPEC of 2.3% from 2019 to 2025. The IEA and OPEC growth estimates reach 3.6% and 3.4% in 2025.

Liquids Demand

The IEA and OPEC expect 2025 world liquids demand to reach 105.7 mb/d and 103.7 mb/d, respectively. COVID-19 turns down average annual growth estimates between 2019 and 2025 to 1.0 and 0.7 mb/d for the IEA and OPEC. The IEA now estimates 1.5 mb/d and OPEC 2.2 mb/d lower demand in 2024 compared to last year's reports. These figures mark a significant decrease in projections compared to last year.

Demand growth remains strongly anchored in non-OECD nations. While OPEC projections show a significant demand decrease from 2019 levels of 4.9 and 4.0 mb/d for OECD and non-OECD countries for 2020, their later forecasting follows a similar trend to IEA estimates. OPEC expects non-OECD liquids demand growth to average 0.8 mb/d per annum by 2025, while the IEA projects growth of 0.9 mb/d. OPEC projects total OECD liquids demand to decline from 47.9 mb/d in 2019 to 46.8 mb/d by 2025. The IEA projects total OECD liquids demand to increase slightly from 47.6 mb/d to 47.7 mb/d over the same period.

The IEA estimates 1.1 mb/d more liquids demand in China in 2025 compared to OPEC. The IEA and OPEC project the same level of demand growth in India despite the IEA's more bullish projection for India's GDP growth.

OPEC provides sectoral oil demand projections for 2019 through to 2025. Road transport is the largest source of cumulative growth at 1.9 mb/d. But road transport demand shrinks between 2019 and 2020 from 44.4 to 40.1 mb/d, respectively, before recovering to 46.3 mb/d in 2025. Similarly, aviation demand nearly halves from 6.7 mb/d in 2019 to 3.5 mb/d in 2020 before recovering to 7.1 mb/d in 2025. The petrochemicals sector shows notable growth over the period by a total of 1.1 mb/d from 2019 to 2025.

The IEA places emphasis on shifting transport fuel demand because of electric vehicle (EV) and fuel standard policies. Fuel efficiency is expected to reduce gasoline and diesel growth significantly by 2025. The IEA also projects strong growth in demand for liquefied petroleum gases (LPG), ethane, and naphtha feedstocks which grows by an average of 0.5 mb/d annually, roughly half of oil product growth.

Liquids Supply

For the full projection period of 2020 and 2025, OPEC projects cumulative net non-OPEC supply growth of 5.7 mb/d, while the IEA projects supply growth of 4.5 mb/d in this category. The IEA and OPEC see medium-term liquids supply reach 105.7 mb/d and 103.9 mb/d in 2025, respectively.

In the pre-pandemic IEA projections, OECD Americas, particularly the United States, were expected to account for 67% of cumulative non-OPEC growth over the medium term, while OPEC's later publication attributes a substantially smaller proportion of 28% of cumulative growth to the region.

Where the IEA predicted growth of 1.3 mb/d for OECD Americas in 2020, OPEC estimates OECD Americas supply to contract by 1.8 mb/d in that year. OPEC projects 27.4 mb/d from OECD Americas in 2025, while the IEA estimates production for the region to reach 28.9 mb/d that year. OPEC's forecasting for OECD America constitutes a downward revision from previous growth estimates and breaks a trend of upward revisions to US tight oil supplies. However, both organisations expect that most liquid supply growth from the OECD Americas will continue to originate from U.S. tight oil.

Both the IEA and OPEC maintain similar predictions for the second largest supply growth contributor of Latin America over the period of 2020 to 2025. The IEA estimates cumulative growth of 1.6 mb/d (36% of total) and OPEC of 2.2 mb/d (39% of total). These gains are driven by new offshore Brazilian and Guyanese production. OPEC projects substantially greater supply from Latin America (8.2 mb/d compared with 7.2 mb/d for the IEA) and Non-OECD Europe and Eurasia (15.2 mb/d compared with 14.6 mb/d for the IEA).

OPEC also projects considerably more supply growth from OECD Europe than the IEA. It estimates growth of 0.8 mb/d compared to the IEA's estimate of 0.0 mb/d for OECD Europe. OPEC estimates of 4.5 mb/d in 2025 for OECD Europe maintain last year's estimate of the same value for 2024, whereas the IEA estimate lower levels of production in the region compared to last year at 3.8 mb/d.

In total, the IEA forecasts 69.4 mb/d in liquids supply from non-OPEC nations in 2025, while OPEC estimates 70.7 mb/d; a 1.2 mb/d difference. The IEA's projections imply supply from OPEC member nations of 36.3 mb/d, 3.1 mb/d higher than the assessments by OPEC. By 2025 the IEA projects that OPEC provides 34% of global liquids, compared with an estimate of 32% from OPEC.

The largest discrepancy in annual growth estimates exists for aggregated non-OECD nations, with OPEC projections averaging 0.3 mb/d higher annually than those of the IEA. Differences in mediumterm supply projections largely reflect different assumptions about technologies and oil prices between the IEA and OPEC.

IEA and OPEC Long-Term Energy Outlooks

Growth Projections

The IEA assumes average annual GDP growth of 3.0% in the Stated Energy Policy Scenario (STEPS) and 2.6% in the Delayed Recovery Scenario (DRS) from 2019 to 2040, compared with OPEC's assumption of 2.9% from 2019 through to 2045 in the OPEC Reference scenario. These figures reflect large downward revisions from last year's assumptions, when the IEA and OPEC assumed annual average growth rates of 3.4% and 3.3%, respectively, from 2018 to 2040.

Primary Energy Demand

Fossil fuels continue to dominate the primary energy mix, with oil, natural gas, and coal providing 73% under IEA STEPS and 74% under OPEC's Reference scenario in 2040. This share declines to 56% under the IEA SDS, 55% under OPEC's Scenario A, and 58% under Scenario B. These show two pathways for alignment with the long-term goals of the Paris Agreement that are driven by market signals and technology solutions, respectively.

In 2019, fossil fuels accounted for 81% of the primary energy mix.

Total primary energy demand grows under the main scenarios considered, increasing by 0.8% per year on average for the IEA STEPS and by 0.9 under OPEC's Reference case from 2019 through 2040. In last year's projections, both scenarios projected long term demand growth of 1.0% annually. Under the IEA Sustainable Development Scenario (SDS), global energy demand declines by an average of 0.5% per year, considerably faster than last year's SDS projection of 0.3%. In OPEC's Scenario A, global demand declines by 0.2% per year, but grows by 1.0% under Scenario B. Last year, OPEC's Below 2°C scenario envisioned declines of 0.4% per year.

Projections for total primary energy supply by energy source, highlight several differences. OPEC's Reference Case projects coal demand to decline by 4 mboe/d from 2019 to 2040, while IEA's STEPS projects a decline of 9 mboe/d. Oil consumption grows by 9 mboe/d for OPEC's Reference Case and by 6 mboe/d under IEA STEPS. Both scenarios project natural gas demand to grow by 20 mboe/d through 2040.

Under all Paris-aligned scenarios global coal demand falls by 50 mboe/d or more, but differences emerge between the scenarios on the future of oil and natural gas. Under the IEA's SDS, oil and natural gas demand decline by 31 and 8 mboe/d, respectively. Under OPEC's Scenario A, oil falls by 15 mboe/d and natural gas declines by 11 mboe/d. However, under OPEC's Scenario B, where carbon capture, use, and storage play an enhanced role, oil and gas consumption respectively rise by 18 and 14 mboe/d through 2040.

Under all scenarios, nuclear, hydro, and other renewables grow considerably over the next two decades. Nuclear energy rises from 2019 to 2040 by 3, 6, and 8 mboe/d under the IEA STEPS, OPEC Reference, and IEA SDS, while hydropower grows by 3 to 4 mboe/d under these scenarios. Other renewables, led by wind and solar, grow by 21 and 22 mboe/d under OPEC's Reference Case and IEA STEPS, respectively, and by 42 mboe/d under the IEA SDS.

Energy mix shares

In all five scenarios examined, oil maintains its position as the leading primary energy source globally. Though its share shrinks in each, demand volume rises in four of the five scenarios. In OPEC's Reference Case and IEA STEPS, the share of oil falls from 31% in 2019 to 28%, and to 23% in IEA's SDS. OPEC's two alternative scenarios show oil falling to 28% under Scenario A and 30% under Scenario B.

Natural gas' share of the global energy mix increases under central scenarios, growing from 23% in 2019 to 25% in OPEC's Reference and IEA's STEPS. Under the Paris-aligned scenarios, natural gas' share remains flat in IEA's SDS, and declines to 20% and 22% in OPEC's Scenarios A and B, respectively.

Coal's share of the mix declines substantially under all scenarios, falling from 26% to 27% of global primary energy supply in 2019 to 19% under IEA STEPS and 21% under OPEC's Reference scenarios. This decline is accelerated under the IEA's SDS, where coal falls to 10% by 2040, and shrinks further to 7% and 5% under OPEC's Scenarios A and B, respectively.

The share of renewables, which is currently dominated by biomass, is projected to increase in all scenarios from 14% in 2019 to 20% in OPEC's Reference Case, 22% under IEA STEPS, and 36% under the IEA's SDS. Virtually all of this growth comes from renewable electricity such as wind, solar, and hydro. OPEC's Sensitivity scenarios do not provide fuel-specific data for non-fossil fuels.

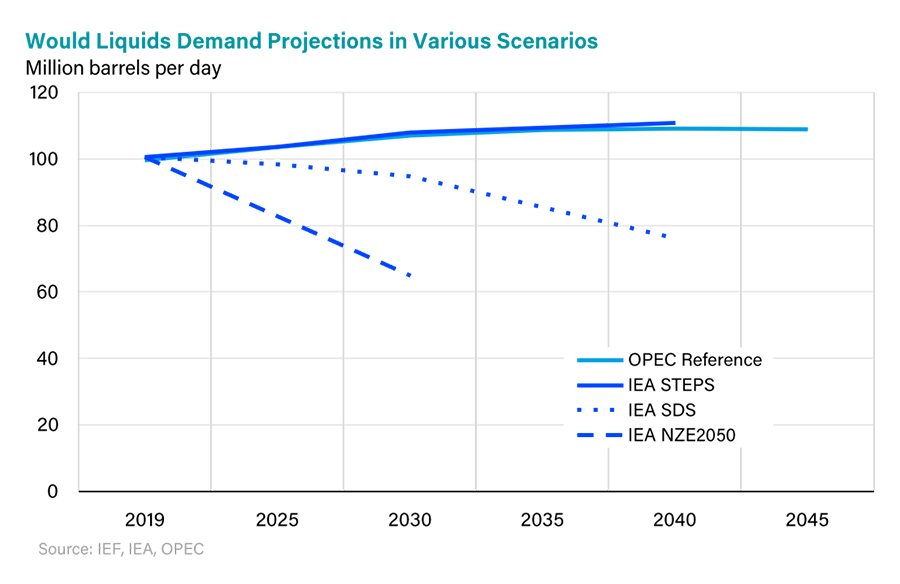

Liquids Demand

The difference between the highest (IEA STEPS) and lowest (IEA SDS) projections for 2040 world liquids demand is 35 mb/d. Last year the difference between the IEA STEPS and lowest IEA SDS projections for 2040 world liquids demand stood at 29 mb/d. This difference highlights the growing "gap" between the greenhouse gas emissions goals articulated in the 2015 Paris climate agreement and those likely to occur under current and announced policies.

To bridge this apparent "gap", energy ministers and market stakeholders from producer and consumer countries have launched efforts to scale up investment in clean energy technology deployment and research and development. These include various net-zero GHG emissions strategies such as the European Unions' Green Deal and the Circular Carbon Economy Platform that the G20 endorsed in September 2020.

The IEA's STEPS projects 111.0 mb/d in supplies in 2040, compared with 109.3 for OPEC's Reference Case. Under the IEA's SPS, global supplies decline to 76.2 mb/d by 2040. Each of these projections are lower than those made in 2019, reflecting in part updated expectations about global economic growth following the COVID-19 pandemic.

The most notable difference is between projections for OECD and non-OECD supplies. IEA's STEPS projects supply from OECD Americas to be 3.0 mb/d higher than under OPEC's Reference Case by 2040, and total OECD supplies to be 2.5 mb/d higher than OPEC's projection. An even larger difference emerges from the non-OECD region, where OPEC projects supplies in 2040 to be 7.1 mb/d higher than IEA's STEPS.

Under IEA STEPS, US tight crude production increases from 7.7 mb/d in 2019 to 10.7 mb/d by 2030, before falling to 9.6 mb/d by 2040. Under OPEC's Reference Case, US tight crude drops to 6.9 mb/d in 2020, then recovers to a peak of 10.3 mb/d in the late 2020s, then declining to 8.1 mb/d by 2040. Tight liquids production also grows in Canada, Argentina, and Russia, but majority of supplies emerge from the United States, led by the Permian basin region.

IEA and OPEC Outlooks Placed in the Wider Context

Total Primary Energy Demand

Primary energy demand grows in central scenarios through 2040: by 19% in IEA STEPS, 18% in Equinor's Rivalry and GECF's Reference Case Scenario (RCS), 17% in OPEC's Reference Scenario, 14% in IRENA's Planned Energy Scenario (PES), 10% in GECF's CMS, and 9% in Equinor's Reform Scenario. With the exemption of the GECF Carbon Mitigation Scenario (CMS), all alternative scenarios project that global energy demand in 2040 will be below 2019 levels, reflecting a major change in the historical relationship between economic growth and energy demand growth. The GECF's CMS scenario investigates the role of natural gas in reducing emissions through available carbon mitigation technologies and policy support that take account of national commitments and challenges.

Under the Paris-aligned scenarios, total primary energy consumption declines considerably through 2040, falling by 6% under IRENA's Transforming Energy scenario (TES) and by 8% under Equinor's Rebalance scenario, compared with a 10% reduction under the IEA SDS. BP's two Paris-aligned scenarios also show considerable declines. Total primary energy consumption (which, for BP, excludes non-marketed biomass) falls by 6% under the Rapid Transition scenario and by 14% under the Net Zero scenario.

Wide variation is also apparent in different scenarios for natural gas. Under central scenarios through to 2040, natural gas consumption increases by 29% and 30% for IEA and OPEC respectively, compared with 34% for IRENA's Planned Energy and GECF Reference Case Scenario, 26% for BP's BAU, and 19% for Equinor's Reform Scenario.

In various alternative scenarios, natural gas use increases by 37% in GECF's CMS, by 9% in BP's Rapid Transition scenario and in Equinor's Rebalance scenario by 1%. However, natural gas use declines considerable in IEA's SDS (-12%), BP's Net Zero scenario (-27%), and IRENA's Transforming Energy scenario (-21%).

Natural gas demand growth assessments range from 34% to 19% in central scenarios and are even wider in alternative scenarios that show natural gas demand will grow by 37% or decline by 27% to 2040. This reflects that policy and technology pathways that affect natural gas demand in both central and alternative scenarios are far from certain. Assumptions on the role of natural gas in energy sector transformations vary widely.

In all scenarios other than Equinor's Rivalry, global coal demand falls, ranging from a reduction of 4% under OPEC's Reference Case to a roughly two-thirds decline in the IEA SDS, BP Rapid Transition, and IRENA's Transforming Energy scenarios.

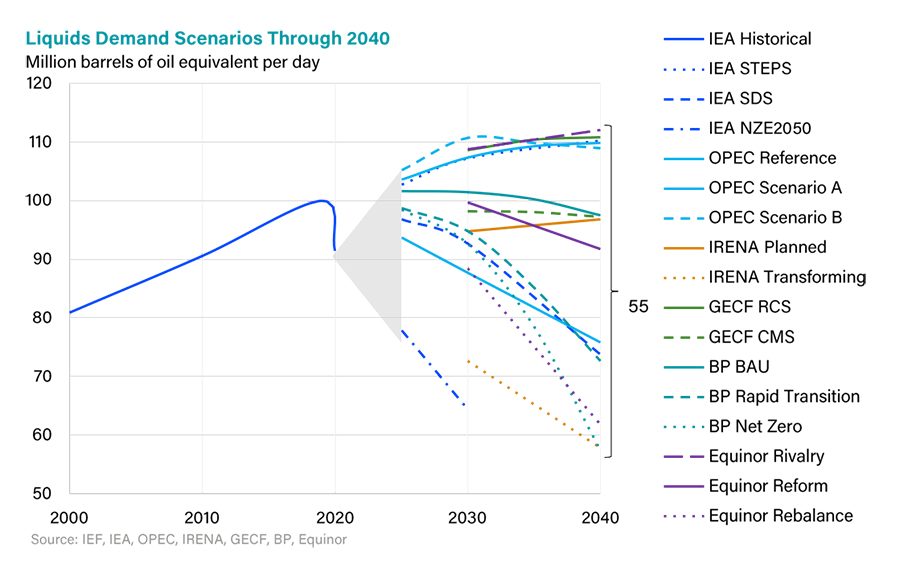

Liquids Demand

Liquids demand grows by 11% in the GECF RCS, 10% for both IEA STEPS and OPEC Reference Case but falls by 2% under BP's BAU, 3% under IRENA's Planned Energy Scenario, and 8% under Equinor's Reform.

Paris-aligned scenarios show global liquids demand falling by 26% for the IEA SDS, 27% for BP's Rapid Transition, 38% in Equinor's Rebalance scenario and 42% in IRENA's Transforming Energy Scenario. This demand falls by 5% in the GECF's CMS.

In volumetric terms, central scenarios from the IEA and OPEC see liquids growth reaching roughly 110 mboe/d by 2040, with lower levels envisioned in Paris-aligned scenarios. The GECF RCS shows liquid demands reach 111 mboe/d in 2040. Other organisations' and market stakeholders' scenarios, however, show lower liquids demand in 2040. BP's BAU scenario projects 98 mboe/d, IRENA's Planned Energy scenario and GECF's CMS each project 97 mboe/d, and Equinor's Reform scenario projects 92 mboe/d.

Paris-aligned scenarios show further declines. In the IEA SDS, liquids demand falls to 74 mboe/d, while BP's Rapid Transition and Net Zero scenarios project liquids demand of 73 and 57 mboe/d, respectively, in 2040. In IRENA's Transforming Energy scenario liquids demand declines to 58 mboe/d, and Equinor's Rebalance scenario shows liquid demand to fall to 62 mboe/d by 2040. Equinor's Rivalry scenario stands out with the highest projected liquids demand of 112 mboe/d in 2040.

Renewables and Nuclear Growth

The fastest growing energy source in these scenarios is renewable energy (including hydropower). Central scenarios show renewable shares grow from 2019 to 2040 by 46% in OPEC's Reference, 72% in GECF RCS, 78% in IEA's STEPS, 86% in IRENA's Planned Energy, and 84% in Equinor's Reform scenario.

For Paris-aligned scenarios, growth is even more robust. Renewables increase by 219% in IRENA's Transforming Energy 119% in IEA's SDS, 114% in Equinor's Rebalance scenario, and 99% in GECF's CMS. Finally, BP's projections for renewables—which exclude non-marketed biomass—show growth of 179%, 343%, and 509% under the BAU, Rapid Transition, and Net Zero scenarios, respectively.

Nuclear energy adds to the energy mix in all scenarios, with growth from 2019 to 2040 ranging from as low as 1% (IRENA's Transforming Energy scenario) to 85% under BP's Net Zero scenario. IEA STEPS and OPEC Reference project nuclear energy growth of 23% and 42%, respectively. Most Paris-aligned scenarios project more rapid growth, such as 55% for IEA SDS, 65% for BP's Rapid Transition, and 63% for Equinor's Rebalance scenario. Only the GECF shows nuclear growing more rapidly in the RCS than in the CMS by 23% and 17 % respectively. The GECF CMS focuses on the possibilities that greater market penetration of natural gas in partnership with renewables offers to reduce emissions.

IEA-IEF-OPEC Symposia on Energy Outlooks

The IEA-IEF-OPEC Symposia on Energy Outlooks are part of a wider joint programme of work agreed upon by the three organisations and endorsed by Energy Ministers at the 12th International Energy Forum (Cancún, March 2010) as part of the Cancún Declaration. IEF Energy Ministers, gathered at the 15th International Energy Forum (Algiers, September 2016), acknowledged the renewed encouragement from the G20 Energy Ministers Meetings (Beijing, June 2016) to continue this fruitful collaboration to further understand energy outlooks.

The G20 Energy Ministers meeting virtually on 27-28 September 2020 in Riyadh Saudi Arabia agreed to collaborate in encouraging dialogue to help mobilize public and private investment in various energy sectors including innovative technologies and quality infrastructure in line with national circumstances, to enhance energy security. Ministers asked the IEA, IEF, IRENA, OPEC and the GECF to further consider this matter in their work program.

The Symposium will be live streamed on social media where so indicated on the agenda.

Highlights Videos

Key Documents

Previous Symposia

- 10th Anniversary Session of the IEA-IEF-OPEC Symposium on Energy Outlooks

19 February 2020, Riyadh, Saudi Arabia - 9th IEA-IEF-OPEC Symposium on Energy Outlooks

27 February 2019, Riyadh, Saudi Arabia - 8th IEA-IEF-OPEC Symposium on Energy Outlooks

14 February 2018, Riyadh, Saudi Arabia - 7th IEA-IEF-OPEC Symposium on Energy Outlooks

15 February 2017, Riyadh, Saudi Arabia - 6th IEA-IEF-OPEC Symposium on Energy Outlooks

16 February 2016, Riyadh, Saudi Arabia - 5th IEA-IEF-OPEC Symposium on Energy Outlooks

23 March 2015, Riyadh, Saudi Arabia - 4th IEA-IEF-OPEC Symposium on Energy Outlooks

22 January 2014, Riyadh, Saudi Arabia - 3rd IEA-IEF-OPEC Symposium on Energy Outlooks

22 January 2013, Riyadh, Saudi Arabia - 2nd IEA-IEF-OPEC Symposium on Energy Outlooks

23-24 January 2012, Riyadh, Saudi Arabia - 1st IEA-IEF-OPEC Symposium on Energy Outlooks

24 January 2011, Riyadh, Saudi Arabia